[ad_1]

On-chain analytic agency Glassnode has damaged down which Bitcoin cohorts have been accumulating and which have been distributed throughout the previous yr.

Bitcoin Whales Distributed Cash Equal To 60% Of Mined Provide In The Final 12 Months

As per information from Glassnode, whales, miners, and alternate outflows had been the first distribution sources prior to now yr. The related indicator right here is the “yearly absorption charges,” which measures the yearly Bitcoin steadiness adjustments of the totally different cohorts out there and compares them with the variety of cash issued over this era.

The “cash issued” confer with the entire quantity BTC miners obtain as block rewards for mining a block. These new cash produced need to go someplace, and that’s what the yearly absorption charges metric tries to color an image of the BTC provide circulation.

The cohorts that Glassnode has thought of are the shrimps (buyers holding lower than 1 BTC), crabs (between 1 to 10 BTC), whales (greater than 1,000 BTC), and miners. Moreover, the agency has additionally included information for the “alternate outflows,” which measure the entire variety of cash withdrawn from the wallets of all centralized exchanges.

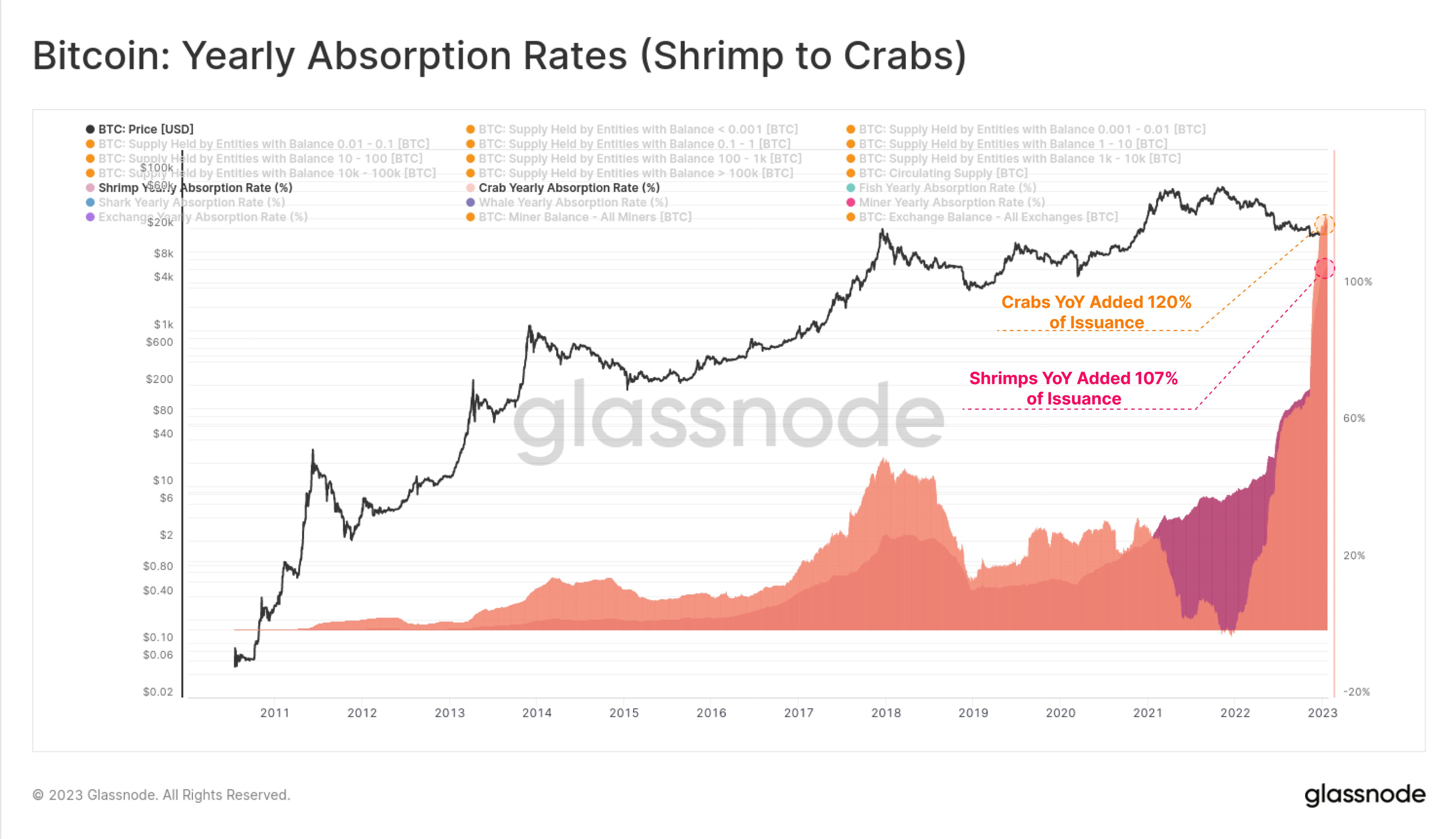

Now, first, under there’s a chart that reveals which of those investor teams had been absorbing a constructive quantity of the yearly coin issuance:

The worth of the metrics appear to have been fairly excessive in current weeks | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin yearly absorption price of the shrimps is 107% proper now, that means that this investor group added 107% of the entire variety of cash issued on the community to their holdings throughout the previous yr.

