[ad_1]

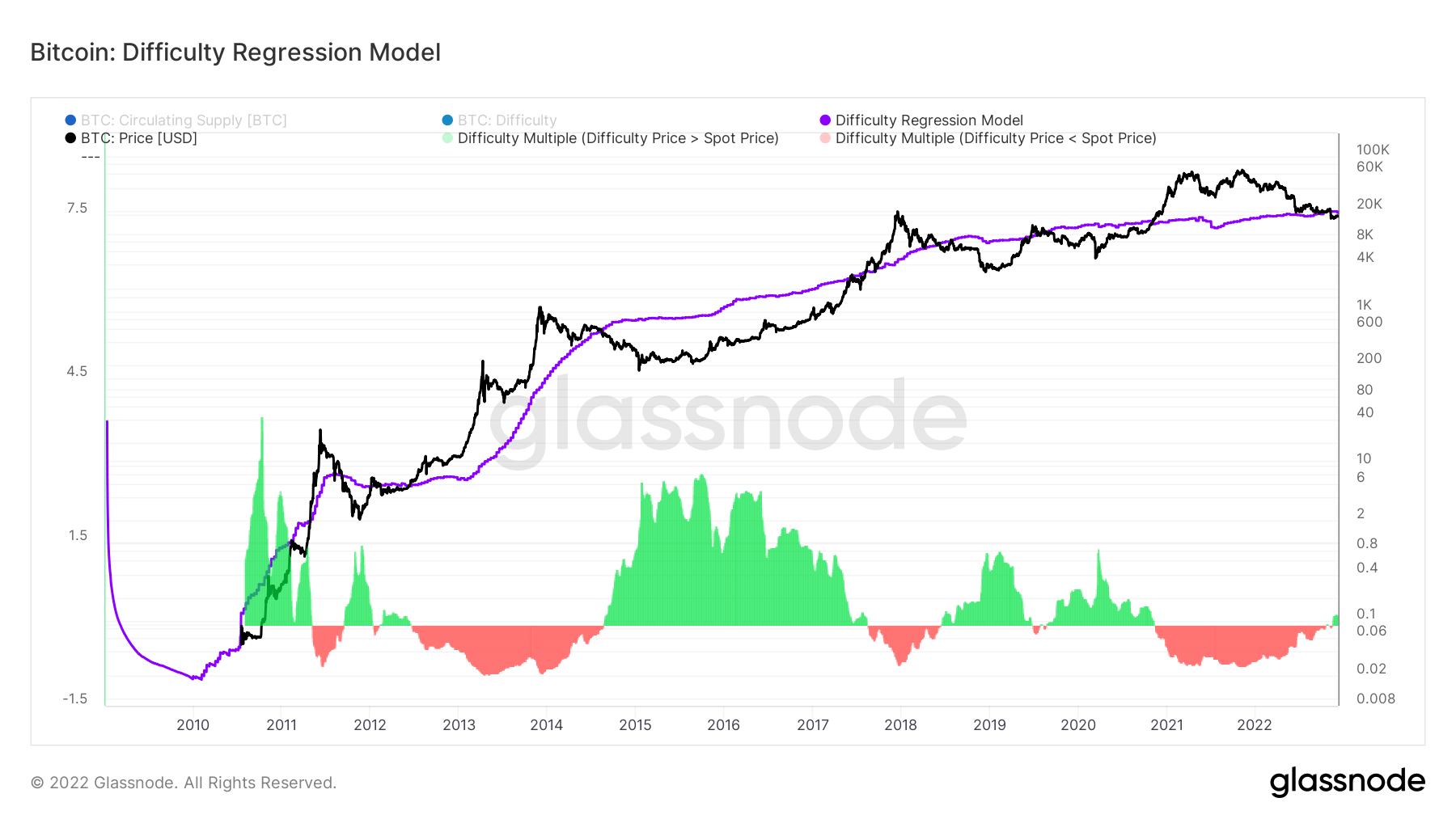

The price of Bitcoin (BTC) is now cheaper than the price of mining one Bitcoin, in accordance with the Problem Regression Mannequin.

