Understanding DeFi

The cryptocurrency phenomenon started with the arrival of cash that had an easy, singular goal. Bitcoin and others aimed to be cash for the digital age by making transactions environment friendly, borderless, and safe. Down the road, different modern visionaries started to comprehend how blockchain expertise might revolutionize numerous industries.

Decentralized finance, or DeFi, has quickly change into essentially the most intriguing and highly-speculative department of the cryptocurrency area. Centered round decentralized apps (dApps), DeFi empowers customers with elevated performance and programmability by integrating blockchain expertise into legacy monetary techniques. Think about a cellular banking app that may additionally operate as an NFT gallery, grant entry to cryptocurrency swaps, or allow crypto staking. These new potentialities are already changing into a actuality.

All of this isn’t solely attainable, however is actively being developed at exceptional velocity. Whereas the cryptocurrency area is at the moment going through the identical uncertainty plaguing conventional markets, the DeFi growth is constant nonetheless. Let’s put the DeFi area below a magnifying glass and see how the primary half of 2022 has fared for the trade.

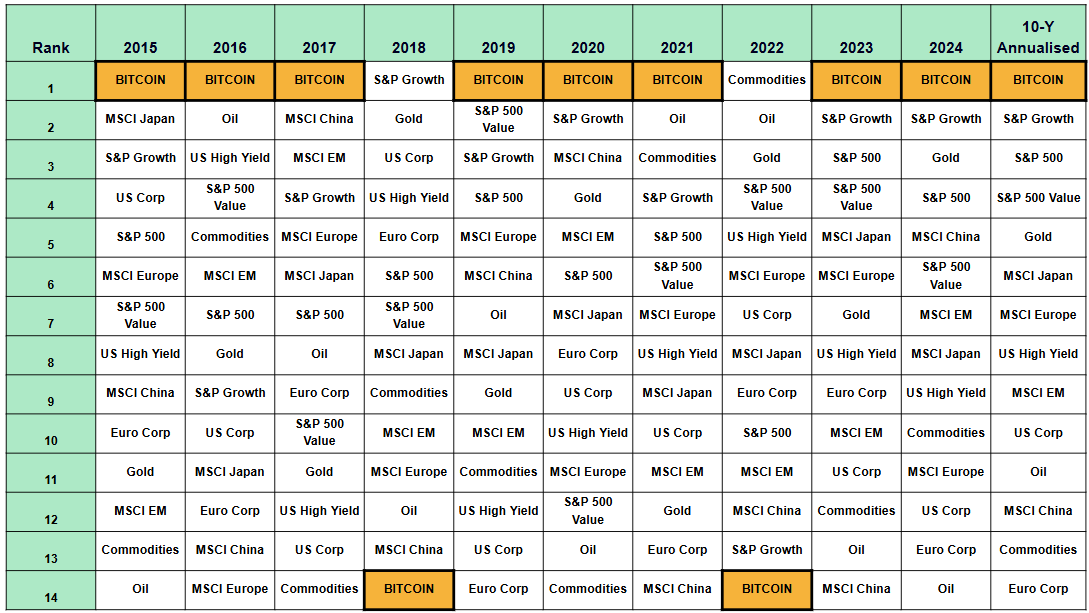

DeFi by the numbers

In case you are a newcomer to the DeFi area, one of the vital omnipresent phrases you’ll encounter is complete worth locked (TVL). This can be a measure of the mixed worth of cryptocurrency property devoted to DeFi dApps and platforms. Throughout occasions of maximum momentum within the crypto market, TVL can be utilized as a revealing gauge of the overall degree of curiosity in DeFi. Within the subsequent part, we’ll confer with the TVL to find out how DeFi has managed to this point in opposition to the “crypto winter” of 2022.

TVL efficiency in 2022

Supply: Glassnode

Efficiency overview:

• January 1, 2022: $235.8 billion

• April 1, 2022: $220.2 billion

• June 30, 2022: $72.8 billion

• YTD change: -69.12%

• Quarter 2 change: -66.94%

With the sensational cryptocurrency explosion from 2020-2021 got here an immense quantity of participation in DeFi and dApps. In November 2021, DeFi TVL reached a historic milestone after surpassing the $250 billion marker for the primary time. Whereas there was a noticeable decline main into January 2022, the TVL was nonetheless comparatively excessive at $235.8 billion.

