An investigation into digital asset exchanges within the Russian capital has established that a few of them are prepared to purchase digital cash and ship paper cash within the U.Ok. The switch of funds doesn’t often contain the identification of the shoppers, Transparency Worldwide Russia reveals in a report.

Russia-based Cryptocurrency Exchanges Swap Stablecoins for British Money

Russian crypto exchanges that may switch cash overseas with out following know-your-customer (KYC) procedures and anti-money laundering (AML) are within the focus of a examine carried out by the Russian Chapter of Transparency Worldwide. The outcomes had been introduced in a brand new report revealed on Wednesday.

The affiliation’s researchers had been in a position to determine greater than 20 coin buying and selling platforms working from Moscow Worldwide Enterprise Middle, generally known as Moscow Metropolis. Via conversations with operators, in addition they discovered that eight of them had been able to alternate U.S. dollar-pegged stablecoins for British kilos and hand over the money to recipients in London.

The authors famous that considered one of them is Suex, a crypto dealer blacklisted by the U.S. Treasury Division’s Workplace of International Belongings Management (OFAC) in September, 2021 for facilitating ransomware-linked transactions. In addition they add {that a} platform referred to as Pridechange despatched important quantities of cash to Garantex, one other blacklisted alternate with workplaces in Moscow Metropolis.

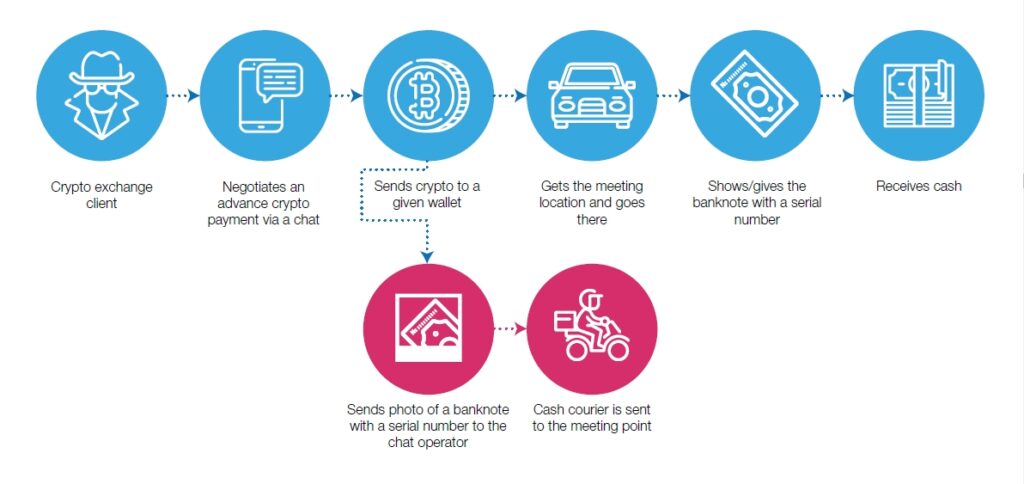

The way in which the transfers had been made was related in all circumstances. First, a buyer must ship the quantity in tether (USDT) to a pockets tackle supplied by the alternate. As soon as the cost is confirmed, the operator would dispatch a courier, often a Russian speaker, to a specified location in London to ship the fiat money on the identical or the next day.

U.Ok. anti-money laundering rules require cryptocurrency exchanges to be registered and perform buyer due diligence checks. Not one of the Russian platforms ever requested to confirm the identification of Transparency’s undercover representatives, regardless of the quantities of cash exceeding 10,000 British kilos ($12,000).

Throughout its communication with the crypto exchanges, the group obtained the crypto addresses used for these transfers. The transaction historical past reveals that the common month-to-month sum of money passing via such wallets ranges between $420,000 and $470,000. The estimate is predicated solely on the USDT turnover whereas usd coin (USDC), one other stablecoin, was additionally used.

“The outcomes of our examine counsel that at the very least a couple of shadow OTC crypto exchanges function within the U.Ok. and are prepared to supply money with out performing obligatory KYC procedures… The complete scale of this exercise could also be unknown, however it’s clearly not insubstantial and deserves nearer scrutiny,” an excerpt of the report concludes.

Do you assume Russians are actively utilizing these channels to switch funds overseas amid monetary restrictions over the Ukraine struggle? Share your ideas on the topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.