[ad_1]

intermediate

Have you ever ever puzzled how blockchain know-how is revolutionizing the banking system? With the emergence of digital currencies and the rising want for safe and clear transactions, blockchain is quickly remodeling the best way banks function.

Blockchain know-how was initially developed to assist the cryptocurrency market. Nevertheless, it has advanced to change into a robust device for companies and organizations throughout numerous industries. The banking sector is among the most important beneficiaries of this know-how.

Howdy! I’m Zifa, and I’m delighted to share with you my insights on the transformative potential of blockchain know-how within the banking business. During the last two years, my focus has been on protecting blockchain and cryptocurrency subjects, which has enabled me to witness firsthand the continuing and immense influence of this revolutionary know-how on a various vary of industries. As part of our persevering with cycle exploring the potential of blockchain in numerous industries, we’ve already delved into its functions in agriculture, healthcare, and provide chain administration. In the present day, we shift our focus to the banking business, the place blockchain has the potential to revolutionize conventional monetary techniques. Be a part of me as we uncover the thrilling potentialities, challenges, and implications of the blockchain’s affect on the banking sector, and discover how this progressive know-how can form the way forward for finance.

Present Points within the Banking Business

The banking business has existed for hundreds of years, however it’s struggling to maintain up with the fast developments in know-how and digitalization going down round us as we speak. Banks are utilized in numerous buying and selling actions, corresponding to lending and borrowing cash, however they’re changing into slowed down by outdated procedures that require an incredible quantity of paperwork. Its processing prices money and time and will increase the danger of safety breaches, one thing banks should deal with instantly. To enhance their providers, banks should take measures to replace their safety techniques and observe credit score historical past to cut back dangerous money owed and enhance regulatory compliance.

The baking sector faces one other downside as we speak — particularly, its lack of entry to essentially the most present technological developments. Many banks nonetheless depend on previous techniques that don’t present the identical stage of service as extra trendy options. In addition they wrestle with buyer onboarding on account of sluggish approval processes and lengthy ready occasions, which can drive away potential prospects. Moreover, there’s a want for various channels that permit prospects to attach with their banks extra simply. These could possibly be web-based functions or open APIs that may be built-in into third-party functions and providers. These options supply improved consumer expertise options corresponding to personalization, AI-driven evaluation, and automation, which make banking simpler for customers.

What Is Blockchain?

Blockchain is a revolutionary know-how that makes use of a decentralized digital ledger to retailer information. In easy phrases, it’s a constantly rising chain of blocks secured by cryptographic protocols and validated by means of peer-to-peer networks. Every block incorporates a set of transaction information, which is saved in a everlasting and tamper-proof method.

In contrast to conventional databases managed by a central entity, a blockchain’s information construction is distributed throughout a community of nodes. Every node has a duplicate of the information, and any updates to the blockchain are verified by the community earlier than being added to the ledger. This decentralized construction ensures that there is no such thing as a central level of failure, making it safer and immune to assaults.

One of many distinctive options of a blockchain is immutability. As soon as a block is added to the chain, it can’t be altered or deleted with out consensus from the whole community. Subsequently, there’s a dependable and unchangeable file of all of the transactions saved on the blockchain. Moreover, blockchain is decentralized, that means there is no such thing as a want for intermediaries or third events to validate transactions, lowering asset alternate charges and processing occasions.

One other essential facet of blockchain is its transparency. All events on the community can view the transactions, making it straightforward to hint the historical past of an asset. Nevertheless, this transparency doesn’t come at the price of anonymity. Customers can stay nameless whereas nonetheless collaborating in transactions on the blockchain.

Blockchain know-how, being limitless to finance, has numerous use circumstances in different industries. As an illustration, provide chain administration, voting techniques, and healthcare all stand to profit from the blockchain’s decentralized and safe nature.

