[ad_1]

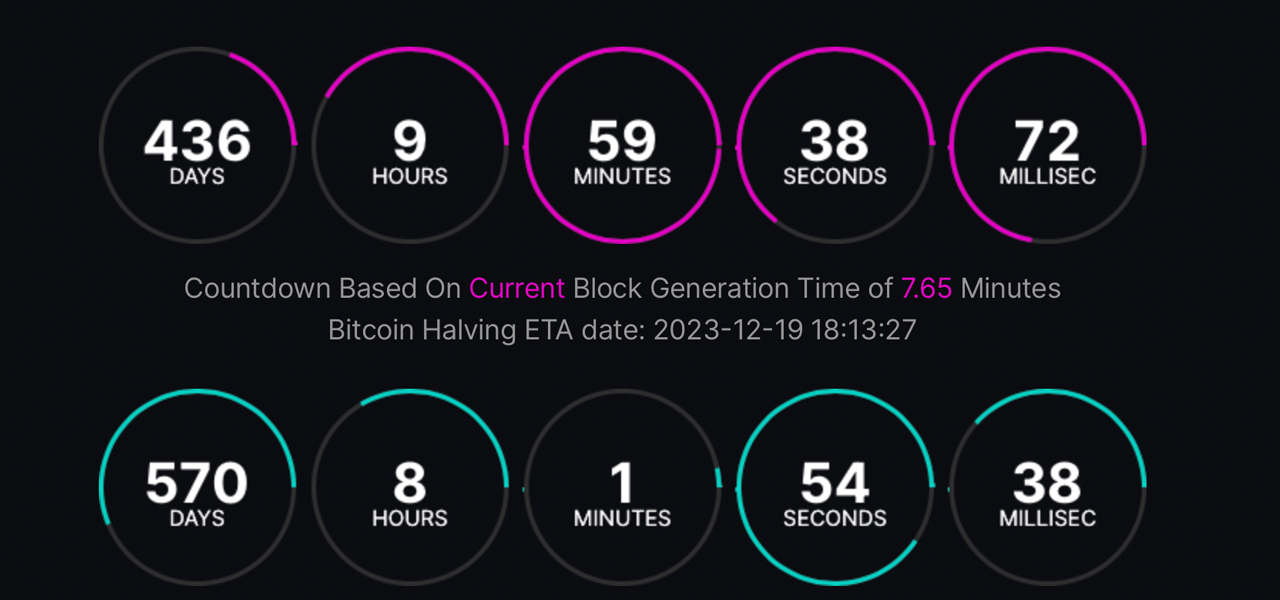

In keeping with countdown statistics based mostly on the typical block technology time of round ten minutes, progress towards the subsequent Bitcoin block reward halving has surpassed 60%. Nonetheless, whereas most halving countdown clocks leverage the ten-minute common, the countdown leveraging probably the most present block intervals of round 7:65 minutes reveals the halving might happen in 2023.

Sooner Block Intervals Recommend Bitcoin Halving May Occur in 2023

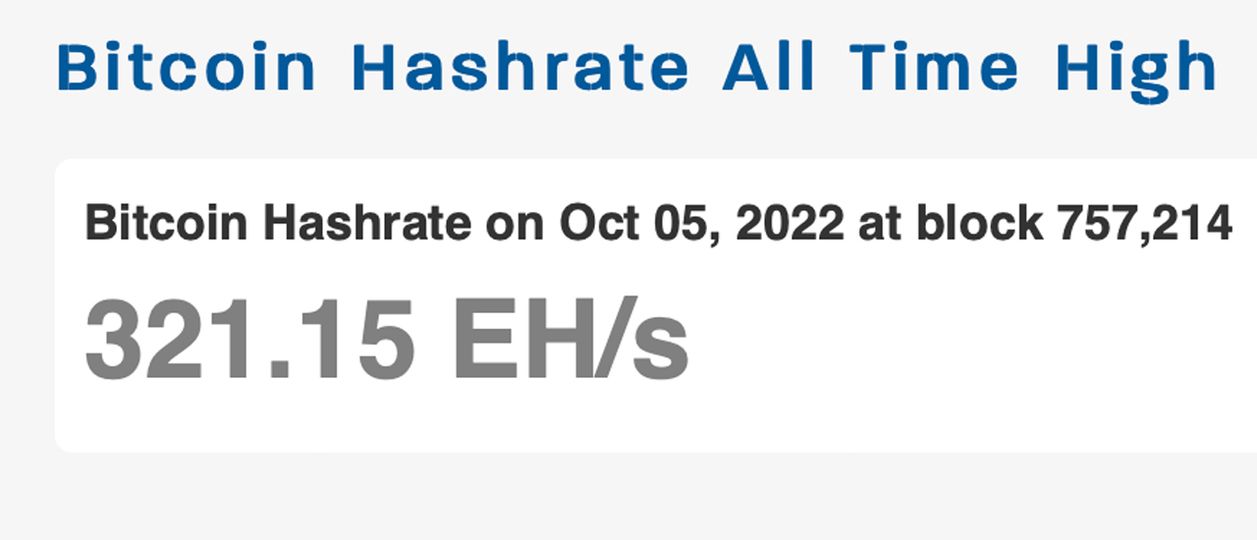

Only recently, at block peak 757,214, mined on October 5, 2022, Bitcoin’s whole hashrate tapped an all-time excessive (ATH) at 321.15 exahash per second (EH/s). Recently, block intervals have been quicker than typical and nicely below the ten-minute common.

