[ad_1]

There’s a motive centralized exchanges have dominated regardless of being antithetical to crypto’s core tenets.

The next opinion editorial was written by Bitcoin.com CEO Dennis Jarvis.

The gross mismanagement and outright fraud in 2022 by many opaque centralized exchanges are driving individuals again to the core tenets of crypto, reminiscent of decentralization, self-custody, transparency, and censorship resistance. Individuals are naturally turning to DeFi (decentralized finance). Sadly, a lot of DeFi will not be but able to act as an acceptable substitute.

On this article, I’ll discuss two of a very powerful challenges: easy methods to make DeFi extra accessible to new customers and easy methods to enhance its efficiency when in comparison with centralized providers.

The Onboarding Downside and Its Resolution

The issue with getting new customers to undertake DeFi is partly because of person expertise (UX). Bitcoin.com’s Head of Product Expertise Alex Knight did a superb job outlining the issues and options of the UX challenges in web3 functions. To summarize: the self-custodial web3 mannequin usually results in builders making a person expertise that’s basically completely different from the one individuals are used to within the custodial web2 mannequin — and that creates large friction.

Fixing the UX drawback is a mix of intelligent design, schooling, and incentives.

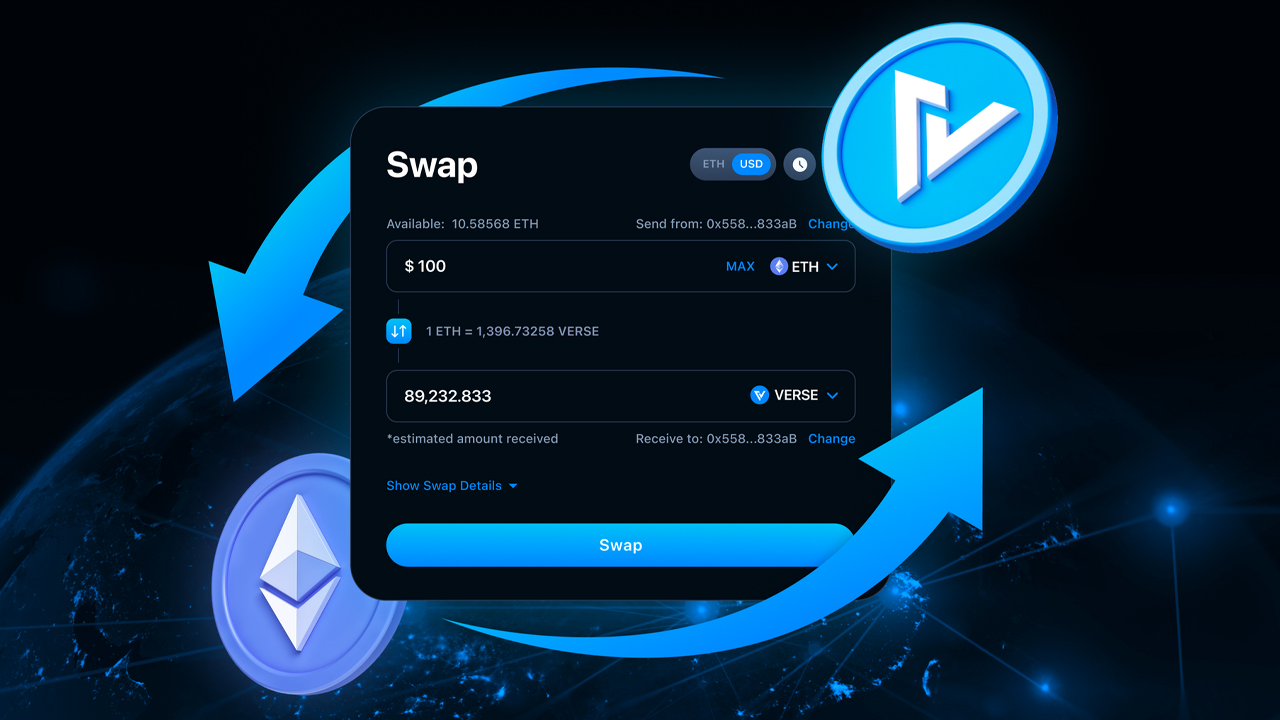

On the design entrance, the problem is to create merchandise which can be as acquainted and easy-to-use as the perfect web2 analogs. At Bitcoin.com our self-custodial multichain pockets app has long-provided an intuitive expertise, however solely for easy actions like shopping for, promoting, sending, and receiving crypto. As we combine extra advanced DeFi options, together with our personal decentralized alternate Verse DEX, proper into the app, it’s crucial that the person expertise stay as indistinguishable from web2 as doable whereas utilizing web3 rails completely.

But even when web3 manages to achieve parity with web2 when it comes to ease-of-use, there may be nonetheless the problem of convincing individuals to make the swap. That is the place schooling and incentives are available in. Training will do two issues: rebuild confidence in crypto, and put together customers to make the transfer. Incentives will present the push that’s typically wanted to attempt one thing new.

Fortunately, the cryptocurrency area is ideally suited to offer the proper mixture of schooling and incentives. I’ve written concerning the energy of loyalty tokens in crypto, and the significance of getting them proper, and we’ve thought lengthy and exhausting about easy methods to combine them within the Bitcoin.com ecosystem.

Now that we’ve launched our personal ecosystem token VERSE, we’re capable of begin experimenting with methods to make use of financial incentives to soundly information individuals into decentralized finance, the place they’ll profit from its benefits over CeFi (centralized finance). A method we’re planning on doing that’s to reward newcomers with VERSE tokens for taking actions like securely backing up their pockets.

