[ad_1]

India is now the world’s fifth-largest financial system after surpassing the U.Ok., the most recent knowledge from the Worldwide Financial Fund (IMF) reveals. India’s former chief financial advisor expects the nation to turn out to be the world’s third-largest financial system by 2028-30.

India Turns into fifth Largest Financial system within the World

India has leaped previous the U.Ok. and turn out to be the fifth-biggest financial system, Bloomberg reported Friday, citing IMF’s GDP knowledge and historic trade charges. In keeping with this estimation, the previous British colony surpassed the U.Ok. within the final quarter of 2021 and is now behind solely the U.S., China, Japan, and Germany when it comes to the scale of its financial system. A decade in the past India was the eleventh largest.

“On an adjusted foundation and utilizing the greenback trade price on the final day of the related quarter, the scale of the Indian financial system in ‘nominal’ money phrases within the quarter via March was $854.7 billion. On the identical foundation, the U.Ok. was $816 billion,” the publication defined.

Many individuals in India welcome the information of the Indian financial system overtaking the British financial system. Indian parliament member Kartik Sharma tweeted: “India emerges because the world’s fifth largest financial system, overturning the U.Ok. from its place. Beneath Hon’ble PM Narendra Modi Ji’s development-oriented management, we’ve made India the fifth largest financial system on the planet.”

Dr. Arvind Virmani, a former chief financial advisor to the federal government of India, expects India to turn out to be the world’s third-largest financial system this decade, based mostly on present figures. Virmani was appointed India’s consultant to the IMF in 2009. Commenting on the information, he informed ANI information company:

Final yr we have been sixth by about 40 billion & it was anticipated to occur in 2022. India is shifting up the ability scale & by worth of forecast we’ll turn out to be third largest by 2028-30.

The IMF’s World Financial Outlook database reveals India overtaking the U.Ok. in greenback phrases on an annual foundation this yr with a GDP of $3.53 trillion in comparison with the U.Ok.’s $3.38 trillion.

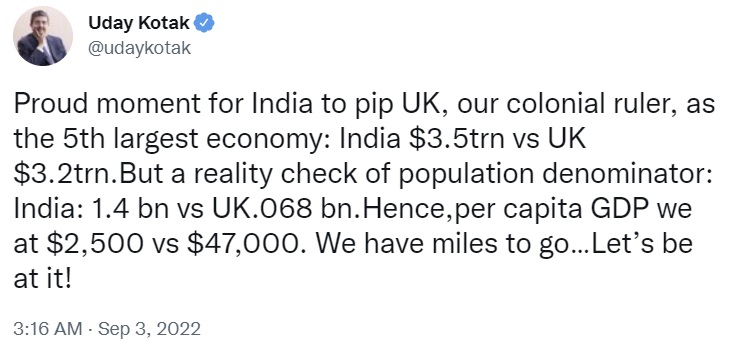

Kotak Mahindra Financial institution CEO Uday Kotak, nonetheless, tweeted explaining that India has a inhabitants 20 instances that of the U.Ok. so its GDP per capita is decrease. “Proud second for India to pip the U.Ok., our colonial ruler, because the fifth largest financial system,” he wrote, including that “a actuality verify of inhabitants denominator: India: 1.4 billion vs U.Ok. 0.068 billion. Therefore, per capita GDP we at $2,500 vs $47,000. We’ve got miles to go.”

In keeping with authorities knowledge, India’s financial system grew by 13.5% within the second quarter of this fiscal yr — the quickest within the final 4 quarters, in response to the nation’s Nationwide Statistical Workplace (NSO). In the meantime, U.Ok. GDP grew simply 1% in money phrases within the second quarter however shrank 0.1% after adjusting for inflation. Sterling has additionally underperformed the U.S. greenback relative to the rupee, with the pound falling 8% in opposition to the Indian rupee this yr.

Final month, Morgan Stanley mentioned India may emerge as Asia’s strongest financial system in 2022-23. The worldwide funding financial institution expects India’s development to common 7% for 2022-2023 “The financial system is about for its greatest run in over a decade as pent-up demand is being unleashed,” the brokerage agency mentioned. “Decrease company taxes, the production-linked incentive (PLI) scheme and India as a possible beneficiary of provide chain diversification will catalyze and maintain home demand, particularly in funding.”

What do you consider India surpassing the U.Ok. because the world’s fifth largest financial system? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link