There’s a correlation between macroeconomic elements and crypto belongings like Bitcoin. Harsh and stricter elements enhance the volatility of digital tokens negatively. That is additionally the case for fairness shares and their markets.

The previous week introduced a downtrend to the first cryptocurrency. Bitcoin was seen going towards the $19,000 area with none anchor. The south motion by your entire crypto market grew to become extra drastic because the US Federal Reserve launched its new fee enhance. Additionally, the fairness market was not unnoticed of the pattern.

Totally different Developments For Crypto And Fairness Markets

However this new week brings a distinction within the pattern between the crypto and fairness markets. Wall Avenue initiated a corrective mode for a lot of the shares. There was a sudden meltdown for the three prime US indices as they displayed a 1% correction on Monday, September 26.

Fairness shares and commodities plummeted by over 10%, however the MVIS CryptoCompare Digital Property 100 index dipped by 1% throughout the final month.

Bitcoin and different cryptocurrencies defied the worth drop within the fairness market from the start of the week. As a substitute, costs within the crypto market have adopted a bullish pattern regardless of all odds. This created an enormous shock inside and outdoors the area because the correlation hyperlink with Wall Avenue failed.

The worth of BTC surged throughout the $20,000 degree. This was after the battle over the previous week as BTC hit $19K. Some analysts anticipated that Bitcoin would steadily drop to its 2022 low of $17,500. However the token made a formidable transfer for the crypto area with its reclaims.

On the time of writing, BTC is buying and selling round $19,114, indicating a miner lower. Its market capitalization is at present over $387.5 billion. With the sudden rise in Bitcoin worth, over $14 million of liquidations in brief positions have occurred.

OnChainCollege reported on the Bitcoin Mayer A number of whereas citing Glassnode information. It famous that the a number of stalls are at a traditionally low degree. Moreover, a comparability with its 200-day transferring common reveals that Bitcoin is undervalued.

The broader crypto market is experiencing a worth rally. Apart from Bitcoin, the altcoins akin to Ethereum (ETH), Avalanche (AVAX), and Solana (SOL) surged by over 6%. This new bullish pattern for BTC and different crypto belongings indicated the crypto market’s resilience to volatility, in contrast to conventional inventory.

Bitcoin May Break Correlation With Fairness Inventory

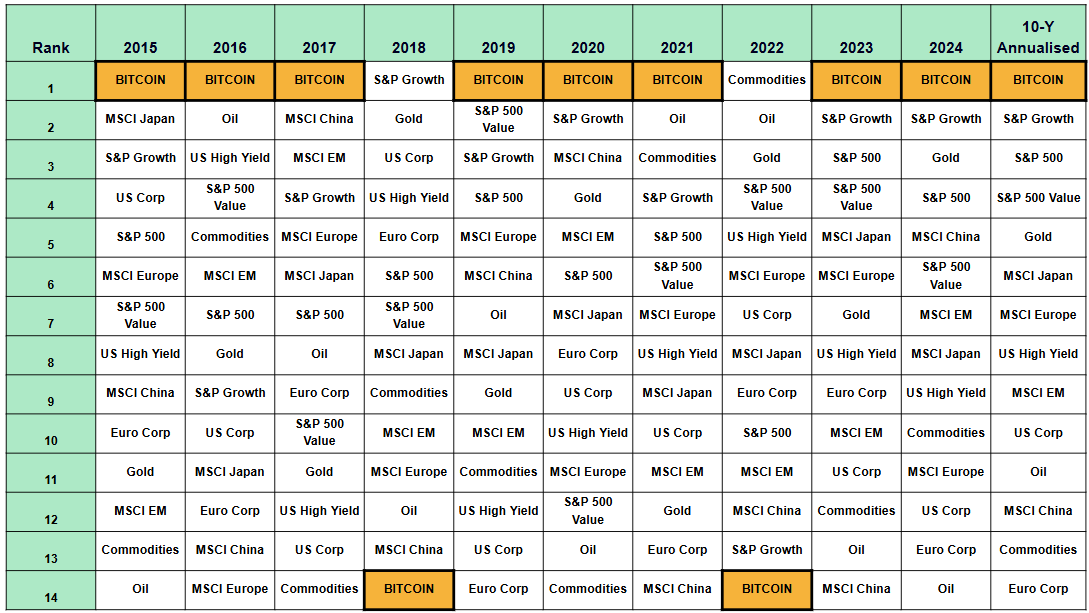

This 12 months, the first crypto asset displayed the next correlation to the US fairness market. Bitcoin’s worth pattern was much like that of the S&P 500. Nevertheless, BTC’s new worth spike is breaking the hyperlink, although it’s solely time that may inform.

Additionally, there’s a priority with the drop within the Bitcoin whale holdings this 12 months. Nevertheless, some analysts are impartial regardless of the uncertainties of the world’s macros.

On Monday, the founding father of fairlead Strateies LLC, Katie Stockton, famous that the BTC rebound is appropriate for short-term gauges. Nevertheless, most individuals could stay impartial as they count on a fast failure within the bounce.

Featured Picture From zipmex, Charts From Tradingview