[ad_1]

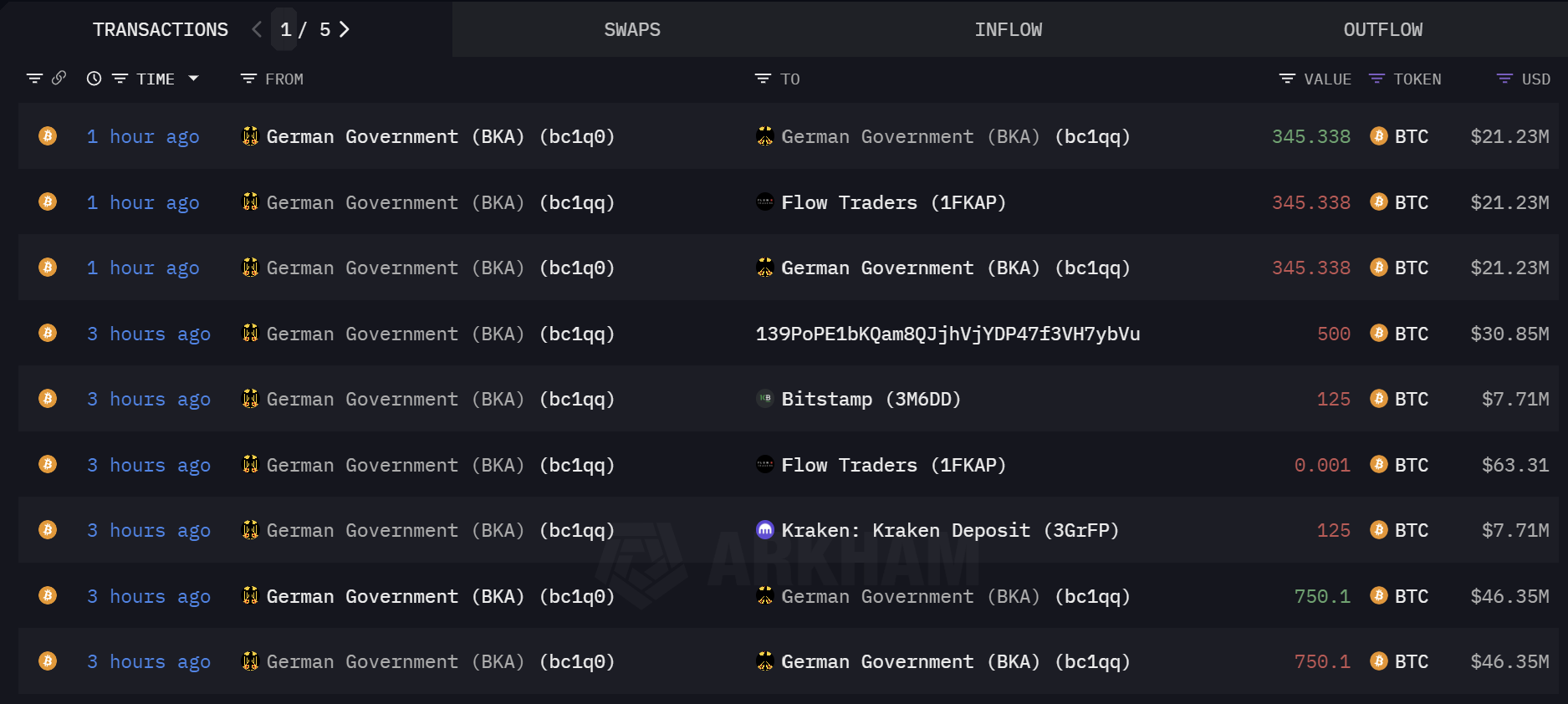

In a continued effort to liquidate its substantial Bitcoin holdings, the German authorities has as soon as once more engaged in important transactions involving BTC, based on information from blockchain analytics platforms Arkham Intel. This morning, the Federal Felony Police Workplace (BKA) executed 9 transactions involving a complete of roughly 2,786 BTC.

German Gov’t Continues Its Bitcoin Promote-Off

Arkham Intel’s information exhibits that 4 of them are inner transfers whereas 5 transactions have been direct transfers to crypto exchanges and market makers, suggesting an intent to promote. The 5 potential gross sales quantity to 1,095.339 BTC value roughly $67 million. Particularly, the BKA made two 125 BTC transfers, every value roughly $7.7 million, to well-known crypt exchanges Bitstamp and Kraken.

An extra transaction concerned a minute take a look at switch of 0.001 BTC to Circulate Merchants, a number one market maker. This small transaction was quickly adopted by a a lot bigger switch of 345.338 BTC to the identical entity, strongly suggesting preparation for a considerable promote order.

Associated Studying

One other noteworthy switch of 500 BTC was directed to an enigmatic handle tagged as “139Po.” This handle has seen earlier exercise linked to the German authorities however stays shrouded in thriller, purported to be one other sale level.

These transactions kind a part of a broader pattern noticed since final week. Only a day prior, on June 25, the federal government had disposed of 400 Bitcoin value $24 million on Kraken and Coinbase, in addition to 500 BTC to handle “139Po.”

