[ad_1]

The largest information within the cryptoverse for Oct. 20 consists of the British Pound’s rising volatility that’s nearing Bitcoin’s, the unprofitable Q3 for Bitcoin miners, and FTX CEO Sam Bankman-Fried’s ideas on crypto rules and Hodlonaut’s victory towards Craig Wright.

Bitcoin volatility stabilizes because the Pound’s soars larger

After the current market actions of the British Pound, it turns into virtually as unstable as Bitcoin (BTC).

In current weeks, the Pound recorded a rise in volatility towards the U.S. greenback, whereas Bitcoin has been transferring in a slim band between $18,100 and $20,500 since mid-September.

Bitcoin mining remained unprofitable all through Q3

Within the third quarter of 2022, Bitcoin costs stored falling whereas the price of mining elevated, which gave miners a tough time.

The hash value decreased by 5% from $83.30/PH/day to $79.60/PH/day, the common industrial electrical energy value elevated by 25% from July 2021 to July 2022, and the value of internet hosting contracts elevated.

Sam Bankman-Fried proposes requirements for sanctions, licensing for DeFi protocols

FTX’s CEO Sam Bankman-Fried shared his opinions on crypto regulation through his Twitter account.

1) As promised:

My present ideas on crypto regulation.https://t.co/O2nG1VrW1l

— SBF (@SBF_FTX) October 19, 2022

SBF stated that the crypto business ought to proceed as an open economic system that continues to supply P2P transfers and codes free of charge. Nevertheless, he additionally argued that regulatory oversight is essential for sustainable innovation.

He added that DeFi protocols internet hosting web sites and advertising merchandise concentrating on U.S. retail traders might have some KYC obligations and licensing.

Binance refutes claims it makes use of customers’ tokens to vote

Uniswap’s founder Haydenz Adams stated on Oct. 19 that Binance delegated 13 million UNI tokens that belonged to its customers.

On Oct.20, Binance’s CEO Changpeng Zhao tweeted to say that Binance doesn’t vote with customers’ tokens, whereas a spokesperson from Binance instructed CryptoSlate:

“Binance doesn’t vote with consumer’s tokens. On this case, there was a misunderstanding of what has occurred throughout the switch of a giant steadiness of UNI (round 4.6M) between wallets. We’re presently in discussions to enhance the method to stop additional misunderstandings from occurring once more.”

‘Hodlonaut’ declares victory towards Craig Wright in Norwegian defamation case

The lawsuit between Craig Wright, who claimed to be Bitcoin’s creator Satoshi Nakamoto, and Magnus Granath, often known as “Hodlonaut,” began on Sept. 12 and was finalized on Sept. 20 with Hodlonaut’s victory.

The embargo that prevented the end result from being disclosed ended on Oct. 20, and Hodlonaut celebrated his triumph by sharing the information together with his Twitter followers.

I gained. Welcome to legislation.

— hodlonaut 🌮⚡🔑 🐝 (@hodlonaut) October 20, 2022

FatMan sounds the alarm on Ronaldinho-backed’ World Cup Inu’ crypto token

FatManTerra revealed suspicious tokenomics of the World Cup Inu token. Well-known soccer participant Ronaldinho tweeted on Oct. 19 to precise that he was “delighted to be a part of the World Cup Inu household.”

After analyzing the newly in style World Cup Inu token, FatManTerra shared his considerations concerning the 4% tax fee, saying that builders have already eliminated a big sum from the tax pool. He completed his phrases by saying, “Please watch out; greatest to remain away.”

FDIC performing chairman needs stablecoins to be safer earlier than integration into monetary system

The Federal Deposit and Insurance coverage Fee’s (FDIC) performing chairman Martin Gruenberg acknowledged the position of stablecoins for the economic system by saying that if regulated, stablecoins would have the facility to disrupt the present banking system.

Nevertheless, he additionally stated that their present volatility prevents stablecoins from integrating with the present monetary system.

South Africa deems cryptocurrency a ‘monetary product’

South African monetary regulator, The Monetary Sector Conduct Authority (FSCA), labeled all crypto property as a monetary product on Oct. 20. This recognition additionally subjected crypto property to the identical regulatory oversights as firm shares, debt, and money-making devices.

