[ad_1]

Crypto funding firm Canary Capital has submitted an utility for a second XRP exchange-traded fund (ETF) in america. This submitting is in step with Bitwise’s current submission of a comparable utility for a spot XRP ETF.

In gentle of the authorized and regulatory uncertainty surrounding XRP, Canary’s determination to proceed with this ETF demonstrates a daring strategy to the asset’s long-term potential.

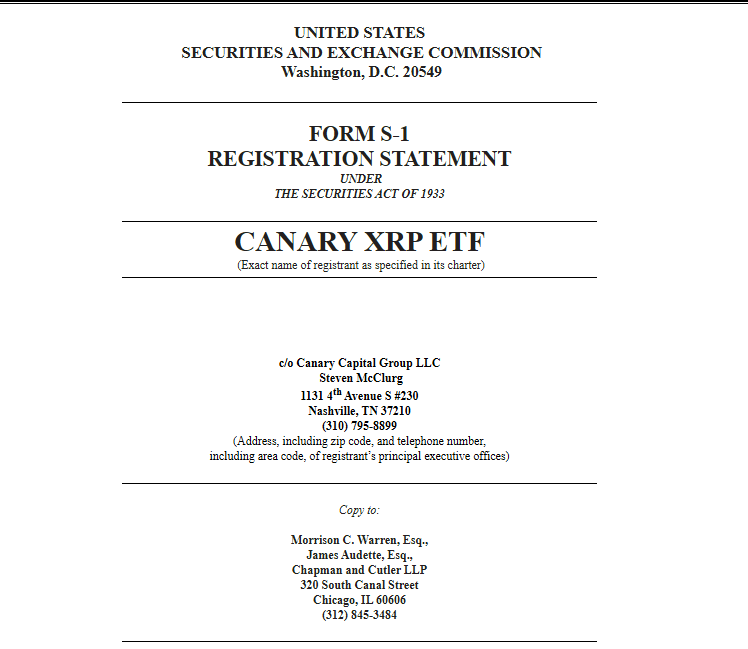

Canary Capital submitted the S-1 submitting Tuesday, which is a requirement for issuers to file to publicly supply new securities.

The Canary ETF is especially formidable because the authorized and regulatory destiny of XRP stays shrouded unsure, indicating a agency conviction within the digital asset’s future function within the finance business.

Supply: SEC

Supply: SEC

Canary Hops In: The 2nd ETF

The brand new Canary ETF comes simply as the way forward for XRP within the US stays unsure, owing to ongoing authorized proceedings between Ripple Labs and the SEC. The case is the topic of a heated dialogue on whether or not XRP must be categorized as a safety token.

Breaking: Canary Capital Information Second XRP ETF Within the UShttps://t.co/6KVIDzKkOe

— John Morgan (@johnmorganFL) October 8, 2024

The authorized consequence is seen as having a major implication on Ripple and the larger crypto market as a measure of how different digital asset issuers will probably be handled. Nevertheless, the submitting by Canary just isn’t made out of desperation. It’s greater than a wishful try and protect the so-called fading purple dream.

Else, the elevated risk to safe the SEC’s backing represents an indication of a modified regulatory angle in direction of crypto initiatives throughout the board.

XRP market cap at the moment at $30 billion. Chart: TradingView.com

XRP Rising Adoption

The ETF submitting additionally underscores a broader pattern of institutional curiosity in XRP. Whereas enthusiasm for XRP is unabated throughout the crypto neighborhood, many institutional buyers are on the lookout for a dependable, regulated technique to acquire an publicity with no need to buy, retailer, and safe it.

Canary Capital’s XRP ETF seeks to observe the CME CF Ripple index, due to this fact offering buyers with a constant value reference. This lets one keep away from the problems of shopping for, storing, and safeguarding the asset whereas not directly exposing oneself to the XRP market.

XRP up within the final 24 hours. Supply: CoinMarketCap

XRP up within the final 24 hours. Supply: CoinMarketCap

Clear Avenue For XRP Market

Canary Capital’s transfer is a daring one. No matter uncharted regulatory territory, XRP’s function in institutionalized finance is much from unknown. If the ETF is permitted, it will give massive buyers a transparent pathway to entry into the XRP market. It might additionally sign XRP’s entry into a brand new stage of maturity, primarily based totally on Ripple’s settlement and SEC’s angle towards cryptos.

A the time of writing, XRP was buying and selling at $0.53, up 0.5% on the 24-hour timeframe, and buying and selling flat within the final week, information from CoinMarketCap exhibits.

Featured picture from The Tech Report, chart from TradingView

[ad_2]

Source link