As per knowledge obtained from Glassnode, the present price of mining one Bitcoin is $18.8k, whereas the price of one Bitcoin is $16,5771.8.

The Problem Regression Mannequin is taken into account the last word distillation of mining ‘value’, because it represents all of the mining variables in a single quantity, representing a mining business’s common manufacturing price for Bitcoin with out requiring an in depth breakdown of mining gear, energy prices, and logistical issues.

A number of days after FTX filed for chapter, Bitcoin’s value went beneath the issue regression mannequin and has remained there since.

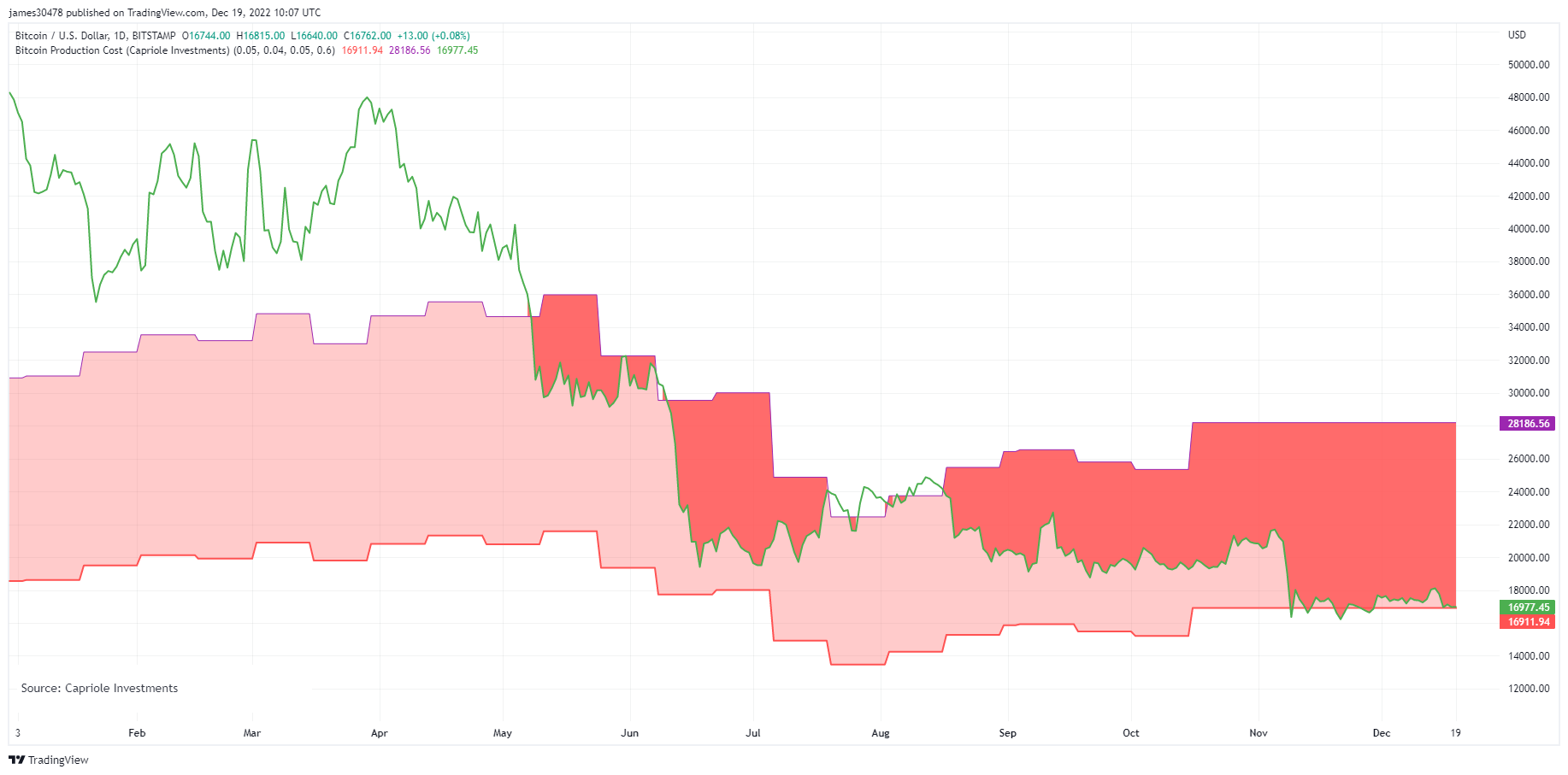

As well as, Tradingview’s knowledge signifies that Bitcoin’s value is now decrease than its electrical energy price. Bitcoin’s Value is at present buying and selling at round a 60% low cost to Bitcoin Vitality Worth, based mostly on the watts of power used within the community. It’s the most important low cost for the reason that value hit $4K on 13 March 2020 and $160 on 14 January 2015.

There have solely been three situations the place the market value has fallen beneath the common mining price – from 2016 to 2017, on the finish of 2018 to Could 2019, and early 2020. In every case, Bitcoin rallied strongly, rising to a brief peak the place the market value was a number of instances the mining prices.

If historical past repeats itself, the smaller the hole between Bitcoin’s market worth and mining price, the extra engaging Bitcoin shall be as an funding. Nonetheless, buyers and merchants must be cautious about investing in Bitcoin or altcoins because of present bearish market situations and the macro atmosphere.

