[ad_1]

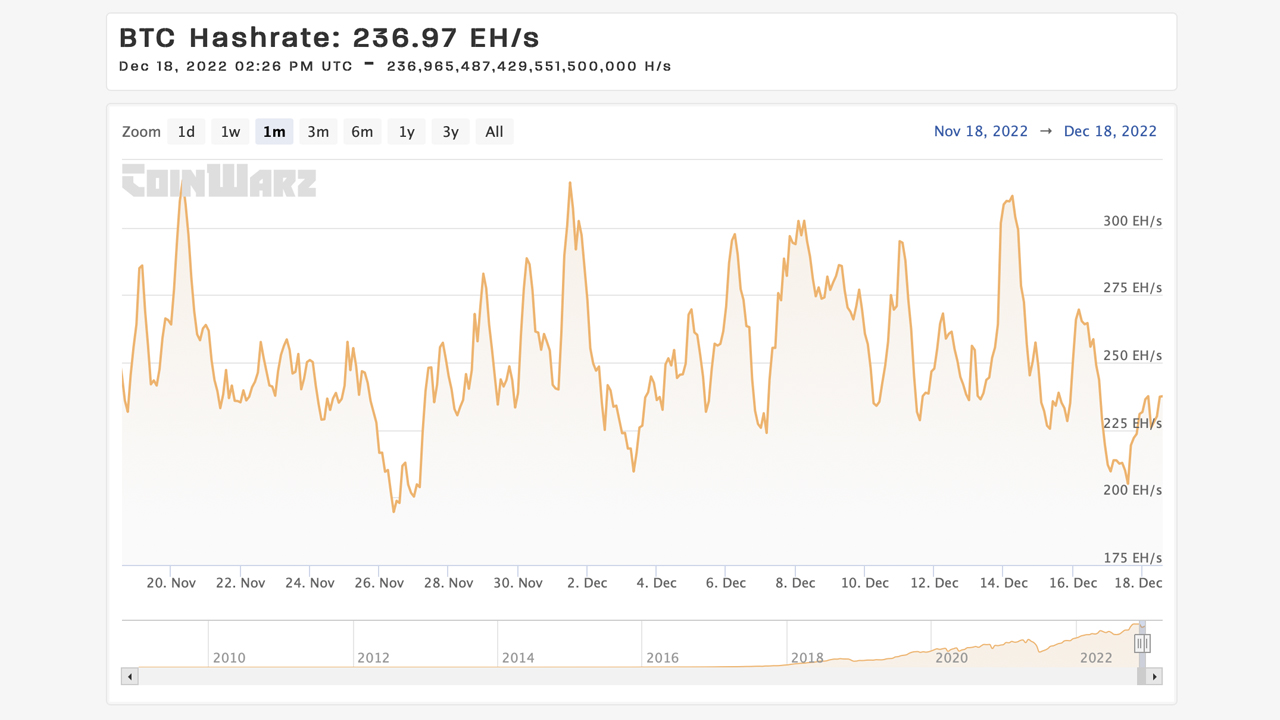

Bitcoin’s mining problem goal is anticipated to extend on Dec. 19, 2022, after printing the biggest discount recorded in 2022 on Dec. 5, at block peak 766,080. Over the past 2,016 blocks, Bitcoin’s hashrate has been round 254.3 exahash per second (EH/s), and block intervals have been quicker at 9:41 minutes per block.

Bitcoin’s Issue Anticipated to Soar 3% Larger on Dec. 19, Bitcoin Common Mining Prices Are Larger Than the Present Spot Market Worth

In roughly 24 hours, the Bitcoin community will expertise one other problem transition, and this time round it’s estimated to extend. The rise is estimated to be round 3.2% to three.76% larger than the present 34.24 trillion worth. The rise would raise the 34.24 trillion to round 35.53 trillion on or round Dec. 19, 2022.

Information exhibits that whereas the community’s problem is growing, BTC’s hashrate has been decrease than the month prior. Bitcoin’s hashrate did faucet a excessive of 316 EH/s on Dec. 1, 2022. The common block time or block interval is between 9:41 minutes per block to roughly 10:43 minutes per block.

The estimated 3% change is going on after the final problem change which noticed a discount of round 7.32% on Dec. 5, at block peak 766,080. The community’s mining problem retarget on that day was the biggest recorded lower in 2022. If the estimated improve happens on Dec. 19, 2022, roughly 3% of the newest discount can be erased making it tougher for miners to discover a BTC block.

Through the previous three days, Foundry USA has been the Bitcoin community’s prime mining pool with 27.05% of the general hashrate or 66.59 EH/s. Foundry is adopted by Antpool (53.51 EH/s), F2pool (35.08 EH/s), Binance Pool (31.51 EH/s), and Viabtc (22 EH/s) respectively. 414 block rewards had been found over the past three days and the highest 5 aforementioned mining swimming pools found 351 of these blocks.

On Dec. 17, macromicro.me stats present bitcoin common mining prices based mostly on metrics from Cambridge College, indicating that the associated fee is round $19,806, and BTC’s value on Dec. 18, is round $16,700 per bitcoin.

What do you consider Bitcoin’s upcoming problem retarget on Dec. 19? What do you consider the stress bitcoin miners are feeling today from low bitcoin costs? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link