To make sure safety, the blockchain applies hash capabilities, private and non-private keys, good contracts, and digital signatures. Hash capabilities encrypt the information within the block, whereas private and non-private keys are used to validate transactions. Sensible contracts automate the execution of predefined guidelines and circumstances throughout the blockchain, making certain that the community operates effectively. Digital signatures, alternatively, present a further layer of safety by permitting for the authentication of transactions and the short identification of fraudulent exercise.

Why Is Blockchain Necessary in Banking?

Blockchain know-how has been gaining a whole lot of traction in recent times, and it’s no secret that it’s remodeling the banking business in numerous methods. Its distinctive traits, corresponding to improved safety, price effectivity, sooner transactions, and information integrity, make it a game-changer for the banking business.

Elevated Safety and Decreased Fraudulent Actions

The implementation of blockchain know-how in banking providers has considerably improved safety and diminished fraudulent actions. One of many primary causes for this elevated safety is the elimination of a single level of failure. Conventional banking techniques depend on a centralized database that shops all information, making it a chief goal for hackers. Blockchain know-how, alternatively, is distributed throughout a community of nodes, making it nearly not possible to hack the system by means of a single level of entry.

One other facet of blockchain know-how that gives elevated safety within the banking business is the immutability of information. As soon as information is added to the blockchain, it can’t be altered or deleted, offering a tamper-proof file of all transactions. Which means that transactions can’t be manipulated or modified, and any try to take action might be instantly flagged by the community.

Moreover, blockchain know-how employs encryption to make sure that information is protected and solely accessible to licensed events. This encryption makes it nearly not possible for hackers to steal delicate data, including an additional layer of safety to the system.

Transactions are validated by the community, lowering the necessity for intermediaries that may be weak to assault. The decentralized and distributed nature of blockchain ensures a clear and correct file of transactions, creating belief between events concerned in monetary transactions.

A number of examples abound of how blockchain has already been used to cut back fraudulent actions within the banking business. As an illustration, Barclays Financial institution, at the side of the fintech agency Wave, created a blockchain-based system that streamlines the method of issuing standby letters of credit score (LOCs), lowering fraudulent actions and processing time. Furthermore, JPMorgan diminished handbook errors and elevated safety of their banking techniques by implementing blockchain-based options, bettering their commerce finance operations.

Decreased Man-Made Errors

Human errors are among the many main causes of operational challenges within the monetary business, resulting in incorrect information entry, inaccurate reporting, and points in transaction reconciliation. Along with human error, conventional monetary techniques are sometimes plagued with sluggish processing occasions ensuing from handbook processes and the necessity for a number of intermediaries. These operational challenges can price banks important sources.

Happily, blockchain know-how gives an answer to those operational challenges. Blockchain supplies a safe and clear community that integrates automation, transparency, and effectivity into monetary operations. By using good contracts in blockchain, routine monetary processes corresponding to mortgage disbursements, account opening, and reconciliation will be automated, lowering the danger of human error.

Improved Information High quality

Blockchain know-how has the potential to revolutionize the best way information is managed within the banking business. One of many key advantages of blockchain is improved information high quality.

In a blockchain-based system, information is managed on a distributed ledger that’s accessible to all licensed events on the community. Which means that all transactions are recorded in actual time, with each participant gaining access to the identical data. The distributed nature of the ledger ensures the accuracy and consistency of information throughout the community.

For the reason that ledger is tamper-proof, any try to switch or alter the information is straight away flagged by the community. Which means that all transactions can’t be deleted or modified, which creates a dependable and unalterable supply of information that each one events can belief.

Using blockchain for information administration within the banking business may help cut back errors and discrepancies in transactions. As an illustration, a mistake in a financial institution switch or another monetary transaction can have devastating penalties for each the financial institution and the client. Nevertheless, with the implementation of blockchain, the probabilities of such errors are considerably diminished because the information is recorded and validated in actual time.

