[ad_1]

Please see this week’s market overview from eToro’s international analyst workforce, which incorporates the newest market knowledge and the home funding view.

Danger urge for food continues amid market positive aspects

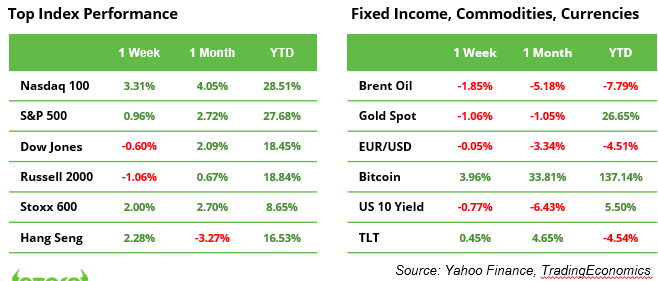

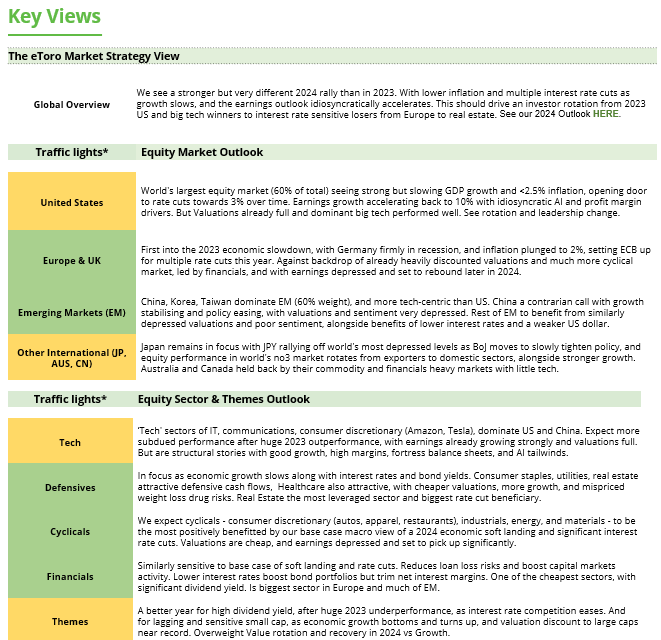

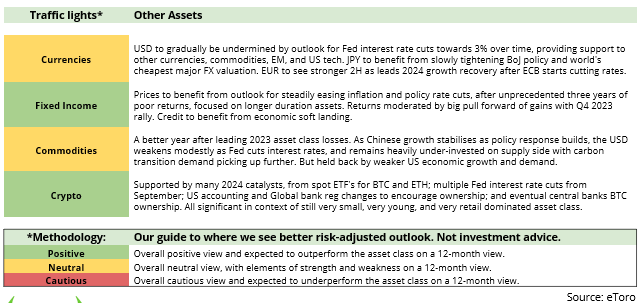

Final week noticed a continued urge for food for threat, with the Nasdaq 100 rising 3.3%, the S&P 500 hitting a file excessive of 6,090, and Bitcoin lastly surpassing the $100,000 mark. Investor sentiment was bolstered by a robust November jobs report, which confirmed the U.S. added 227K jobs (October: 36K) and unemployment fell to 4.2%. The market’s major focus this week would be the ECB charge determination on Thursday. Analysts are divided between a 25 or 50 foundation level minimize. In the meantime, within the U.S., the inflation report (CPI) will present the ultimate knowledge level earlier than the Fed’s assembly subsequent week, the place markets are pricing in an 83% probability of a 25 foundation level minimize.

Regardless of elevated fairness valuations and hovering cryptocurrency costs, promoting stress within the present market seems restricted. Many anticipated dangers haven’t materialised, together with chaos across the U.S. elections, escalating geopolitical tensions, main cybersecurity breaches, vital local weather disasters, or a client spending slowdown. Nevertheless, dangers stay. Essentially the most fast concern seems to be the potential for one more European debt disaster.

