[ad_1]

Shark Tank star Kevin O’Leary and billionaire hedge fund supervisor Invoice Ackman have been slammed for stating that they imagine Sam Bankman-Fried (SBF) was telling the reality that he “didn’t knowingly commingle funds.” The previous CEO of the collapsed crypto alternate FTX additionally mentioned he “wasn’t operating Alameda,” so he “didn’t know precisely what was occurring.”

Kevin O’Leary, Invoice Ackman Defend Sam Bankman-Fried

Shark Tank star Kevin O’Leary, aka Mr. Great, and billionaire hedge fund supervisor Invoice Ackman had been slammed Thursday after they mentioned they imagine former FTX CEO Sam Bankman-Fried (SBF) was telling the reality throughout an interview at The New York Instances’ Dealbook Summit, aired Wednesday night. Crypto alternate FTX collapsed and filed for chapter on Nov. 11. An estimated a million clients and traders misplaced billions of {dollars} within the alternate meltdown.

Bankman-Fried mentioned through the interview that he “didn’t knowingly commingle funds.” He additionally shifted blame to Alameda Analysis, stating: “I wasn’t operating Alameda … I didn’t know precisely what was occurring.”

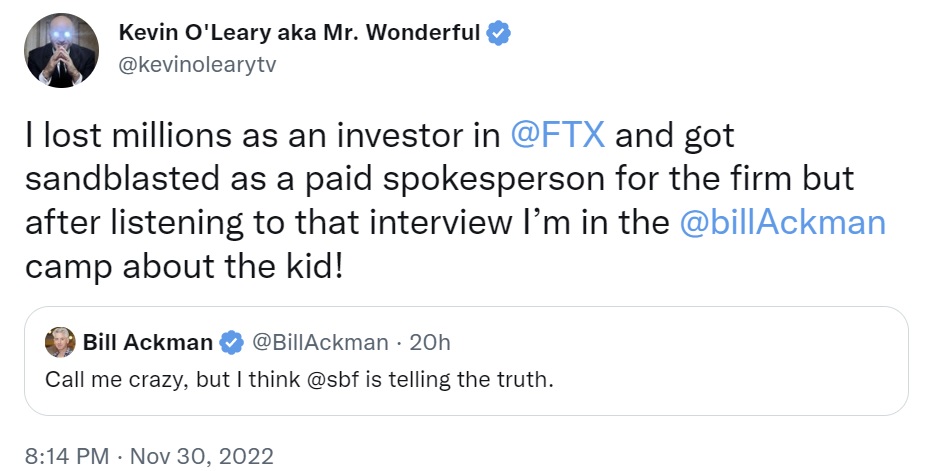

Whereas most individuals within the crypto group don’t imagine Bankman-Fried’s story, a minimum of two distinguished folks spoke up in favor of the previous FTX CEO. Ackman, the CEO and portfolio supervisor of Pershing Sq. Capital Administration, tweeted after the interview: “Name me loopy, however I feel SBF is telling the reality.”

O’Leary rapidly concurred, tweeting that he misplaced hundreds of thousands as an investor in FTX and received sandblasted as a paid spokesperson for the crypto alternate. Nevertheless, he burdened that after listening to the interview, he agrees with Ackman “concerning the child.”

Many individuals disagreed with O’Leary and Ackman. Some referred to as them “morons,” “idiots,” and “scammers.” One wrote: “I’m a bit confused why folks have this view on SBF because the actually sensible child that screwed up. He’s nearly 31, which implies he’s a grown man. This isn’t a 23-year-old recent grad making a buying and selling error on the desk. The narrative round this story shouldn’t actually be that.”

“I think about that if I used to be a public spokesperson for what turned out to be a Ponzi, I’d in all probability hope the chief received off with out legal fees as effectively (much less probably legal fees could be introduced towards me). Simply saying, take a look at the incentives,” one other commented.

A 3rd opined: “Assume I perceive now. All of those statements are a type of authorized safety and that interview was crafted in a really deliberate method. Higher to be a spokesperson for one thing that failed than one thing that dedicated mass fraud. Blatantly apparent the latter is true.” A fourth mentioned: “You gave hundreds of thousands to a fraudster who didn’t know the very first thing about operating an alternate or a hedge fund or learn how to shield investor property and who probably absconded together with your cash attributable to full incompetence however certain he’s harmless.”

Following the collapse of FTX, O’Leary mentioned that he would assist Bankman-Fried once more if he has one other enterprise, noting that SBF is without doubt one of the finest merchants within the crypto area. Mr. Great additionally not too long ago revealed that he and Bankman-Fried nearly raised $8 billion to rescue FTX earlier than it collapsed.

What do you concentrate on Kevin O’Leary and Invoice Ackman believing that SBF didn’t know what he was doing when he commingled funds? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link