Analysis Spotlight

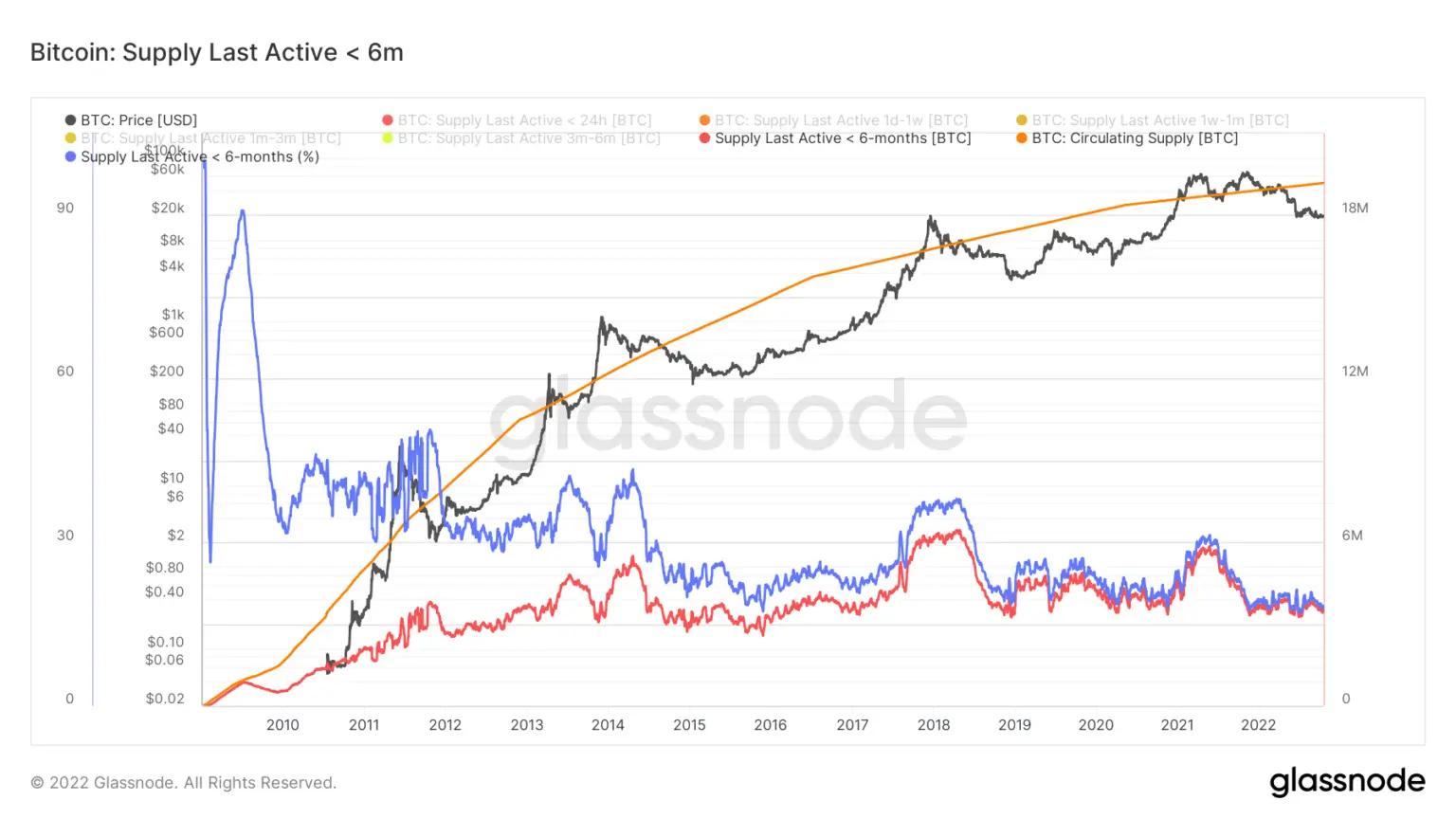

Analysis: Bitcoin’s on-chain knowledge suggests market has hit the underside

Traders holding Bitcoin for lower than six months are known as “short-term holders.”

In earlier bear markets, short-term holders have been often speculators who invested to revenue from the anticipated value positive aspects. Nevertheless, present on-chain knowledge exhibits that short-term holders are on the identical level as within the earlier bear market, which means that they misplaced religion within the ecosystem.

Judging by earlier cycles, short-term holders’ behaviors point out that the market is already close to the underside of this bear cycle,

Information from across the Cryptoverse

Tether might be out there in over 24,000 ATMs in Brazil

In keeping with an announcement submit by Tether, USDT might be out there in over 24,000 crypto ATMs in Brazil on Nov.3. This enlargement goals at together with 34 million unbanked adults in Brazil into the monetary system.

Binance acquires regulatory approval from Cyprus

On Oct.20, Binance introduced that it acquired regulatory approval from Cyprus’ monetary watchdog, Cyprus Securities and Trade Fee (CySEC). The license is the fourth one Binance obtained from the European area.

Coinbase brings commission-free buying and selling through non-USD currencies

Coinbase posted an article on its weblog to announce that it’ll waive fee charges when shopping for or promoting USDC through any fiat currencies to assist the worldwide adoption of USDC.

Japan eases guidelines for token vetting processes

Bloomberg reported in the present day that Japan’s self-regulatory crypto physique plans to make it simpler to record digital cash in December. The comfort of the foundations signifies that Japan is looking for to revitalize the crypto sector.

Lens integrates music NFTs

Lens Protocol’s founder Stani Kulechov introduced through his Twitter account that Lens began to assist music NFTs as content material on Lenster, the corporate’s decentralized social media app.

Indian cricket legend steps into NFTs

India’s cricket legend Sachin Tendulkar dipped his toe into the NFT market by investing in Rario. The information was shared by the cricket staff Rario’s Twitter account.

Crypto Market

Bitcoin (BTC) decreased by -0.74% to commerce at $19,052 within the final 24 hours, whereas Ethereum (ETH) additionally fell by -0.78% to commerce at $1,283.

Greatest Gainers (24h)

Greatest Losers (24h)

[ad_2]

Source link