That is along with important actions earlier final week: $130 million value of BTC have been transferred to exchanges on June 19 and $65 million on June 20. Counterbalancing these outflows, the federal government acquired $20.1 million again from Kraken and $5.5 million from wallets related to Robinhood, Bitstamp, and Coinbase.

Associated Studying

Presently, the German authorities’s holdings quantity to 45,264 BTC, valued at round $2.8 billion. This makes Germany one of many prime nation-state holders of Bitcoin, trailing solely behind the US, China, and the UK, which maintain 213,246 BTC, 190,000 BTC, and 61,000 BTC respectively, based on information from Bitcoin Treasuries.

BTC Worth Hangs Above Crucial Stage

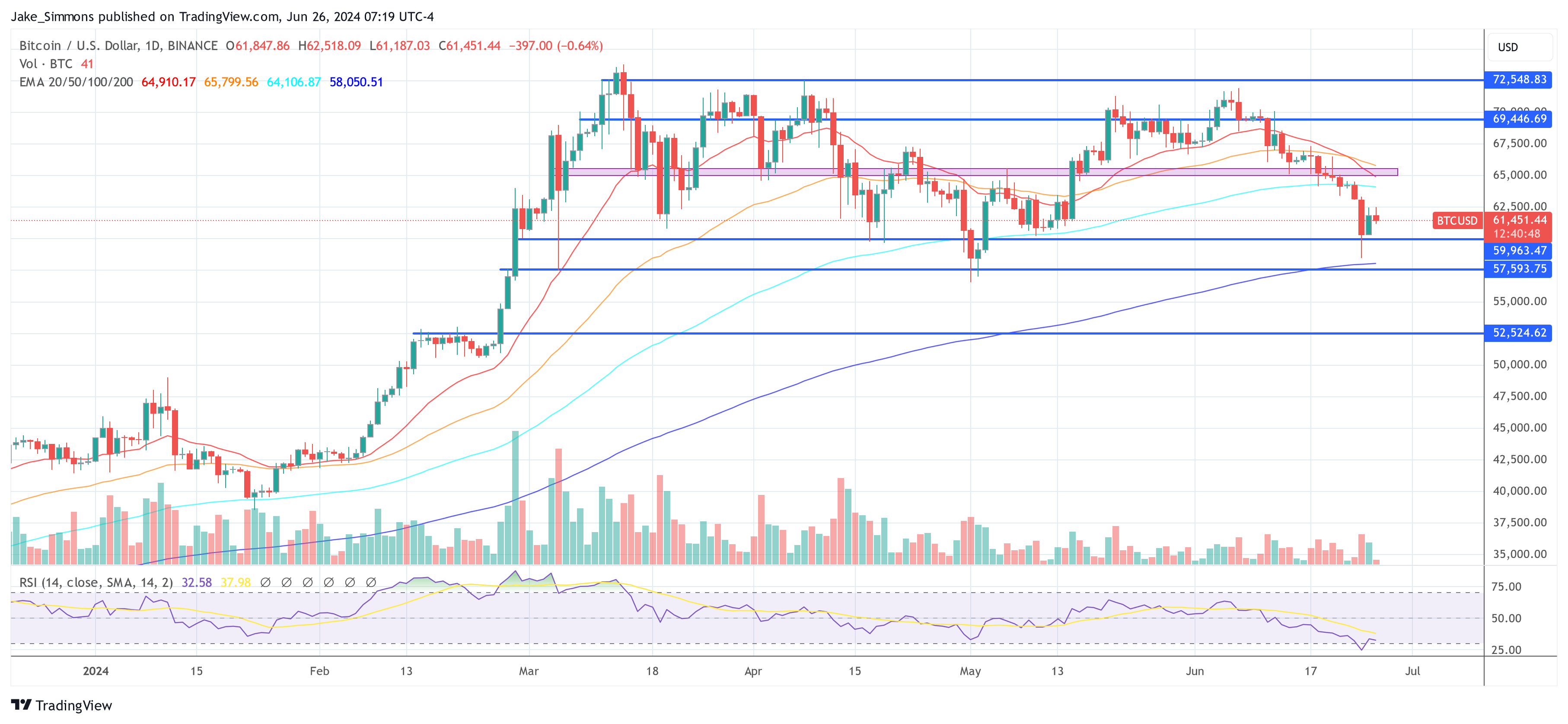

The sample of large-scale disposals by the German authorities has contributed to fluctuations in Bitcoin’s market worth, which has skilled a decline of roughly 6% because the onset of those transactions. Bitcoin’s worth briefly fell under the $60,000 threshold following the announcement from Mt. Gox about disbursing roughly $9 billion value of Bitcoin and Bitcoin Money beginning in July.

Market analysts and traders are additionally keenly observing these governmental actions because the sell-off appears to proceed at a sluggish tempo. This strategic liquidation by the German authorities arrives at a pivotal juncture for market sentiment, with Bitcoin costs teetering simply above vital help ranges. Ought to the day by day buying and selling worth shut under the $60,000 threshold, it may probably set off a extra pronounced downturn in Bitcoin’s worth, exacerbating market volatility and uncertainty.

At press time, BTC traded at $61,451.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Source link