[ad_1]

Decentralized finance (defi) and sensible contract platform tokens rallied on Monday morning (ET) and the overall worth locked in defi jumped above the $40 billion zone for the primary time since mid-December 2022. The highest sensible contract platform cash by market capitalization elevated 7.1% on January 9, 2023, and most have seen double-digit good points over the past week.

Lido Finance Emerges as Most Dominant Defi Protocol, Surpassing Makerdao in TVL Measurement

Cryptocurrency markets have been constructive initially of the second week of 2023, as your entire crypto financial system has elevated 3.6% to $893 billion on Monday round 11:00 a.m. (ET). Sensible contract platform tokens have seen a 7.1% rise to $274 billion, which equates to roughly 30.68% of your entire crypto financial system. Out of the highest 5 sensible contract platform cash, Solana (SOL) noticed the largest achieve, rising 24.2% in 24 hours.

Cardano (ADA) adopted, with ADA growing by 11.7% over the past day. Ethereum (ETH) is up 5.1%, BNB 5.5%, and polygon (MATIC) swelled by 6.7% in 24 hours. Moreover, all 5 of the highest sensible contract belongings have seen double-digit spikes over the past seven days. Once more, SOL led the pack, leaping 72.3% larger this previous week, and ADA elevated by 28.8% throughout the identical timeframe. Ethereum (ETH) noticed the bottom improve over the past seven days in comparison with the highest opponents, because the cryptocurrency is up 11.5% this week.

After all, the rise within the value of sensible contract platform tokens has led to a swelling of the overall worth locked (TVL) in defi as effectively. Since mid-December 2022, the TVL in defi was under the $40 billion vary, however on January 9, 2023, it managed to climb again above that to roughly $41.1 billion on Monday. Whereas Makerdao was probably the most dominant defi protocol, Lido Finance is now probably the most dominant with 15.92% of the TVL in defi. Lido has a TVL of round $6.54 billion, whereas Makerdao follows behind with $6.44 billion. Lido and Makerdao are adopted by Aave, Curve, and Uniswap, respectively, when it comes to TVL measurement.

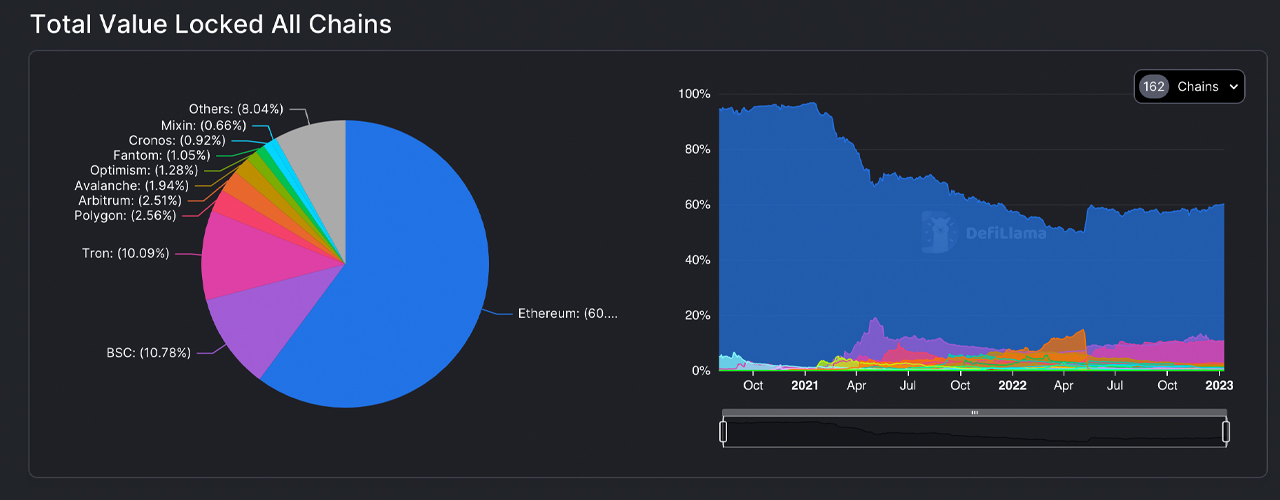

Ethereum remains to be probably the most dominant in defi at the moment, when it comes to TVL measurement, because the chain’s $24.61 billion represents 59.88% of the overall $41.1 billion locked. Binance Sensible Chain has the second largest TVL with $4.41 billion, Tron is available in third with $4.13 billion, Polygon takes the fourth place with $1.05 billion, and the fifth largest in defi at the moment, so far as blockchains are involved, is Arbitrum with $1.03 billion. During the last day, the TVL in defi jumped 2.99% larger, however the TVL has an extended strategy to go to succeed in the $178.55 billion excessive reached in November 2021.

What are your ideas on the state of decentralized finance and sensible contract belongings as we begin the second week of the brand new yr? Share your ideas on this subject within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

[ad_2]

Source link