[ad_1]

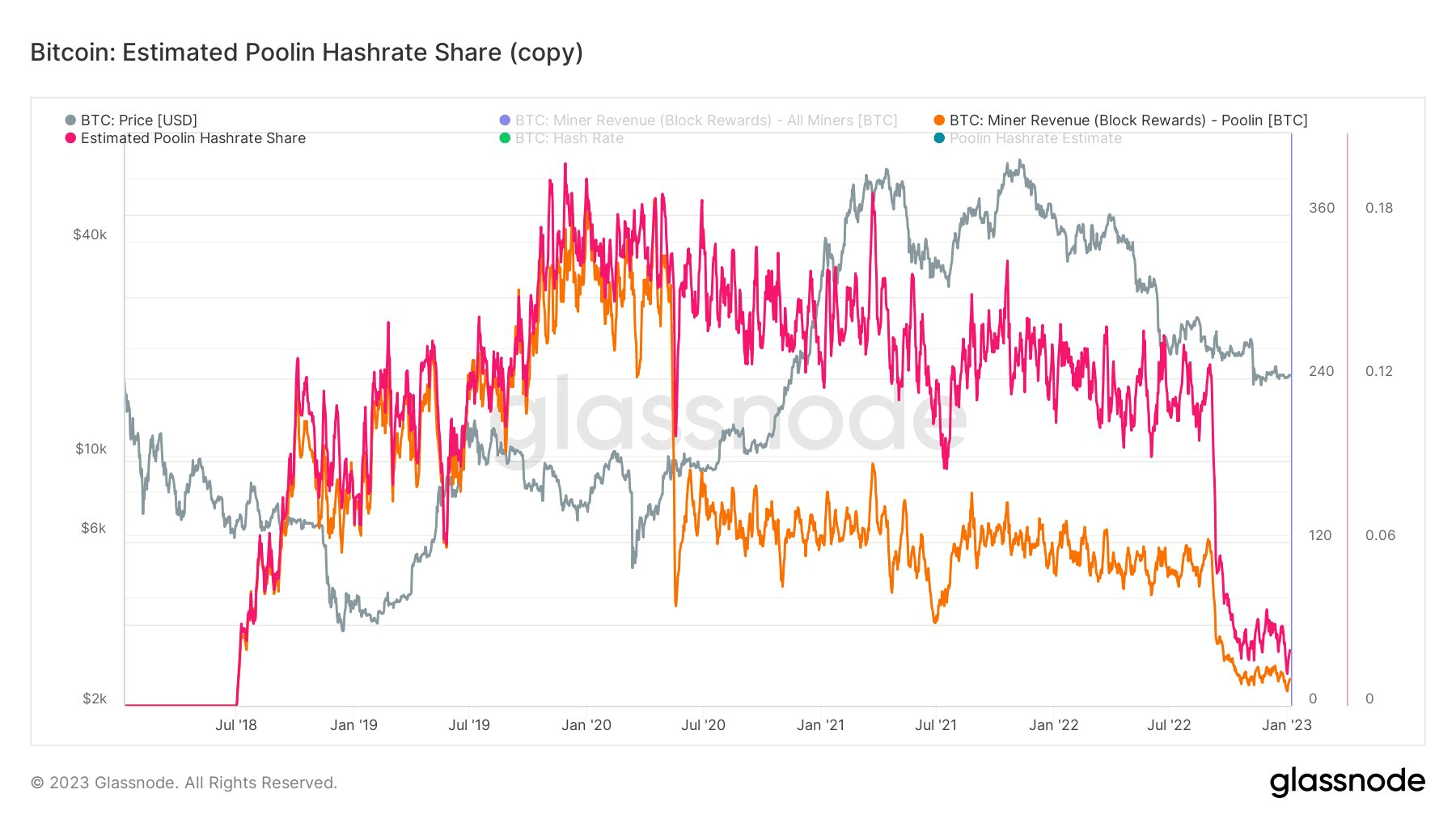

China-based Bitcoin mining pool, Poolin, registers a document decline in hash price share to 1% from its all-time excessive of 18% – a 94% decline, in line with information from Glassnode.

Poolin contributed 4354 blocks within the Bitcoin mining pool with a hash price share of 8.182% if we lengthen the timeline to a 12 months. However, in 2022, Bitcoin mining suffered a major blow because of growing mining problem, declining Bitcoin costs, and miners closing their companies because of declining profitability.

The current downturn could be traced again to final September when the mining pool agency introduced liquidity issues. The pool accounted for about 12% of Bitcoin’s hash price previous to its announcement.

Poolin additional suspended all withdrawals, flash trades, and inside transfers from its community to protect belongings and stabilize liquidity. Consequently, many miners left the pool, leading to a drop in hashing energy and block rewards.

Amidst this, Poolin had the biggest miner outflow in two years, amounting to 10,000 Bitcoins. Additional, CryptoSlate’s earlier evaluation exhibits that Bitcoin held in Poolin wallets dropped sharply from 22,000 BTC in early November to 6000 BTC in December. It accounted for a considerable portion of the market’s total decline in balances held by miners.

Value noting Bitcoin mining grew to become tough in China after the Chinese language authorities banned crypto mining in 2021. In 2020, Poolin introduced its partnership with Three Arrows Capital, a crypto hedge fund that declared chapter after the Terra-Luna collapse final 12 months.

[ad_2]

Source link