[ad_1]

A Bitcoin cycle indicator from the analytics agency CryptoQuant suggests BTC has gone by way of a transition to a bearish part after the crash.

CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator Now In Unfavorable Territory

In a brand new publish on X, CryptoQuant Head of Analysis Julio Moreno has mentioned the most recent improvement within the “Bull-Bear Market Cycle Indicator” devised by the analytics agency.

This metric is predicated on CryptoQuant’s P&L Index, which itself is a unification of some totally different standard on-chain indicators associated to unrealized and realized revenue/loss.

The P&L Index mainly serves as a strategy to decide if BTC is in a bear or bull market proper now. When the indicator crosses above its 365-day shifting common (MA), BTC may very well be assumed to have entered right into a bullish part. Equally, a drop beneath the MA implies a bearish transition.

The Bull-Bear Market Cycle Indicator, the precise metric of focus right here, visualizes the P&L Index in a extra handy type by holding monitor of its distance from its 365-day MA.

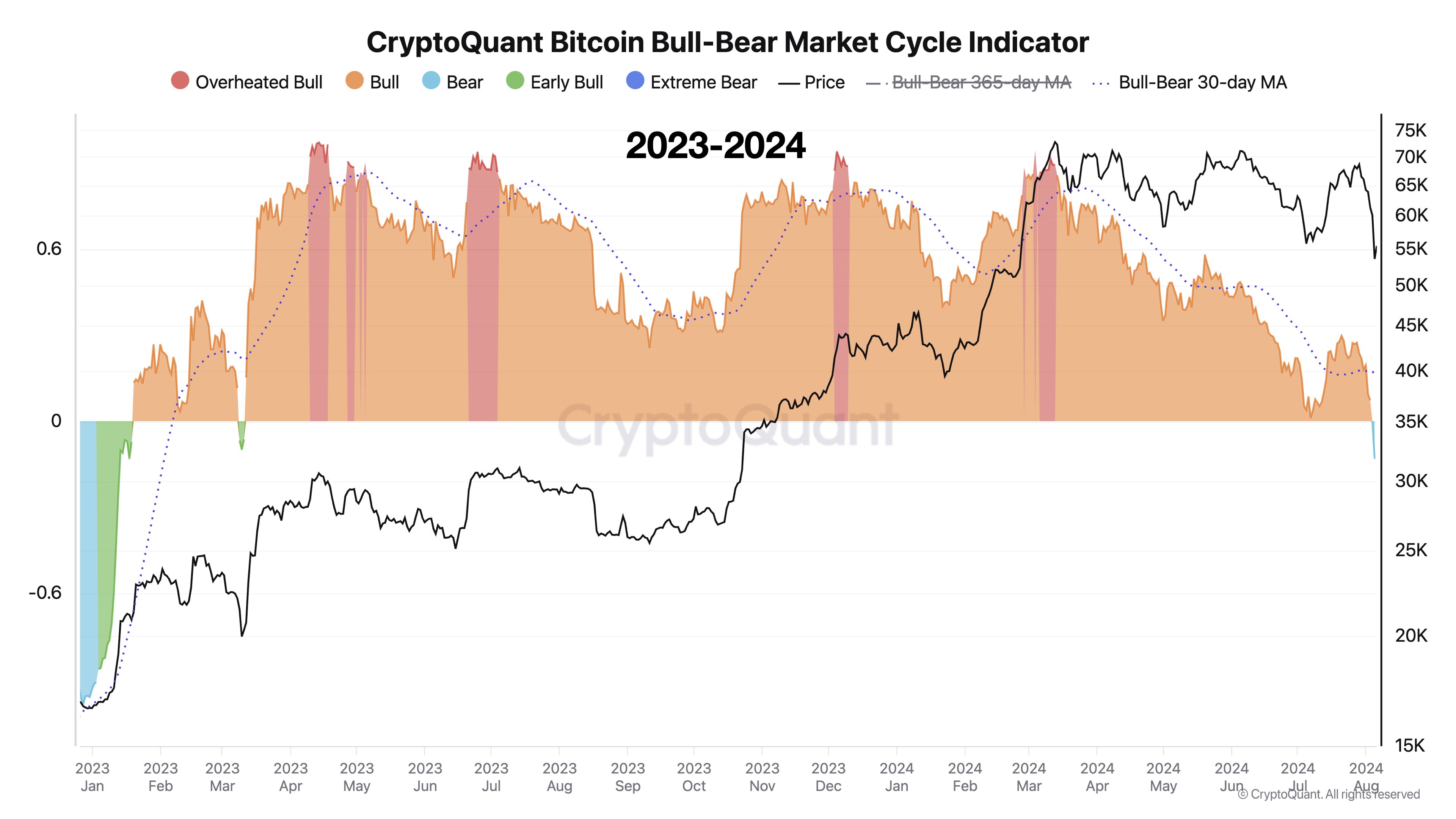

Now, here’s a chart that exhibits the pattern on this Bitcoin indicator during the last couple of years:

The worth of the metric seems to have plunged into the damaging territory in current days | Supply: @jjcmoreno on X

As displayed within the above graph, the Bitcoin Bull-Bear Market Cycle Indicator had shot up earlier within the 12 months when the asset’s value had rallied to a brand new all-time excessive (ATH) and reached a territory known as the “overheated bull.”