The true-time nature of information administration on the blockchain additionally helps cut back the necessity for handbook reconciliation and improves processing occasions. In a standard banking system, reconciliation can take days and even weeks, resulting in inefficiencies and errors. With a blockchain-based answer, all events can view the identical information in real-time, lowering the necessity for handbook intervention and bettering the general velocity and effectivity of transactions.

Faster and Cheaper Worldwide Transactions

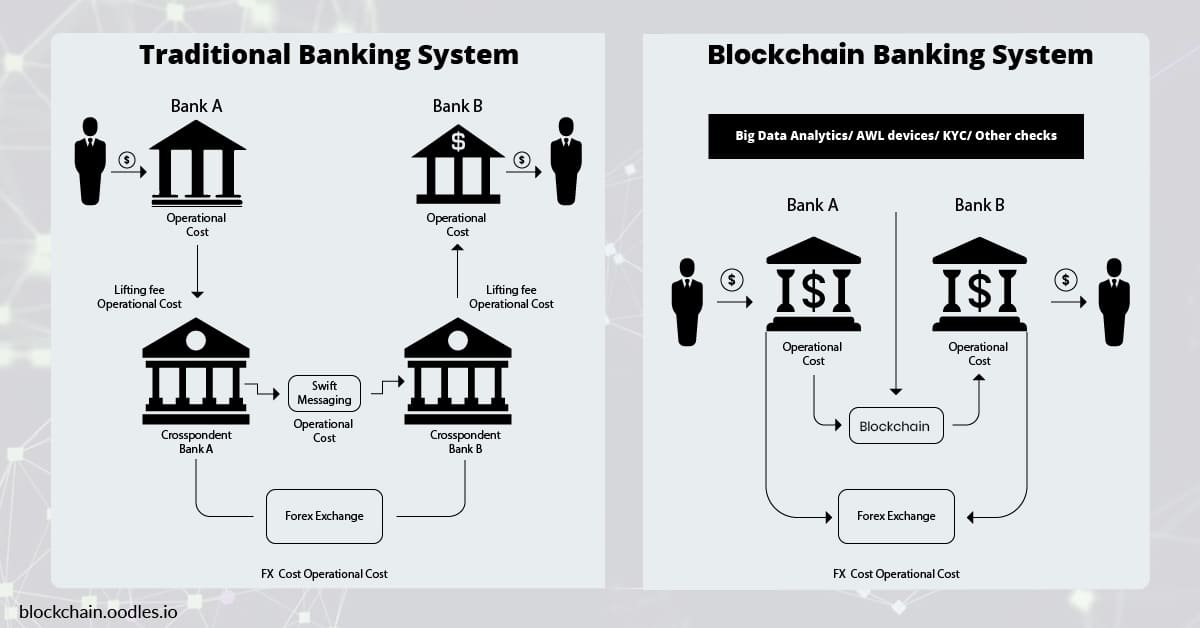

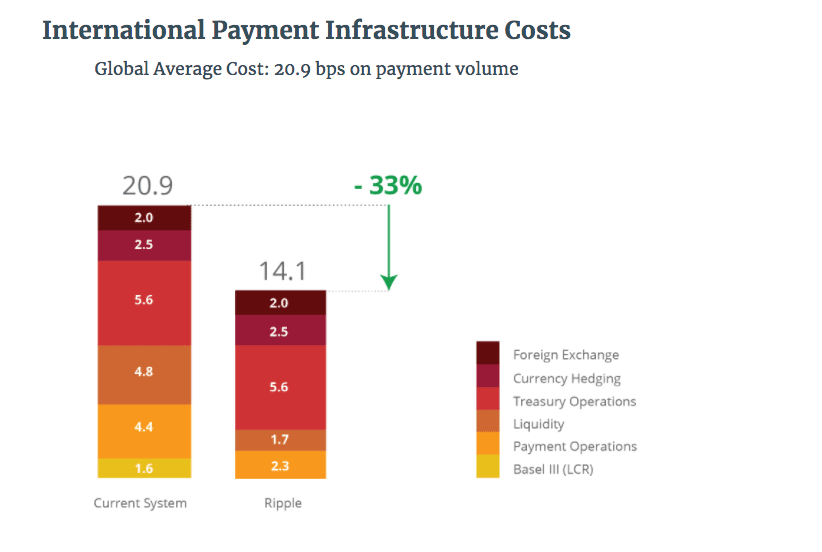

Worldwide transactions have been a problem for monetary establishments because of the advanced nature of cross-border funds. The present system entails a number of middleman banks that end in excessive transaction prices, lengthy processing occasions, and diminished transparency. These points have an effect on the effectivity and reliability of the cost course of, resulting in dissatisfied prospects and elevated operational prices for banks.

Nevertheless, the adoption of blockchain know-how within the banking sector has launched a promising answer to those challenges. Through the use of blockchain, worldwide transactions have gotten faster and cheaper for banks and prospects alike. Blockchain eliminates the necessity for intermediaries, considerably lowering transaction prices and bettering processing occasions.

A mean financial institution switch normally takes 3 days to settle; this creates issues for each prospects and banks. With blockchain, worldwide funds will be settled in a matter of seconds, enabling sooner and smoother cross-border transactions. Blockchain additionally supplies higher transparency, enabling prospects to trace the standing of their transactions in actual time. For instance, JP Morgan’s blockchain-based Interbank Data Community (IIN) permits for real-time data sharing between banks.

A number of banks, corresponding to Santander and Customary Chartered, have made profitable use of blockchain know-how in worldwide funds. These establishments have leveraged blockchain’s safe and dependable community to allow low-cost and environment friendly transactions between events throughout totally different nations.

