[ad_1]

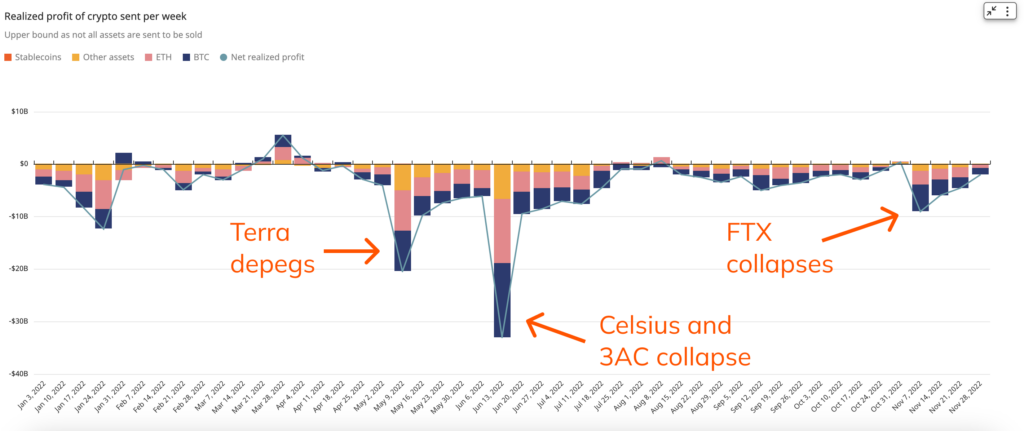

FTX’s collapse resulted in round $9 billion in realized losses for crypto buyers, in response to a Chainalysis report.

Chainalysis famous that this loss paled in comparison with Terra’s UST depeg, which brought about a lack of $20.5 billion. The implosion of crypto corporations like Celsius and Three Arrows Capitals led to $33 billion in realized losses.

In accordance with Chainalysis, weekly realized loss and acquire are calculated primarily based on the worth of belongings in a pockets on the time they had been acquired minus the worth of the portion of the belongings transferred from the pockets on the time of recording the info.

Whereas the switch of belongings from a pockets doesn’t essentially suggest a sale, it offers an perception into how these occasions affected buyers. The info reveals that many buyers had already misplaced considerably extra worth earlier than the FTX crash.

Nonetheless, the info doesn’t account for many who misplaced their deposits on the FTX change.

CryptoSlate reported that realized Bitcoin (BTC) losses reached a yearly excessive of $4.3 billion following FTX’s collapse.

Stories revealed that over a million collectors had been affected by the FTX collapse, with no less than $8 billion in lacking funds. The crypto change founder Sam Bankman-Fried was arrested within the Bahamas and confronted legal costs in the USA.

Learn Our Newest Market Report

[ad_2]

Source link