[ad_1]

MATIC is at present going through elevated uncertainty because it has been formally categorised as a safety by the US Securities and Trade Fee, as revealed within the latest submitting in opposition to Binance.

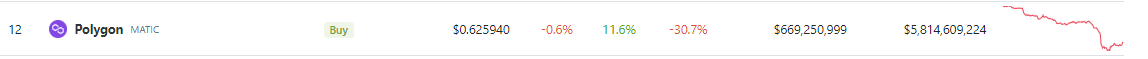

Consequently, the Polygon blockchain token skilled a major drop of 31% inside every week, setting a brand new document. Nevertheless, there’s some constructive information because it has managed to get well, witnessing a promising rebound of over 11% within the final 24 hours.

Supply: Coingecko

L2 cash would be the subsequent bullrun cash. Already knew, already confirmed.$SOL $ADA $MATIC and others L1’s acquired the safety stamp. Regulation will kick onerous = tight alternative of L1/L2 cash. The place will all this cash movement to? pic.twitter.com/jw5xpLRA4j

— Zoomer Oracle (@ZoomerOracle) June 5, 2023

MATIC is likely one of the 13 tokens throughout the Binance lawsuit to be designated as a safety. Polygon Labs, the developer of MATIC, issued a press release on Twitter defending Polygon saying that the community is “developed exterior the US, deployed exterior the US, and centered to at the present time on the worldwide group that helps the community.”

This latest lawsuit in opposition to Binance was adopted up by the SEC’s lawsuit in opposition to Coinbase, citing that the corporate is working an unregistered trade in reference to the corporate’s staking service.

Concern, Uncertainty And Doubt In The Market

With the latest classification of a number of cryptocurrencies as securities, the market has slid significantly throughout the previous week. Bitcoin, the highest cryptocurrency, gained dominance in gentle of the latest regulatory fillings in opposition to Binance and Coinbase.

The opposite tokens within the listing are SOL, ADA, FIL, ATOM, SAND, MANA, ALGO, and COTI. In accordance with the lawsuit, the tokens are listed as funding contracts. This made the SEC label them as securities in accordance with the Howey Take a look at, which is a take a look at to know whether or not a sure asset is a safety or not.

MATIC market cap at $5.8 billion. Chart: TradingView.com

This transfer by the SEC was consistent with its latest actions in opposition to the crypto business. Simply this February, the regulatory physique cracked down on Kraken’s staking service together with forcing the corporate to pay $30 million in penalties for the violations.

If the talked about tokens and firms fail to adjust to the SEC, it might result in one other Ripple-like occasion which is able to have an effect on the market.

MATIC Bulls Ought to Watch This Stage

On the time of writing, MATIC is being supported on the $0.6 value stage which is able to act because the launch pad for future bullishness. Nevertheless, exterior market forces nonetheless maintain sway within the token’s momentum and value actions within the close to future. The latest lawsuits already slashed tens of millions upon tens of millions of potential beneficial properties for traders.

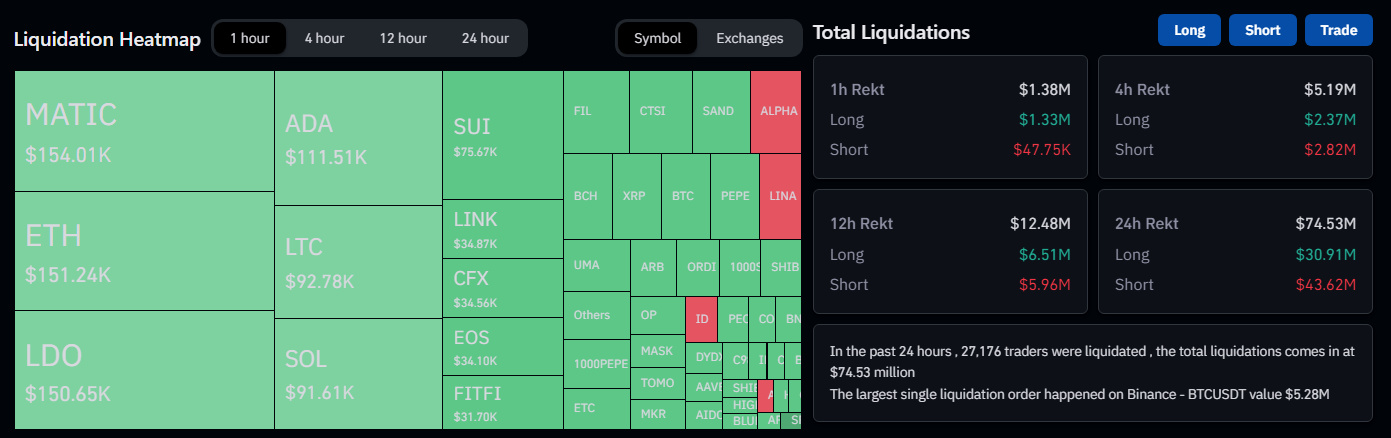

Supply: Coinglass

In the meantime, CoinGlass information reveals MATIC lengthy positions being liquidated because the market crashed after the lawsuits had been made public.

Regardless of this, shopping for stress after the crash continued with MATIC bulls holding $0.6 help. If they’ll maintain on to this help stage, we would be capable to see a return in the direction of the $0.83 help within the medium to long run.

Featured picture from The Every day Hodl

[ad_2]

Source link