[ad_1]

On-chain information exhibits that Bitcoin miners might have been promoting at a historic price not too long ago, one thing that may very well be bearish for the asset’s worth.

Bitcoin Miner Influx To Exchanges Has Registered A Spike Lately

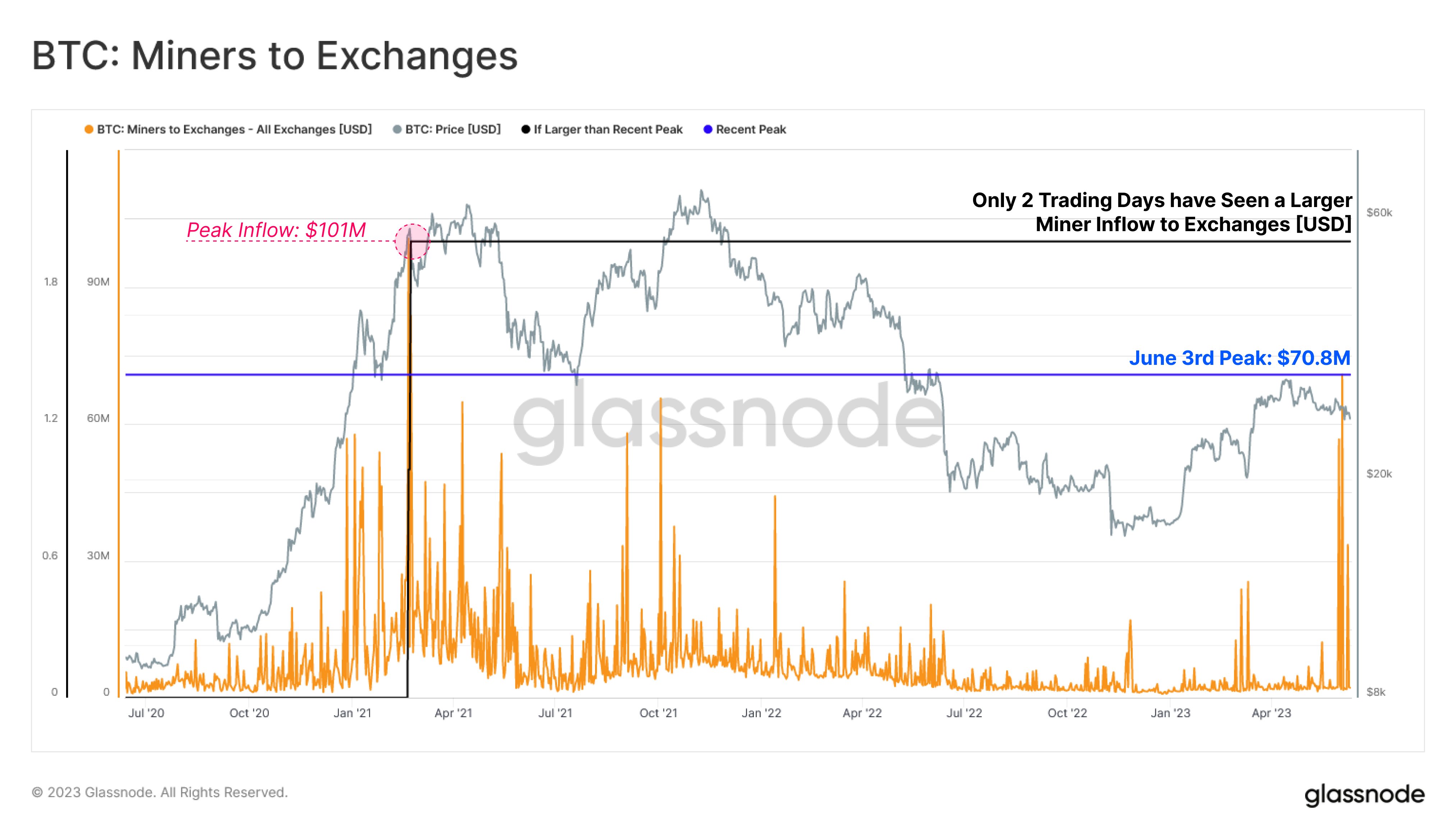

In response to information from the on-chain analytics agency Glassnode, miner change inflows hit a peak worth of $70 million not too long ago. The “miner influx to exchanges” is an indicator that measures the full quantity of Bitcoin that miners are transferring to the wallets of all centralized exchanges.

When the worth of this metric is excessive, it means the miners are sending numerous cash to those platforms presently. Usually, these chain validators deposit their BTC to exchanges for selling-related functions, so this sort of development can have a bearish impact on the worth of the cryptocurrency.

Then again, low values counsel the promoting strain coming from the miners could also be low proper now, as this cohort isn’t depositing any important quantities to exchanges in the meanwhile.

Now, here’s a chart that exhibits the development within the Bitcoin miner influx to exchanges over the previous couple of years:

The worth of the metric appears to have been fairly excessive in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin miner influx to exchanges has noticed a spike in its worth not too long ago. This implies that miners have been sending reasonably massive quantities to those platforms throughout the previous couple of weeks.

These excessive values of the indicator have come because the cryptocurrency has been regularly heading downwards. This may occasionally indicate that the current market atmosphere has made among the miners panic promote their holdings.

Since these inflows have turn out to be elevated, the asset’s worth has solely prolonged its decline additional, because it has now dropped beneath the $26,000 stage. This current decline within the worth could also be fueled partly by the dumping being finished by this cohort.

From the chart, it’s seen that the height of those inflows noticed on third June noticed the indicator attain a price of round $70.8 million. This can be a traditionally extraordinary stage for the metric as solely two buying and selling days in your complete lifetime of the coin have seen the miners depositing at a bigger scale.

Each of the cases the place miners despatched bigger quantities to those platforms happened manner again throughout early 2021, when the bull market was in full move. The height influx spike again then (that’s, the biggest worth the metric has ever recorded) measured to about $101 million, implying that the present surge is about $30.2 million away from it.

Naturally, Bitcoin miners promoting at such a excessive price not too long ago could be unhealthy information for the market. It now stays to be seen whether or not these chain validators proceed to promote extra within the close to future, or if they’re finished with their dumping spree for now.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $25,900, down 3% within the final week.

BTC appears to be like to have declined prior to now few days | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link