Santa rally: buyers really feel validated

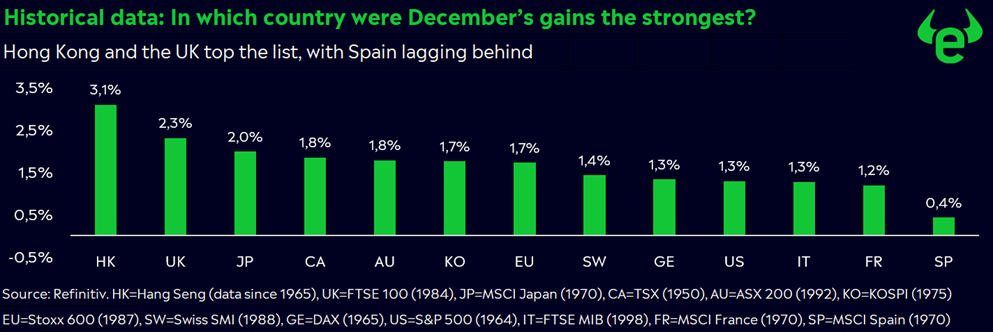

December is historically a robust month for inventory markets, with the so-called “Santa rally“, a seasonal rise in costs, changing into a globally recognised phenomenon. In accordance with our evaluation, Hong Kong and the UK (see chart) current the very best alternatives for above-average positive aspects.

Notably, December accounts for a good portion of annual returns in some areas. Italy leads the pack, with the month contributing a powerful 39% of yearly positive aspects. The UK follows intently at 36%, whereas Japan data 32%. Europe additionally performs nicely, averaging 29%, although the US lags behind, with December including simply 16% to annual returns.

Though previous efficiency isn’t any assure of future outcomes, the information means that investing throughout December may be rewarding. Buyers who preserve their positions through the vacation season might profit from these seasonal traits, whilst annually brings distinctive challenges.

Present uncertainties embrace Trump’s unpredictable commerce insurance policies, sluggish financial development in Europe and China, and political turmoil in nations like France and Germany. But, the rally continues regardless of these dangers. Investor confidence stays excessive: the S&P 500 volatility index dropped to just about 13, whereas the DAX climbed a powerful 4% final week.

ECB charge determination: Trump provides uncertainty to the combination

So the year-end rally is gaining momentum, with the DAX posting its strongest positive aspects since September. This week, the European Central Financial institution (ECB) holds the important thing to figuring out the market’s subsequent strikes. Its determination might both prolong the rally or deliver it to a sudden halt.

Because the ECB continues its rate-cutting cycle, the first query stays: how a lot decrease will charges go? A transparent roadmap is unlikely to emerge from this assembly, as ECB President Christine Lagarde is anticipated to sidestep addressing essentially the most urgent points. Buyers ought to mood their expectations for concrete steering.

Including additional complexity is the unpredictable issue of Donald Trump. Doubtlessly larger tariffs might have an inflationary impact, creating extra challenges for policymakers. Trump’s commerce insurance policies stay a major wildcard in an already unsure financial panorama. Consequently, the ECB might choose to purchase extra time to evaluate the broader financial affect earlier than committing to additional actions.

A 25 foundation level charge minimize appears more than likely, with markets anticipating a drop within the benchmark charge to 1.75% by the tip of 2025. Such a transfer might ignite a virtuous cycle: elevated lending, larger funding, and rising consumption might present a sustainable increase to financial development, even amid persistent uncertainties.

Upcoming: eToro’s annual funding outlook 2025

This week, eToro’s workforce of market analysts will launch its annual funding outlook. As a part of the Digest & Make investments sequence, an in depth YouTube video (additionally accessible as a podcast) will spotlight key takeaways for 2024, main market drivers anticipated in 2025, and in-depth analyses of Europe and the U.S. The report will even embrace an up to date funding outlook for all main asset courses and have insights from a world ballot of over 3,000 retail buyers. Don’t miss this complete information to navigating the markets within the yr forward!

Knowledge releases and earnings experiences

Macro knowledge:

U.S. CPI (11/12), ECB financial coverage assembly + speech Lagarde (12/12)

Earnings:

Oracle (9/12), Gamestop (10/12), Adobe (11/12), Broadcom, Costco (12/12)

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

[ad_2]

Source link