[ad_1]

In 32 days, Ethereum is predicted to improve from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) system after the community used PoW for seven years. Whereas the testnets have carried out the brand new guidelines, most individuals envision a comparatively easy mainnet transition. Nonetheless, one other chain is predicted to fork away from the Ethereum department and since August 8, the proposed fork referred to as ETHW has gained market worth in just a few IOU markets. Regardless of the worth gathered, the potential token misplaced greater than half of its USD worth in lower than six days’ time.

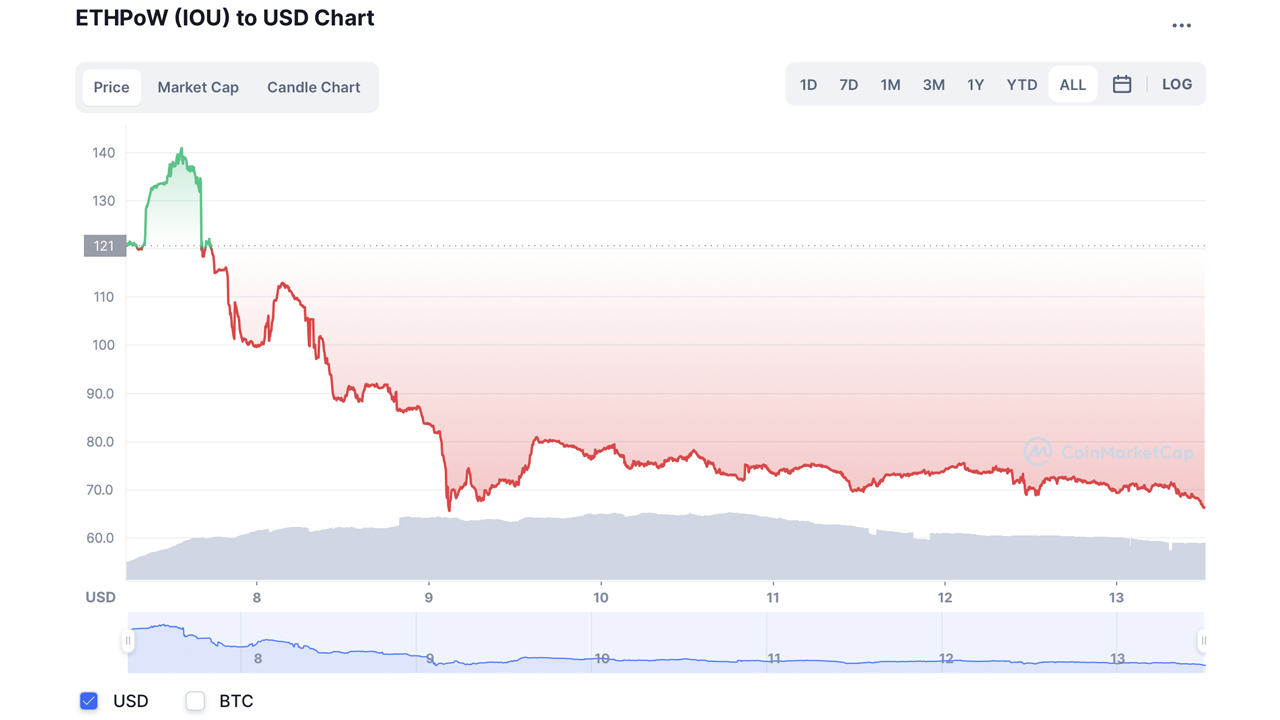

Whereas ETHW Captures Worth, Proposed Ethereum Fork Token’s Worth Shudders by Extra Than 53%

Ever because the bitcoin miner Chandler Guo began speaking a few new proof-of-work (PoW) model of Ethereum, after the chain transitions to proof-of-stake (PoS), the thought has gained some traction. The crypto asset change Poloniex revealed the launch of ETHW markets and there’s a brand new web site referred to as ethereumpow.org.

Statistics from coinmarketcap.com point out that MEXC, Digifinex, Gate.io, and Poloniex listing ETHW IOU markets. However the ETHW website additionally claims to have connections with numerous “communities, exchanges, miners and people [that] have labored collectively to make ETHW potential.” Twitter vertical tendencies present that the ETHW fork is controversial amongst die-hard Ethereum supporters and Ethereum Basic supporters have chimed in as nicely.

The web site exhibits connections by ETHW change listings, and alleged mining supporters with talked about companies corresponding to Binance, FTX, Antpool, Poolin, Coincheck, Huobi, Hiveon, Flexpool.io, 2miners.com, F2pool, and Bitfly. ETHW has been listed on exchanges providing IOU markets for roughly six days up to now.

$ETC is the unique chain. $ETH is a fork. And $ETHW is a fork of a fork. pic.twitter.com/0PkIYu4RrE

— ETCPOW (@ETCPOW) August 5, 2022

Ethereumpow.org additionally claims it has a bridge companion and advertises Bridgetech’s emblem on the positioning. When markets formally launched and ETHW got here out the gate, the worth jumped to an all-time excessive of round $141.36 per unit.

Since then, ETHW has misplaced 53% in worth and in comparison with ETH’s present worth, ETHW represents 3.2% at present market costs. ETHW tapped an all-time low on August 10, 2022, reaching $65.17 per coin and it’s up 1.9% on the time of writing, buying and selling for roughly $66.10 per unit.

There are 5 fundamental variations between this ETH1-ETH2 fork and the ETC-ETH fork. (1) The ETC-ETH fork was primarily as a consequence of ideology. It was PoW vs PoW; the miners may simply mine whichever chain was extra worthwhile.

— Galois Capital (@Galois_Capital) August 6, 2022

ETHW’s worth is extra corresponding to ethereum basic’s (ETC) present worth, which is round $43.86 per unit on the time of writing. Meaning ETHW is $23 increased in USD worth at this time than ETC’s present worth. But many crypto supporters have mentioned how ETC was created for ideological causes whereas ETHW is being referred to as a “cash seize.”

So Far, There’s Been No Significant Rises in Ethereum Basic’s Hashrate

A lot of the mining swimming pools talked about on ethereumpow.org already mine ethereum basic (ETC). For example, 2miners.com is the second largest ETC mining pool, dedicating shut to 6 terahash per second (TH/s) to ETC’s PoW community.

What ETH PoW fork will imply for me:

State of affairs A:worth is break up throughout each chainsStrategy: Promote $ETHW for $ETHOutcome: extra $ETH than earlier than.

State of affairs B:$ETHW worth is $0 from beginningStrategy: submit memes laughing aboutOutcome: free enjoyable

Can’t think about a greater occasion

— Alejandro Perezpayá (@aperezpaya) August 6, 2022

So far as the ETHW fork, if even one of many aforementioned mining swimming pools that allegedly help the chain begin mining it, ETHW will turn out to be a actuality. Presently, dozens of ethereum mining swimming pools are seemingly mining ETH to the very finish, because the crypto asset’s rise has made it fairly precious to take action.

ETH’s hashrate is way bigger than ETC’s and up to now, there’s been no significant rises in ETC’s hashrate, apart from the preliminary spike on July 28, 2022. Ethereum is at present one of the worthwhile crypto networks to mine at this time, as Bitmain’s new Antminer E9, with 2.4 gigahash per second (GH/s) or 0.0024 TH/s, can get an estimated revenue of round $63.43 per day.

What do you concentrate on the proposed Ethereum fork and the way the IOU token has already shed half of its worth this previous week? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link