Nonetheless, because the extreme promoting stress of the oncoming bear market ensued, TVL progressively dropped consequently. The second quarter of 2022 introduced essentially the most dramatic change. April started with a complete TVL of $220.2 billion. Nonetheless, as the worth of crypto chief BTC dropped by 64% from April by means of June, DeFi TVL concurrently dropped practically 67% as nicely.

DeFi quarter efficiency by class

Knowledge Supply: DeFi Llama

Efficiency overview:

• Dexes: -63%/ $23.22 billion TVL

• Lending: -71%/ $15.19 billion TVL

• Yield: -68%/ $6.53 billion TVL

• Liquid staking: -76%/ $5.53 billion TVL

• Cumulative DeFi: -66.94%/ $72.8 billion

Chains and dApps by income

Supply: Token Terminal

Thus far, there are tons of of various DeFi chains and dApps. Every has its personal aspirations, and distinctive market gaps or utility that it seeks to deal with. Ideally, every mission ought to be capable of discover success or failure based mostly by itself deserves and design. This idea might sound typical below the lens of a typical enterprise, however within the cryptocurrency world, there are exterior components that exude immense stress on the DeFi market as an entire, typically by means of no fault of the person corporations.

Whereas a dApp could also be targeted on serving its customers in the easiest way attainable, a pullback within the cryptocurrency market may cause dApp and DeFi customers to flee. When BTC and others started their downslide, customers left these DeFi platforms in droves, and took their funds with them. Consequently, many dApps have struggled to seek out their footing because the drop. Nonetheless, some have managed to remain in enterprise regardless of the downside. Let’s check out just a few of the largest chains and dApps by income by means of Q2 of 2022.

Ethereum (ETH):

Ethereum closed the quarter because the clear chief by cumulative income. In reality, nothing else comes shut or must be anticipated to. For the 90-day interval ending on June 30, Ethereum earned customers $1.1 billion in income. Most of this income was a results of the protocol and actions on the community.

As gasoline is burnt for transfers and different actions, deflationary stress is asserted on the remainder of the circulating provide. This helps to boost the worth of the remaining ETH. Provide-side income is one other metric that refers back to the quantity that ETH miners are paid for his or her companies.

Supply: Token Terminal

OpenSea:

OpenSea, a platform devoted to NFTs, generated $155.8 million in the identical timeframe. They supply all the pieces from data and group of collections, to the advertising and sale of distinctive property. OpenSea deducts a flat charge from gross sales on the secondary market after particular person NFTs have been minted and resold.

LooksRare:

Arguably the largest competitor to OpenSea is LooksRare. In the identical method, they introduced in $87.1 million in income by means of Q2 of 2022.

DeFi ecosystem updates

Crypto strikes quick. With markets that by no means sleep, making an attempt to maintain up with the seemingly infinite stream of occasions throughout a bull run is an impractical, if not inconceivable, feat. The information might decelerate in a crypto winter, however weeks of inactivity are a factor of the previous. Amidst the latest pullback within the crypto market, there have been nonetheless many newsworthy occasions going down.

Listed below are a number of the most eye-catching updates of the previous quarter:

Robinhood launched a self-custody Internet 3.0 walletCoinbase permits customers to faucet into ETH dApps from an change walletCoinbase launched a pockets characteristic permitting customers to commerce on dexesAndreessen Horowitz (a16z) $4.5 billion capital raiseUST depegMoonbeam (Polkadot) is including liquid staking by means of Lido SEC investigating UST and TerraOptimism exploited for $20 million 2 weeks after airdropCircle to help USDC on Polygon Oracle pricing error on Luna Traditional results in $2 million exploitsSTEPN’s decentralized change turns into the biggest dex on Solana Solana NFT market Magic Eden raises $130 million at a $1.6 billion valuationSolana Cell publicizes Saga Internet 3.0 smartphone PayPal allows crypto transfers on the platform

DeFi traits to look at

Blockchain expertise is evolving at a parabolic fee. DeFi particularly retains increasing to embody extra industries, extra utility, and a wider person base. As this development continues, we’re prone to witness rising traits shaping the way forward for DeFi in real-time. Listed below are a number of the most vital traits to bear in mind.

