Digital asset custody options supplier Qredo has cast a brand new partnership with DitoBanx, a neobank for the unbanked in Latin America. DitoBanx prospects now entry storage for digital belongings utilizing Qredo’s decentralised multi-party computation (dMPC) protocol.

Integrating the Qredo digital asset custody resolution into the DitoBanx ecosystem allows prospects to securely handle their monetary belongings throughout the neobank’s merchandise.

Qredo’s dMPC protocol is absolutely compliant; providing cryptocurrency safety and governance options. When a DitoBanx buyer indicators a transaction, the protocol distributes all computational processes throughout the community.

This course of seems to make sure that, people signal transactions, Qredo doesn’t maintain non-public keys in anyone geographic location. Qredo goals to eradicate the danger of third events hacking or accessing non-public keys. By these processes, the agency additionally goals to help the safety of Latin America’s unbanked.

Anthony Foy, CEO of Qredo, additionally commented on the partnership. He stated: “We’re thrilled to associate with DitoBanx to convey institutional-grade digital asset custody options to the unbanked in Latin America.

“By leveraging Qredo’s cutting-edge dMPC expertise, DitoBanx can now provide its prospects safe and controlled digital asset companies, enabling them to take part within the rising digital financial system.”

Options for the unbanked in Latin America

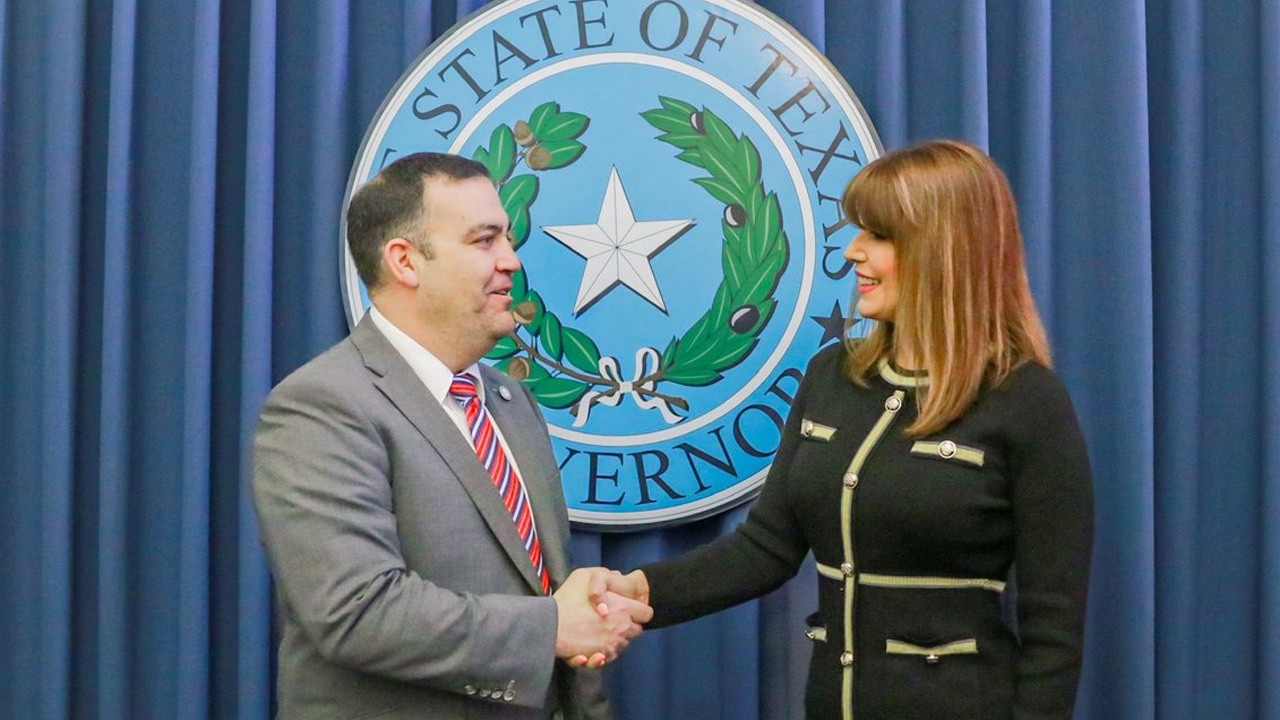

Guillermo Contreras, CEO of DitoBanx, defined the potential significance of Qredo companies for the unbanked. Contreras stated: “The partnership with Qredo is an thrilling step for DitoBanx as we attempt to convey monetary companies to the unbanked in Latin America.

“The power to supply institutional-grade digital asset custody companies might be a game-changer for our prospects, enabling them to securely retailer, in addition to handle their digital belongings in a regulated atmosphere.”

Since its inception in El Salvador, DitoBanx has launched a variety of digital asset options throughout Latin America. Its merchandise embody Bitcoin-backed loans, digital asset wallets in addition to enterprise cost processing options. The neobank goals to convey better ranges of monetary inclusion to unbanked and underbanked people within the area.