How Blockchain Can Be Utilized in Banking: Seven use Instances

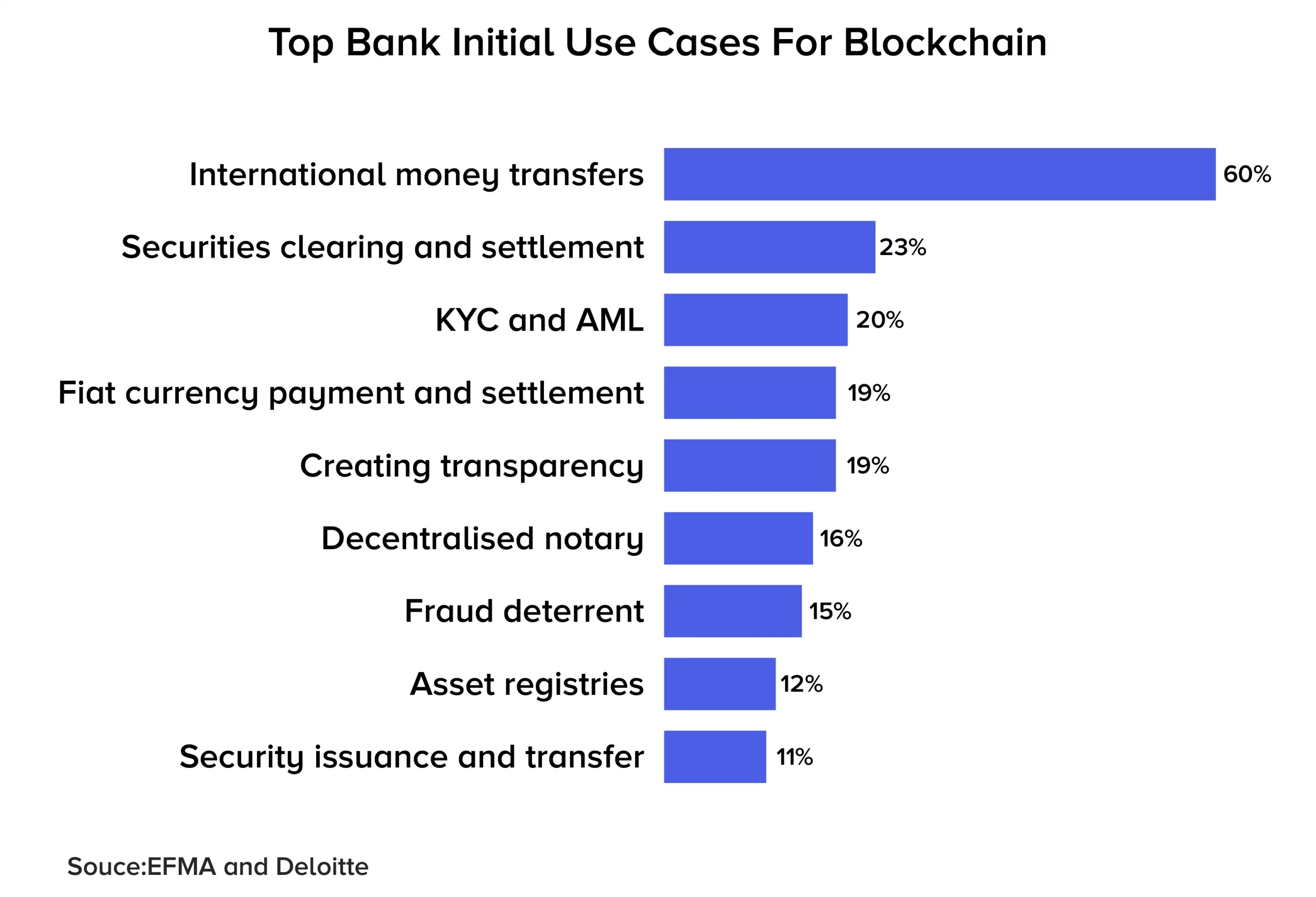

Blockchain know-how has change into more and more necessary within the monetary business on account of its capability to offer safe, clear, and immutable information. Blockchain adoption in banking gives a variety of advantages for monetary establishments, together with increased operational effectivity, improved transparency, price financial savings, and diminished fraud dangers.

Listed here are seven particular use circumstances of blockchain in banking and monetary providers:

Cross-border funds

Blockchain know-how may help monetary establishments to course of cross-border funds sooner and cheaper. Blockchain-based techniques can eradicate the necessity for intermediaries, permitting for extra direct and safe transactions. Apart from, blockchain-based options can velocity up processing occasions, cut back the potential for errors, and enhance the transparency of the cost course of. Ripple is an efficient instance of a blockchain-based platform designed to facilitate cross-border funds and transactions.

Commerce finance

Blockchain know-how can streamline the commerce finance course of. With blockchain-based options, all contributors can entry the identical distributed ledger and achieve real-time entry to transaction data. This functionality may help to cut back the potential for fraud and automate the reconciliation course of. One instance is the blockchain-based platform we.commerce, which supplies a safe and clear atmosphere for commerce finance transactions.

Digital foreign money

Apart from, blockchain-based know-how conceives a safe infrastructure for the issuance and administration of digital belongings. A blockchain-based system can supply near-instantaneous transactions without having for intermediaries. Cryptocurrencies like Bitcoin and Ethereum are the most well-liked digital currencies constructed on a blockchain community.