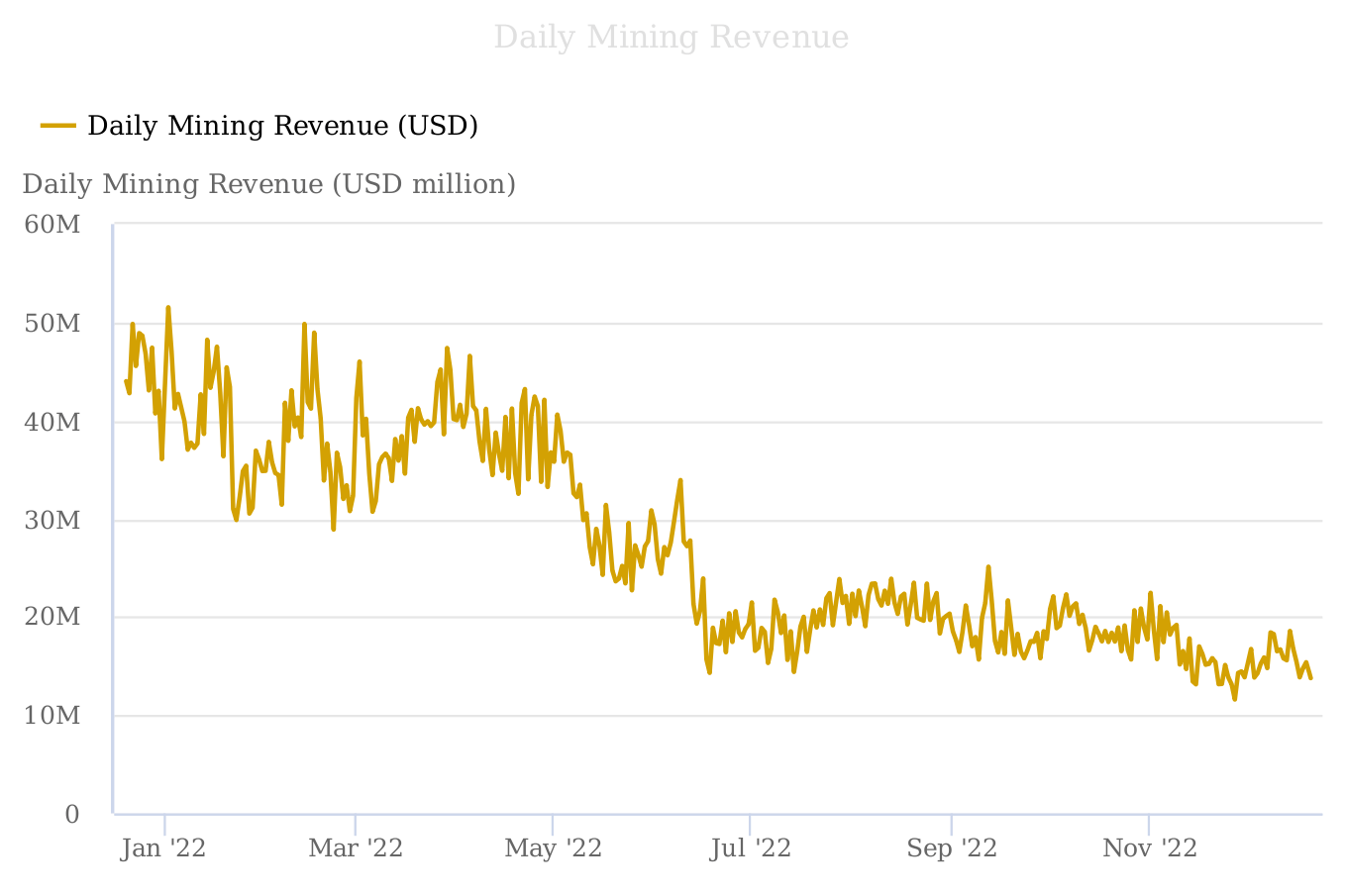

The present market put miners below strain

When mining prices are decrease than Bitcoin’s market worth, a mining operation stays worthwhile extra miners will be part of. Nevertheless, the present market has put miners below strain as mining prices are rising.

Within the final 12 months, miner income has decreased by 72.34 %, in accordance with knowledge obtained from Braiins.com.

Moreover, CryptoSlate’s earlier report revealed that the Hash Value representing the income earned per Exahash per day had hit an all-time low of $583,000.

