[ad_1]

Ethereum has skilled a light setback after breaking the necessary barrier at $2,000 and continues to commerce within the inexperienced over right now’s buying and selling session. The cryptocurrency is main the present crypto market aid and sees poised for additional features.

On the time of writing, Ethereum (ETH) trades at $1,980 with a 6% and 15% revenue over the past 24 hours and seven days, respectively. Solely Solana (SOL), and Cardano (ADA) come near ETH’s value features with double digits income over the identical interval.

Buying and selling agency QCP Capital believes the bullish momentum is on monitor to increase on the again of constructive macro-economic elements. The crypto aid rally took off final week when the U.S. revealed the Client Worth Index (CPI) July print, a measure of inflation within the greenback.

The metric stood at round 8.5% and, as QCP Capital stated, “confirms the height inflation narrative”. Thus, market contributors anticipate a much less aggressive Federal Reserve (Fed) as inflation seems to be trending down. The buying and selling desk stated:

This has led to the market pricing a extra dovish Fed, creating bullish momentum that’s prone to proceed till the subsequent FOMC assembly on 22 September.

Within the coming weeks, there are different macro-economic occasions that would negatively impression market contributors’ perceptions in regards to the Fed. Nevertheless, QCP Capital believes the market will “stay supported regardless”.

For the value of Ethereum, the bullish narrative is double as there’s a tentative date for the mainnet implementation of “The Merge”, the occasion that can full ETH transition to a Proof-of-Stake (PoS) consensus. The occasion is anticipated to happen between September 15 to 16.

This has led to an “unprecedented” shift within the crypto choices markets, the whole open curiosity (OI) for ETH contracts has overshadowed Bitcoin (BTC) open curiosity. The previous stands at $8 billion and the latter at $5 billion.

What Might Develop into An Impediment For Ethereum’s Bullish Momentum

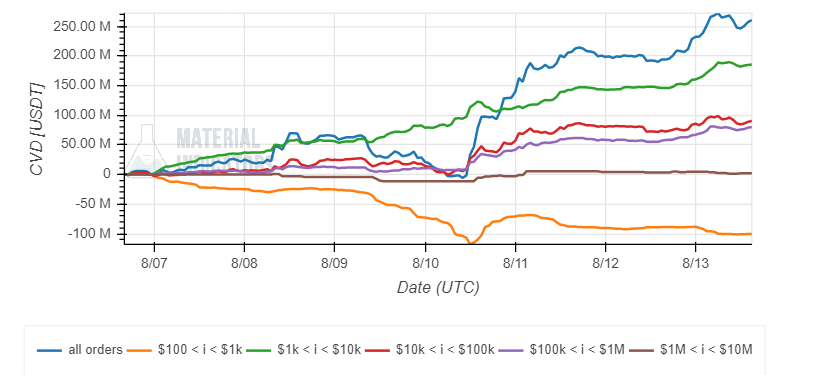

The above may recommend market contributors are shopping for name (purchase) choices for Ethereum heading into “The Merge”, relying on the occasion to achieve success. Within the spot market, information from Materials Indicators reveals that buyers with bid orders from $1,000 to $100,000 have been shopping for into ETH’s value motion over the past week.

If giant buyers proceed to help Ethereum, the bullish momentum might maintain, as QCP Capital expects. Nevertheless, Bitcoin ought to see extra upward strain to help any long-term bullish value motion, as NewsBTC beforehand reported.

Further information supplied by Materials Indicators information skinny resistance for ETH’s value, on low timeframes, north of $2,050. If bulls can push the value past these ranges, ETH might reclaim its earlier highs and switch crucial resistance into help.

[ad_2]

Source link