That is supported by our newly launched CEX Training Program that may reward individuals affected by centralized crypto firm insolvencies whereas encouraging the adoption of decentralized finance and self-custody.

The Execution Downside

Even for those who clear up the issue of onboarding new customers, DeFi in its present iteration fails in responsiveness and market measurement. If both of those is missing, individuals is not going to come, or abandon quickly after.

DeFi responsiveness has seized up beneath what could be thought-about gentle visitors in web2. On-chain capability has not been capable of deal with peak 2021 DeFi utilization. Even with the proliferation of alt-L1’s and the beginnings of dwell L2’s, on-chain block area was simply swamped.

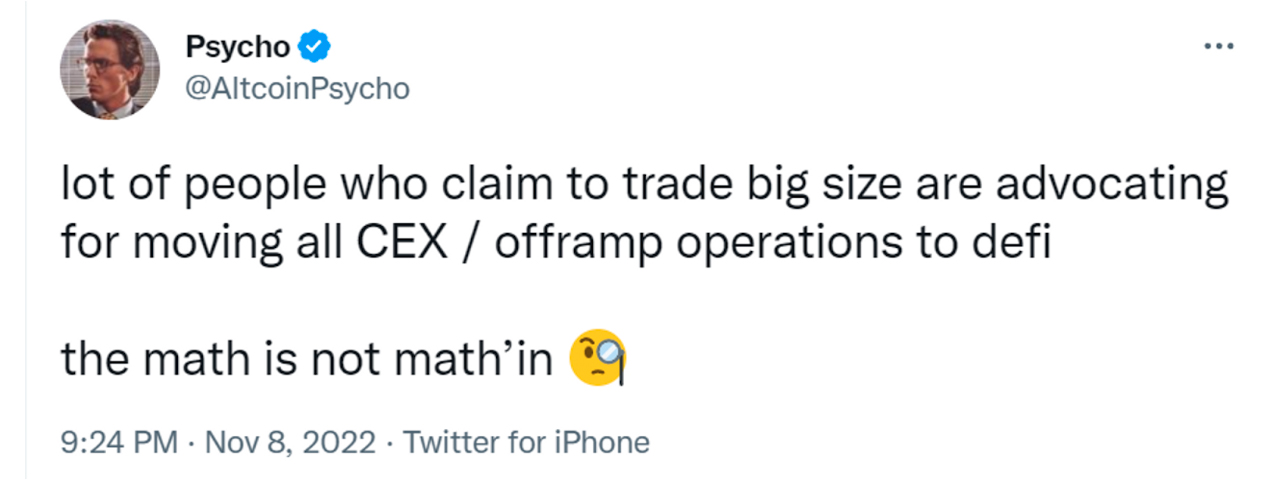

DEX market measurement encapsulates DeFi’s capability drawback. I’ll let crypto Twitter assist me out right here:

Word that these feedback had been posted simply earlier than FTX imploded. It’s doable that the tweets’ authors’ views have modified since then. Nonetheless, their criticisms ring true: Present DeFi merchandise merely can not exchange CEXs when it comes to liquidity, quantity, and order matching.

It’s an issue for the crypto trade when lots of the greatest merchants, market makers, and proponents of crypto can not execute trades or take part in measurement on decentralized platforms. They’re compelled to collect on dangerous centralized exchanges, which creates a self-reinforcing cycle of dependence on CEXs.

Up to now, CEXs appeared like an agreed upon stop-gap till crypto know-how was at a spot the place it was succesful to take over. As crypto garnered extra consideration, I really feel just like the trade as an entire grew to become complacent, distracted by the amount of cash pouring in. The sensation was one thing like, “These issues will likely be solved in time.”

Resolution to the Execution Downside

I imagine that the bottom crypto technological instruments are all right here, or practically so. An instance of a DEX that may compete on a suitable stage with a CEX, is the layer 2-based dYdX alternate. Leveraging zero-knowledge proof techniques, dYdX can execute transactions cheaply and rapidly sufficient to check with the responsiveness of CEXs. At present, “the prevailing dYdX product processes about 10 trades per second and 1,000 order locations/cancellations per second, with the purpose to scale up orders of magnitude greater.”

Now the one factor it lacks is comparable liquidity. Since good liquidity begets higher liquidity, a constructive first step is that dYdX makes use of an order e-book and matching engine, a way more environment friendly and worthwhile approach to make markets. Utilizing an order e-book ought to entice market makers to offer the liquidity adequate to make DEXs corresponding to CEXs.

Moreover, liquidity will come now that it’s apparent (once more!) that you would be able to’t belief these centralized intermediaries. Massive gamers in crypto have to make a concerted effort to maneuver out of CEXs into DeFi protocols. Bitcoin.com, for one, is proud to offer in depth DeFi options. The Bitcoin.com Pockets, with over 35 million self-custodial wallets created thus far, continues to be an essential onboarding instrument, organising newcomers to simply and securely work together with decentralized finance.

The Future Is DeFi

Don’t be disillusioned by the shortcomings I’ve recognized right here. The reality of the matter is that every one of DeFi’s shortcomings are trivial compared to its strengths. DeFi allows self-custody of your property however with the utility we’ve come to depend on from centralized monetary establishments; for instance, swapping between property, incomes yield in your property, or utilizing your property to take out loans. Till now, these monetary actions have all the time required trusted intermediaries. The options to DeFi’s issues are attainable, which is in stark distinction to the entrenched issues in conventional finance. Finally the reply to conventional finance’s issues is DeFi.

What are your ideas on the potential for decentralized finance to exchange centralized finance? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link