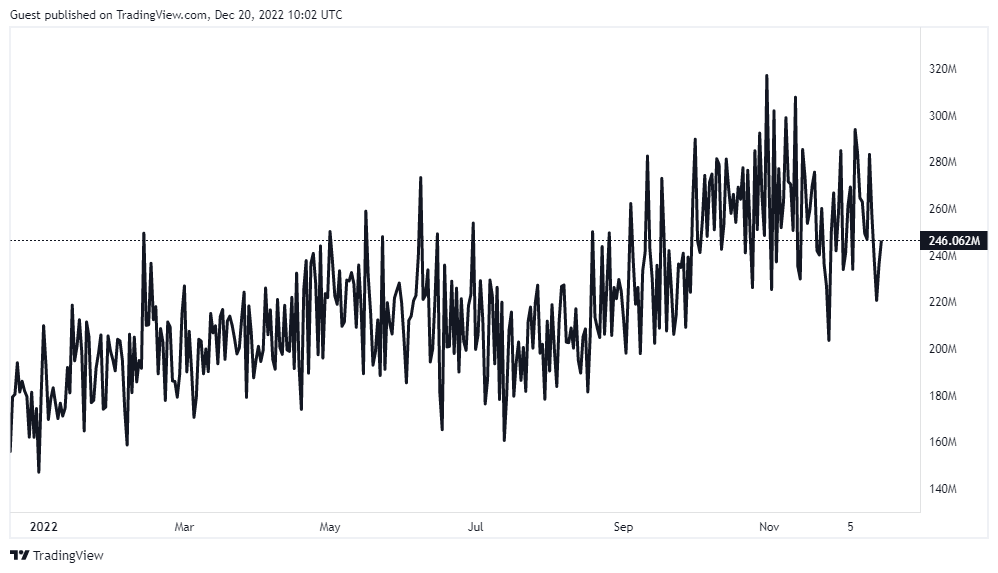

As well as, Bitcoin’s hash fee additionally means that it’s getting dearer to supply and that it’s being bought at a reduction.

Bitcoin Hashrate measures the quantity of processing and computing energy given to the Bitcoin community by miners. The Bitcoin hash fee at present stands at 246.062 EH/s, in accordance with Buying and selling View.

There’s a risk that a lot of Bitcoin mining operations shall be pressured out of enterprise if bitcoin costs don’t rise or fall decrease.

Learn Our Newest Market Report

[ad_2]

Source link