[ad_1]

With the Federal Open Market Committee convening on Wednesday and the current monetary troubles going through the U.S. banking system, White Home press secretary Karine Jean-Pierre mentioned President Joe Biden has “confidence” in Federal Reserve chair Jerome Powell. In the meantime, in keeping with the CME Group’s Fedwatch device, the goal charge likelihood suggests the Fed will increase the federal funds charge by 25 foundation factors (bps) this week. There’s additionally a 26.9% probability the U.S. central financial institution gained’t increase the speed this month.

Market Laser-Centered on Upcoming Fed Assembly; Biden Administration Assured in Powell’s Management

It has been a tumultuous week within the U.S. banking business as three main banks collapsed, and the Federal Reserve introduced that it will totally bail out two of them. Moreover, the U.S. central financial institution created the Financial institution Time period Funding Program (BTFP) to help failed banks and their depositors. Furthermore, the Fed loaned the banks $164.8 billion to strengthen liquidity and collaborated on March 19 with 5 different main central banks to spice up U.S. greenback liquidity.

To make issues worse, a not too long ago printed paper signifies that roughly 186 U.S. banks are grappling with the identical issues as Silicon Valley Financial institution, and First Republic Financial institution’s inventory plummeted on March 20, shedding greater than 40% of its worth in a single day. Within the meantime, on March 22, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell will decide the destiny of the federal funds charge.

Previous to the banking business fallout, the U.S. central financial institution had been elevating the benchmark charge quickly each month since this time final yr, following the numerous financial growth in response to the Covid-19 pandemic, which noticed the establishment holding charges suppressed at zero. When inflation started to soar, Fed members, together with chair Powell, referred to it as “transitory” and predicted it wouldn’t final.

Nevertheless, the Fed’s swift financial tightening in response to inflation has triggered vital points with long-duration Treasury notes. Throughout the White Home press briefing on Monday, press secretary Karine Jean-Pierre was requested about president Biden’s opinion of the Fed chair’s management and whether or not Powell could be changed because the Fed’s head. “No, under no circumstances. The president has confidence in Jerome Powell,” Jean-Pierre said.

Eight days prior, on March 13, president Biden had reassured People that the U.S. banking system was safe. “People can relaxation assured that our banking system is secure,” he mentioned. “Your deposits are safe. Let me additionally guarantee you that we’ll not cease right here. We’ll do no matter is important,” the U.S. president added.

Moreover, market strategists and economists are curious in regards to the Fed’s plans for Wednesday, with some speculating that the central financial institution will probably be dovish. For instance, final week, Goldman Sachs chief economist Jan Hatzius revised the financial institution’s U.S. federal funds charge forecast and said that he doesn’t count on a hike on Wednesday.

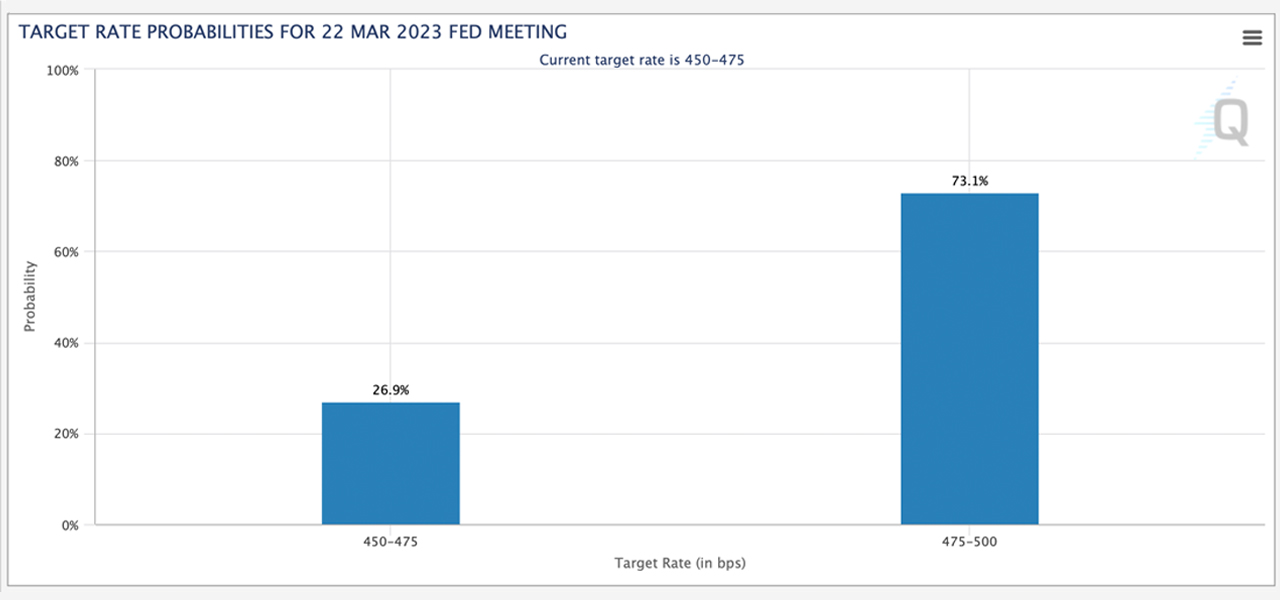

Different market analysts anticipate that the Fed will increase the speed by 25 foundation factors (bps) this week. On the time of writing, the CME Group Fedwatch device signifies a 73.1% probability that the 25bps charge enhance will happen. The Fedwatch device additionally signifies that 26.9% of analysts predict no charge hike this month.

What do you suppose the Fed’s determination will probably be this coming Wednesday? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link