[ad_1]

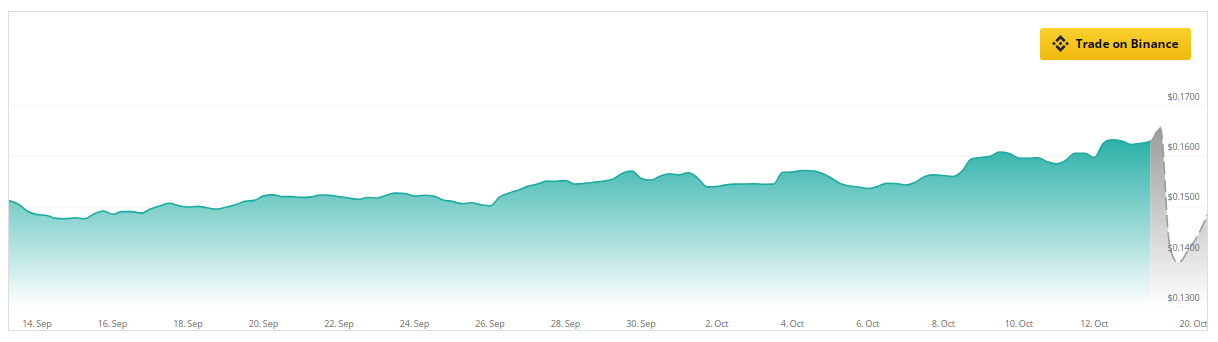

TRON (TRX) just lately garnered consideration by incinerating over 10 million tokens, demonstrating its dedication to a deflationary method meant to reinforce its worth. Presently, TRX is buying and selling at roughly $0.1605, indicating a small improve.

Analysts specific optimism on TRON’s future, forecasting a 57% worth improve through the subsequent three months, and an much more outstanding 208% rise over six months, figures from CoinCheckup present. This optimistic perspective signifies that TRX could also be poised for a considerable upward trajectory within the cryptocurrency market.

A Sturdy Technical Basis

The technical indicators for TRX are converging in direction of a constructive sentiment. The worth chart demonstrates a modest upward development, whereas the Relative Power Index (RSI) is presently at 57.58. This statistic signifies that TRX is approaching overbought space, nevertheless there nonetheless potential for extra good points.

The Stochastic indicator, at present at 66.63, reinforces this bullish perspective by demonstrating momentum with out indicating imminent exhaustion. Collectively, these components recommend that TRX could maintain its upward development within the brief future, rendering it an interesting alternative for traders.

Rising Enthusiasm For TRON

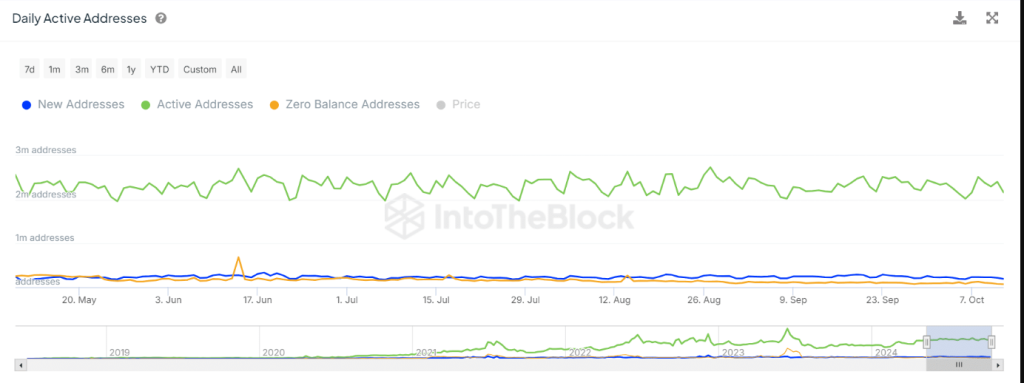

Alongside the token burn, TRON has had a good improve in each day energetic addresses, indicating a rising investor curiosity, knowledge from IntoTheBlock reveals. Though the final development appears fixed, this minor uptick means that extra individuals are getting into the market.

This growing participation could improve the token’s upward trajectory, notably when coupled with the present deflationary methods. As TRON endeavors to decrease its circulating provide, these parts could set up a basis for heightened costs.

Market Sentiment And Buying and selling Conduct

Regardless of the constructive statistics, merchants stay extraordinarily cautious. The Lengthy/Quick Ratio reveals shorts barely outstrip longs with 54% shorts and 46% of longs. It is a ‘wait-and-see’ angle by merchants whereas awaiting a potential volatility within the worth motion of TRX.

The TRX OI-Weighted Funding Charge is at roughly 0. That implies that the steadiness of longs to shorts is impartial, and therefore it could additionally mirror positively on market sentiment pending short-term variability for TRX’s worth.

Latest burning of tokens by TRON and the regular improve in energetic addresses can enhance the momentum TRX must publish stable development charges for the following couple of months.

Technical indicators depict a constructive development and stable worth projections, which reveals TRX will acquire considerably within the brief time period.

Featured picture from Pixabay, chart from TradingView

[ad_2]

Source link