Dynamic gasoline charges

Appropriately named, gasoline is what fuels the Ethereum community. Completely different actions on the community all price various quantities of gasoline. For instance, a easy ETH switch requires much less gasoline than deploying a wise contract. Nonetheless, since each motion requires some quantity of gasoline issues can come up when the community is experiencing peak use time.

Analysts have been fast to evaluate Ethereum’s scaling points as proof that the community will probably be unable to carry out below widespread adoption. Throughout sure durations of time, just like the latest NFT craze, ETH switch prices skyrocketed. It was not exceptional for particular person transfers to price tons of in USD denomination. Customers had been keen to spend much more gasoline in precedence charges to leap the road and have their transactions confirmed first.

Although gasoline charges on the community have declined immensely throughout this crypto recession, they’re anticipated to stay dynamic for the foreseeable future. In flip, exorbitant gasoline charges have propelled customers to discover different Layer 2 networks.

The rise of Layer 2 options

Layer 2 (L2) options are protocols that run on high of the Ethereum community and assist complement its capability to scale. Offering different routes for transfers and actions has proved to be each appreciated and immensely profitable to this point. Whereas these L2 options have been round for the previous few years, utilizing the Ethereum base layer has been the higher choice prior to now.

Nonetheless, throughout the immense community congestion we witnessed not too long ago, L2s started to shine. An increasing number of typically, customers are opting to make use of these options. It’s extremely anticipated that these L2 options will proceed to develop and alter the best way we work together with the Ethereum community. A major observe, gasoline remains to be used to finalize any transfers made by means of L2 options, that means that ETH remains to be important for all transfers that make the most of the Ethereum community.

Sources: Glassnode, Arbiscan, Optimistic Etherscan

Within the charts above, we will see how two L2 options, Optimism and Arbitrum, have taken an growing quantity of transactions from the Ethereum community.

Listed below are some vital results L2 options can provide:

Decreasing the price of community actions.Enable for larger velocity and throughput.Offering a substitute for roadblocks and bottlenecks.Permitting the bottom layers of a community to deal with safety and decentralization with out worrying about assembly the calls for of mass adoption.

stETH decoupling from ETH

Staked ETH (stETH) has been buying and selling at a reduction for the previous few months. It could appear logical to imagine that one stETH ought to at all times commerce on the equal worth of 1 ETH, however this previous yr has proven us why that isn’t the case. This example is complicated, and lots of the troubles with this worth discrepancy might be traced again to liquid staking.

Liquid staking

When cash are staked, they’re usually inaccessible to the proprietor. This has introduced apparent limitations and held again ecosystem progress to some extent. What liquid staking proposes is a technique to retain asset mobility whereas cash or tokens are being staked.

Key options of liquid staking:

Liquid staking makes staked worth extra liquid by creating proxies of staked property.These are primarily derivatives which have related utility to the bottom asset.Liquid staking can cut back alternative prices for networks.

For extra about liquid staking, try our latest weblog put up.

At present, ETH that’s locked in staking contracts can’t be accessed till a degree after the upcoming “Merge.” Due to this fact, a secondary market has been developed round stETH and the related worth can differ from commonplace ETH. It’s because stETH can’t at the moment be redeemed for an equal quantity of ETH as a result of lockup. As soon as this staked ETH is launched, the worth of stETH will probably realign with ETH’s worth. Nonetheless, the Merge just isn’t deliberate till September nineteenth, and there’s no telling how this occasion will play out.

Keep tuned for extra DeFi breakdowns and evaluation as we stay up for what Q3 might have in retailer. For extra data, comply with us on social media, and sign-up for our weekly publication to obtain well timed updates on occasions impacting the digital asset ecosystem.

Disclaimer: Data offered by CEX.IO just isn’t supposed to be, nor ought to or not it’s construed as monetary, tax, or authorized recommendation. The chance of loss in buying and selling or holding digital property might be substantial. You need to rigorously contemplate whether or not interacting with, holding, or buying and selling digital property is appropriate for you in mild of the danger concerned and your monetary situation. You need to consider your degree of expertise and search unbiased recommendation if obligatory concerning your particular circumstances. CEX.IO just isn’t engaged within the provide, sale, or buying and selling of securities. Please confer with the Phrases of Use for extra particulars.