The indicator’s worth has been even larger for the crabs at round 120%. From the chart, it’s obvious that the metric has noticed a really speedy rise in the previous couple of months, suggesting that a variety of accumulation occurred on the lows following the FTX collapse.

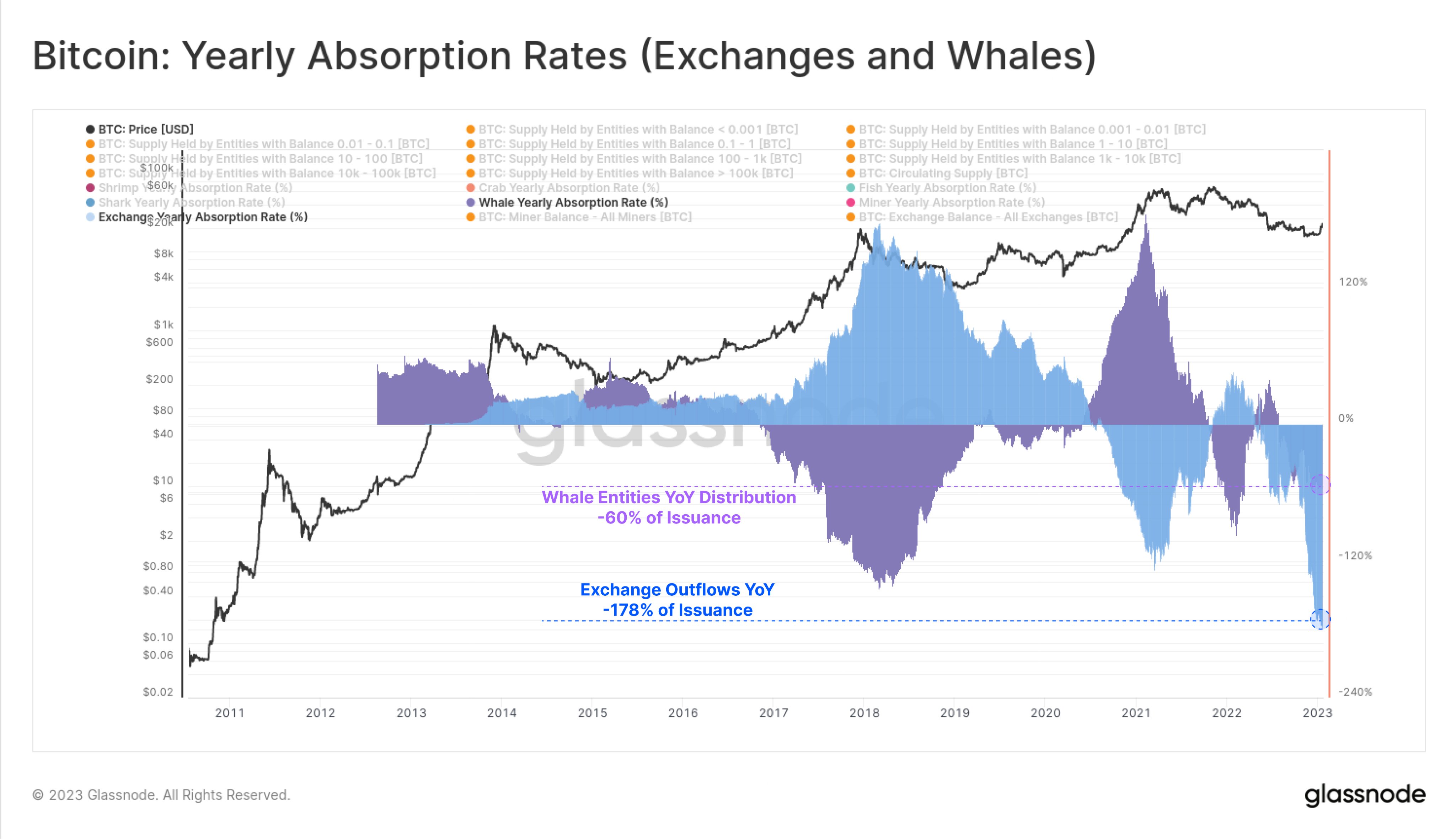

For the reason that quantities added by these cohorts are larger than what the community issued prior to now yr, it appears affordable to imagine that some teams should have distributed or bought their cash to make up for the distinction. The under chart reveals which cohorts displayed distribution conduct throughout the previous yr.

Appears like these metrics have been deeply destructive not too long ago | Supply: Glassnode on Twitter

Evidently the yearly absorption price of the whales is 60% underwater, which means that these humongous holders have shed cash equal to 60% of the issued provide from their wallets over the previous yr.

Exchanges additionally distributed an enormous quantity of Bitcoin because the metric’s worth was destructive 178% for alternate outflows. These platforms noticed massive withdrawals on this interval partly due to the FTX collapse, which made BTC holders extra conscious of the dangers of holding their cash in centralized wallets. This led to an enormous migration of the BTC stored on centralized entities.

Customers switch massive quantities of BTC from exchanges to maintain their holdings in privately owned {hardware} wallets. Although not displayed within the chart, Glassnode additionally mentions within the tweet that miners distributed 100% of the cash they mined (which implies 100% of the issuance), plus an extra 2% from their current reserves.

BTC Value

On the time of writing, Bitcoin is buying and selling round $22,600, up 8% within the final week.

BTC continues to maneuver sideways | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link