[ad_1]

In instances of worry of a WWIII, inflation, recession and vitality scarcity many of the funding devices endure substantial losses. Shares, gold and principally cryptocurrencies are drastically affected by the troublesome environment around the globe.

With Ether down roughly 64% year-to-date, adopted by Bitcoin down roughly 58% year-to-date, BestBrokers analyst workforce determined to look into blockchain transaction knowledge and learn how this drop impacts crypto customers if truth be told.

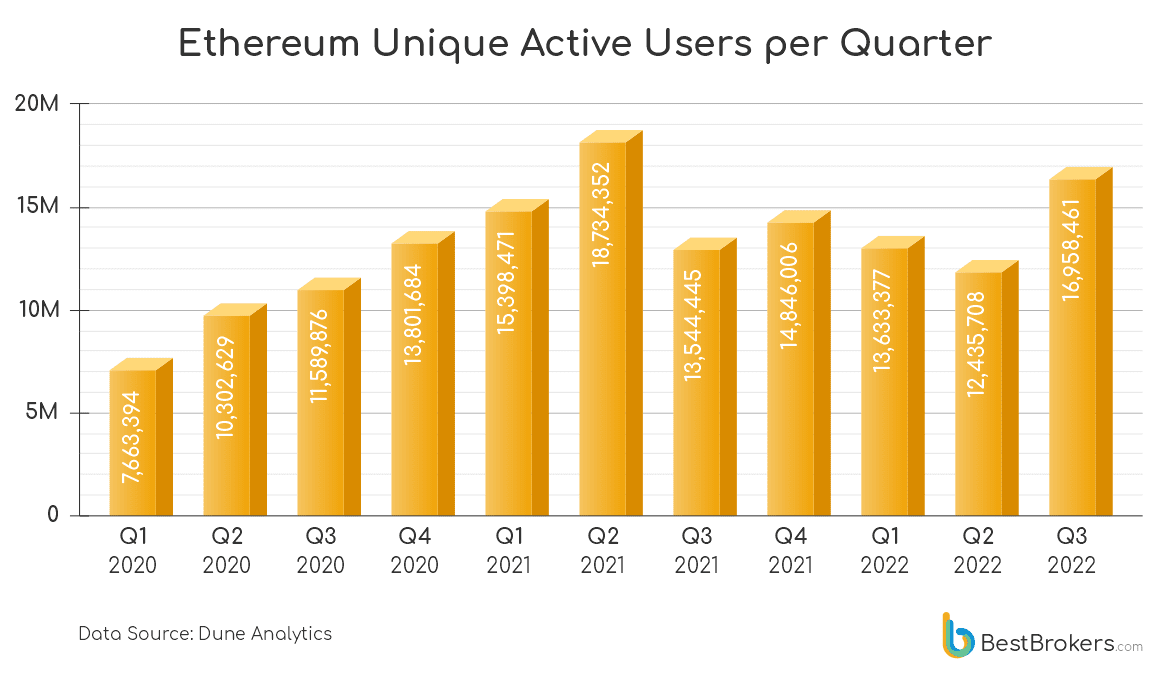

The uncooked knowledge, queried from Dune Analytics clearly reveals an incredible improve in curiosity in Ether because the variety of lively Ethereum customers rose over 36% in Q3 2022, in comparison with Q2. Truly, that is the primary constructive quarter since This fall 2021 when Ether’s value rose to a report all time excessive of simply over $4,890.

Alan Goldberg, analyst at BestBrokers feedback:

“The Ethereum 2.0 replace went dwell simply three weeks in the past. It certainly introduced extra curiosity within the Ethereum community but it surely can not justify such an incredible rise. Different elements should be taken into consideration, together with the truth that folks truly discover cryptocurrencies as an funding choice and the report lows of Q3 2022 appeared like a discount to loads of particular person buyers.”

The long-awaited Ethereum 2.0 replace undeniably had a constructive affect on Еthereum consumer depend. Nevertheless, it was accomplished so late in Q3 2022 that it’s undoubtedly not the one motive for the uptrend. The expectation and the information in mid July, confirming the ultimate replace date undoubtedly contributed to the inreased commerce, however we additionally should keep in mind the truth that Ether value dropped under the $900 mark in late Q2 2022 and that low value will need to have seemed like a discount low cost to optimistic buyers. Since then the worth went regular up with a number of instances touching the $1,000 resistance however remodeled 100% rise to simply over $2,000 in August 2022.

Regardless of the present value sitting at round $1,360 or someway round 33% decrease than the August heights, Ether had nice value swings, typical to many of the cryptocurrencies. In any case, the worth volatility and excessive quantity are among the many elements which drive investor curiosity into the crypto markets and that’s precisely what Ethereum delivered in Q3, clearly exhibiting that the markets have potential to get again on a constructive development.

Alan additionally provides that the 36% improve within the lively customers inside simply 3 months could very nicely be interpreted as an indication that the crypto markets are getting again on the constructive development. He says, ”The truth that the variety of lively customers is over 14% larger than This fall 2021, when each Bitcoin and Ether costs have been at an all time excessive, solely reinforces crypto analysts’ expectations that the markets have an incredible potential to rise once more.”

[ad_2]

Source link