At these values, the P&L Index positive factors a big distance over its 365-day MA, therefore why the asset’s value is taken into account to be overheated. Alongside these overheated values, the asset had achieved a high which continues to be the height of the rally so far.

After spending months inside the traditional bull territory, the indicator seems to have seen a plunge beneath the zero mark, implying that the P&L Index has now crossed beneath its 365-day MA.

The Bull-Bear Market Cycle Indicator is now flagging a bear part for Bitcoin. Moreno notes that that is the primary time since January 2023 that the metric is giving this sign.

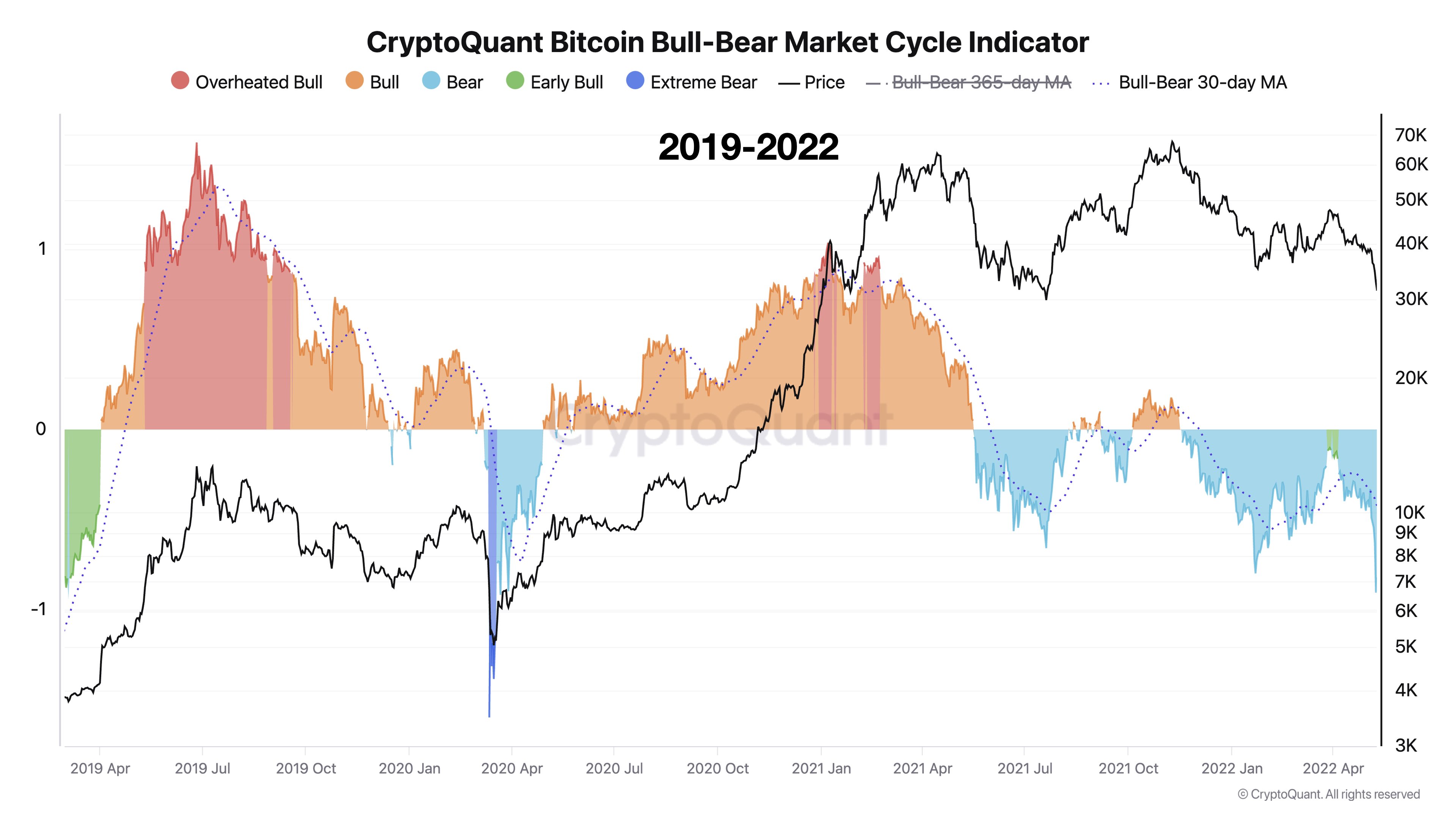

One thing to remember, nonetheless, is that this sign doesn’t essentially must imply that the cryptocurrency is heading into an prolonged bear market. Because the CryptoQuant head has identified, there have been intervals previously the place the metric has solely quickly flagged a bearish part for BTC.

The earlier bear phases for the asset | Supply: @jjcmoreno on X

From the chart, it’s obvious that the COVID-19 crash in March 2020 and the China mining ban in Could 2021 each led to momentary bear phases from the angle of the indicator.

It now stays to be seen if the Bitcoin Bull-Bear Market Cycle Indicator will stay contained in the damaging territory for less than a quick interval this time as effectively or not.

BTC Value

On the time of writing, Bitcoin is buying and selling just below the $57,000 degree, down virtually 14% during the last seven days.

Seems like the value of the coin has been making restoration because the crash | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

[ad_2]

Source link