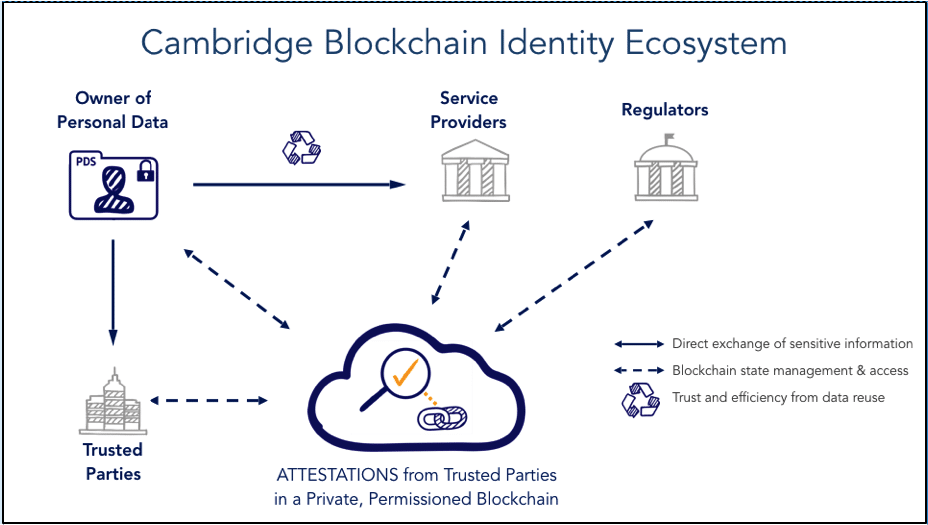

Id administration

Blockchain know-how can arrange a extra environment friendly id administration system. Through the use of a distributed ledger, prospects can have full management over their private information and resolve who can entry it. This functionality may help to enhance Know Your Buyer (KYC) processes in retail banking, mitigate id fraud, and enhance buyer onboarding processes.

Tradle, Cambridge Blockchain, and ID2020 are fintech startups engaged on private identification. Tradle and Cambridge Blockchain retailer proof of id verification and supply possession of the information. ID2020 focuses on issuing digital IDs to these with out paper IDs. It’s supported by Accenture, Microsoft, and the Rockefeller Basis.

Asset monitoring

Blockchain will be employed to trace and handle asset possession, provenance, and motion. With a blockchain-based system, the authenticity and transferability of belongings will be verified extra effectively and precisely. This use case is particularly essential in industries the place monitoring bodily items is of the utmost significance, corresponding to actual property, diamonds, and luxurious items.

Sensible contracts

Blockchain know-how can automate conventional contract processes, leading to price and effectivity enhancements. The good contracts’ code executes routinely based mostly on pre-defined standards, and all events have the identical information and transactions in actual time. Sensible contracts can increase the velocity of contract execution, cut back handbook processing occasions, and eradicate the necessity for intermediaries.

Mortgage issuance

Blockchain-based options can streamline the lending course of, making it sooner and extra clear for all events concerned. Loans will be originated, distributed, monitored, and serviced with the assistance of blockchain-based techniques, all inside a safe and immutable atmosphere. Banks can make the most of blockchain know-how to supply sooner, extra environment friendly, and cheaper loans than conventional lending strategies.

