[ad_1]

Gold is on the rise in 2023 and within the first week of the brand new 12 months alone, the dear metallic has jumped 2.36% towards the U.S. greenback. Over the previous 65 days, gold has soared 14.55% whereas silver has skyrocketed 22.31% towards the dollar since Nov. 3, 2022. In accordance with the pinnacle of metals technique at MKS Pamp Group, there’s a “respectable quantity of bullish ‘pent-up’ demand that has been carried over from final 12 months” for gold.

Central Financial institution Demand and Ongoing Geopolitical Tensions Proceed to Drive Gold’s Ascent

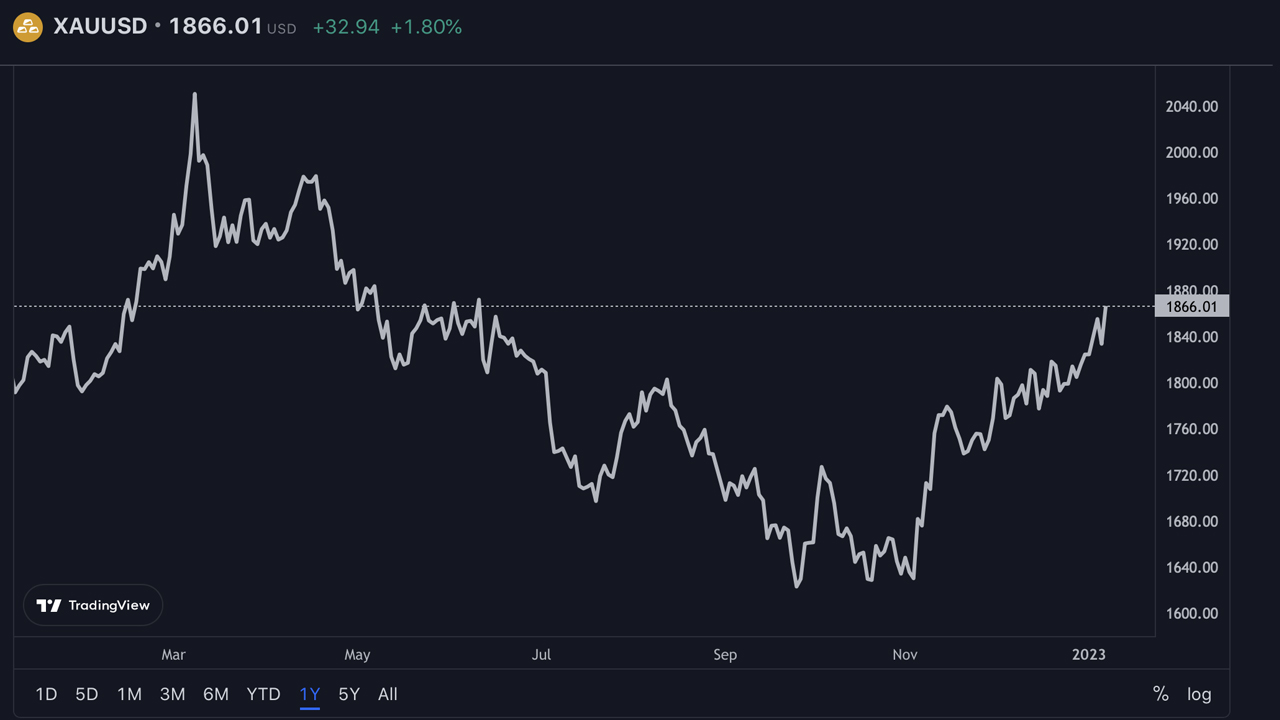

The insistence for gold has continued to rise in response to market costs through the previous seven days. Gold jumped from $1,823 per troy ounce to $1,866 in that timeframe. Whereas gold is up 2.36% towards the U.S. greenback, a troy ounce of nice silver is down roughly 0.58% because the begin of the 12 months.

Over the previous two months, each gold and silver have risen an important deal, with gold leaping 14.55% and silver growing 22.31% towards the dollar. With treasured metals on the rise, ‘gold bugs’ imagine the yellow metallic is “set to shine in 2023.”

In a two-part sequence, “Gold Mining Bull,” an creator for Searching for Alpha, argues that gold will carry out higher in 2023. The creator cites central financial institution demand and “ongoing geopolitical tensions” as causes for optimism. Gold Mining Bull is paying notably shut consideration to central financial institution gold purchases this 12 months.

“Central banks world wide, notably in China, Turkey, and India, have been shopping for gold at a file tempo,” the creator explains. “This pattern has been happening for the previous 13 consecutive years, however lately the tempo has accelerated.” The analyst provides:

They’ve been growing their gold reserves in recent times as a technique to diversify their international trade holdings and scale back reliance on the U.S. greenback.

Moreover, the creator additionally believes there are six extra issues that would increase gold’s worth, together with a rebound in jewellery demand, the Federal Reserve’s eventual pivot, the escalation of the Ukraine-Russia conflict, a weaker U.S. greenback, a restricted new mine provide, and the opportunity of China invading Taiwan.

Central financial institution gold purchases have been a very influential issue when it comes to gold curiosity over the previous 12 months. In accordance with analysts cited by the Monetary Occasions, Russia and China gathered probably the most gold in 2022 when it comes to demand.

MKS Pamp Group’s Head of Metals Technique Feedback on Gold’s Constructive Market Pattern

Nicky Shiels, head of metals technique and macro for MKS Pamp Group, instructed Kitco Information on Friday that there was pent-up demand for gold, which might point out a constructive market pattern. Shiels mentioned this week’s rising U.S. nonfarm payrolls and mentioned there’s “merely nothing recessionary” concerning the report.

As for gold, it is dependent upon whether or not the dear metallic can keep its weekly appreciation. “Relying on whether or not gold can maintain its weekly beneficial properties (which is wanting more and more doubtless), it solidifies the offensive means gold has been buying and selling because it established a gentle bull pattern since early November – at all times on the lookout for causes to rally,” she mentioned. Shiels continued:

There’s an honest quantity of bullish ‘pent-up’ demand that has been rolled over from final 12 months and might get ignited on the fitting knowledge level (CPI & PCE) might be much more telling.

On Jan. 5, 2023, Shiels additionally shared MKS Pamp Group’s 2023 treasured metals forecast, which reveals a mean worth of $1,880 for gold and $22.50 for silver. In accordance with the forecast, gold might attain a excessive of $2,100 and silver might attain $28 per ounce in 2023. ABN AMRO expects gold to be round $1,900 per ounce in 2023, and Saxo Financial institution has detailed that gold might attain $3K per ounce this 12 months.

“2023 is the 12 months that the market lastly discovers that inflation is about to stay ablaze for the foreseeable future,” mentioned Ole Hansen, head of commodity technique at Saxo. Juerg Kiener, managing director and chief funding officer of Swiss Asia Capital, thinks gold might presumably even surge to $4K per ounce in 2023.

What do you concentrate on the 2023 gold worth predictions? Tell us your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

[ad_2]

Source link