The velocity at which the two,016 blocks are present in between problem changes determines the problem and present block intervals counsel a big problem bounce is within the playing cards. Now, previous to the subsequent problem rise, the hashrate has continued to stay robust and block instances on the time of writing are round 7:65 minutes.

The following mining problem retarget is scheduled to occur on or round October 10, 2022. If block instances stay quicker than typical even after the retarget, the protocol’s block reward halving might very nicely occur in 2023. Statistics from bitcoinsensus.com point out that at 7:65 minutes per block interval, the halving might happen on or round December 19, 2023.

Bitcoinsensus.com additional reveals the halving time based mostly on the typical ten-minute rule which reveals the halving will happen on Might 1, 2024. Most countdown calculators apply the typical ten-minute rule, and different knowledge factors counsel the halving might happen on April 20, 2024.

Both method, the progress towards the subsequent halving remains to be greater than 60% full, and when it happens, bitcoin miner rewards can be lowered from 6.25 BTC to three.125 BTC put up halving. Regardless of the excessive velocity now, miners might simply decelerate after the significant problem enhance on October 10 is recorded and if BTC costs stay low.

This, in flip, would push the halving date again to the 2024 vary and in spite of everything, there’s nonetheless nicely over a yr’s value of BTC block subsidies to mine. So much can change. In keeping with a latest weblog put up from Blocksbridge Consulting, the problem change and low worth vary might give bitcoin miners a headache from lack of earnings.

“Bitcoin’s every day mining income per PH/s is presently round $80. If the problem rises 13% on Monday and bitcoin’s worth stays at $19.5K, the every day income would lower to $70 per (petahash) PH/s,” Blocksbridge Consulting’s Miner Weekly difficulty #17 notes. “That might trigger mining firms to mine at all-time low revenues every day, even decrease than what we noticed throughout the summer time following the Might 2020 halving.”

The weblog put up provides:

Except bitcoin’s worth breaks the $20,000 barrier, those that make use of older-generation machines or have bloated mining operations will face a good more durable time forward.

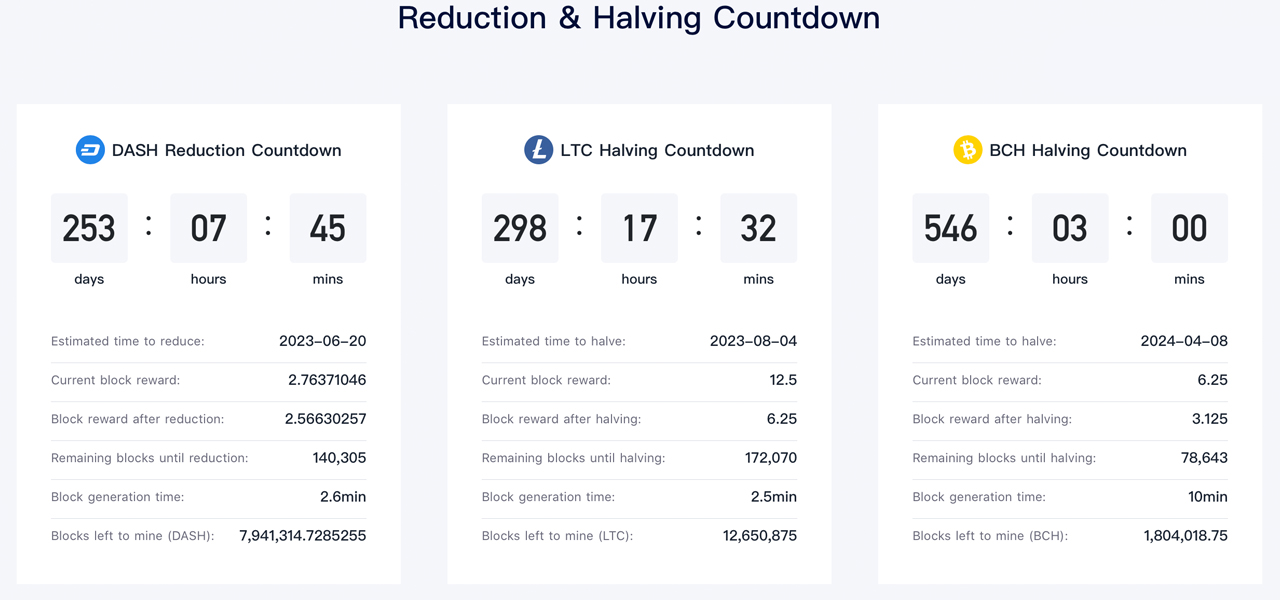

Viabtc’s Viawallet halving metrics present that eight blockchains are anticipated to see reward halvings or what’s often known as “reward reductions.” Sprint expects a reward discount on June 20, 2023, as rewards will shrink from 2.76 DASH to 2.56 DASH. Different discount occasions and reward halvings will stem from blockchains that embrace BCH, BSV, LTC, ETC, ZEC, and ZEN.

What do you consider the Bitcoin community’s progress towards the subsequent halving exceeding 60%? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link