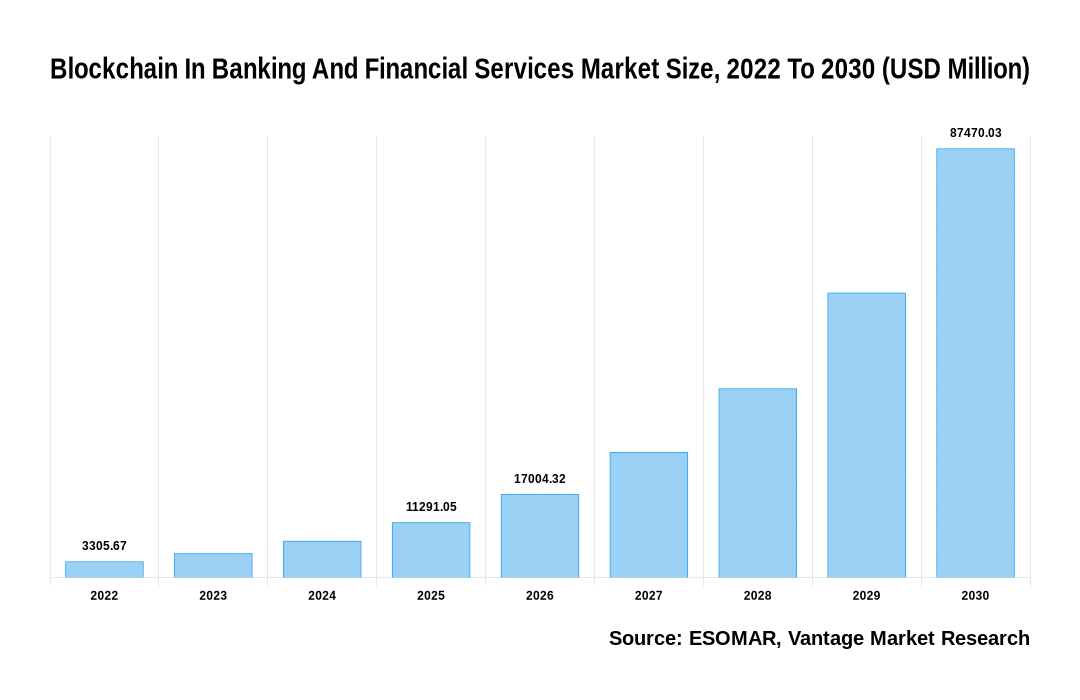

Way forward for Blockchain in Monetary Providers Business

At present, the usage of blockchain in banking remains to be in its early phases. Nevertheless, there are a number of optimistic developments within the business. As an illustration, a number of banks have began testing and implementing blockchain-based options. Tasks like we.commerce, which facilitates commerce finance transactions, and JPMorgan’s JPM Coin, used for settling institutional trades, have been efficiently carried out.

The implementation of distributed ledger know-how within the banking business is quickly evolving, and there are a number of potential developments of blockchain integration within the sector.

One potential improvement is the implementation of interbank settlement techniques utilizing blockchain know-how. Blockchain utilization may automate clearing and settlement processes, lowering charges and growing effectivity. Blockchain may additionally facilitate the combination of cost techniques throughout borders, eliminating intermediaries and lowering transaction prices.

One other space of potential progress in blockchain adoption in banking is digital id administration. Blockchain know-how can present safer and clear strategies of authentication, verification, and validation of buyer identities. This might mitigate the danger of fraud and improve compliance with regulatory frameworks.

Furthermore, blockchain presents a possibility for banks to offer new and progressive monetary providers to their prospects, corresponding to decentralized finance (DeFi) and good contracts. DeFi functions constructed on blockchain know-how may grant entry to decentralized monetary providers, whereas good contracts supply the potential to automate advanced monetary transactions and contracts, lowering prices and bettering transaction occasions.

Regardless of the alternatives launched by the blockchain, there are nonetheless challenges to be addressed. Banks face important hurdles corresponding to scalability, interoperability, and regulatory compliance. Moreover, the combination of latest know-how requires important funding, and any system failures may result in extreme monetary losses.

Conclusion

In abstract, blockchain know-how has the potential to revolutionize the banking business. It gives elevated safety, improved information high quality, and diminished operational prices and errors. Blockchain already has numerous use circumstances, together with interbank settlement techniques, digital id administration, transaction settlement, the mortgage and credit score business, and DeFi providers.

A number of banks and monetary service suppliers have already began testing and implementing blockchain options. Nevertheless, there are nonetheless challenges to beat, together with scalability, interoperability, and regulatory compliance. Regardless of these challenges, the way forward for blockchain in banking seems to be promising, with potential impacts on the business’s regulatory atmosphere and the adoption of digital currencies.

As extra banks and monetary establishments undertake blockchain know-how, we are able to anticipate to see extra progressive services which are safer and environment friendly for purchasers. Using blockchain know-how will assist cut back the dangers related to conventional banking techniques whereas additionally offering a extra clear and accessible monetary system for everybody. It’s clear that the way forward for banking is digital, and blockchain know-how will undoubtedly play a major function in shaping it.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.

[ad_2]

Source link