[ad_1]

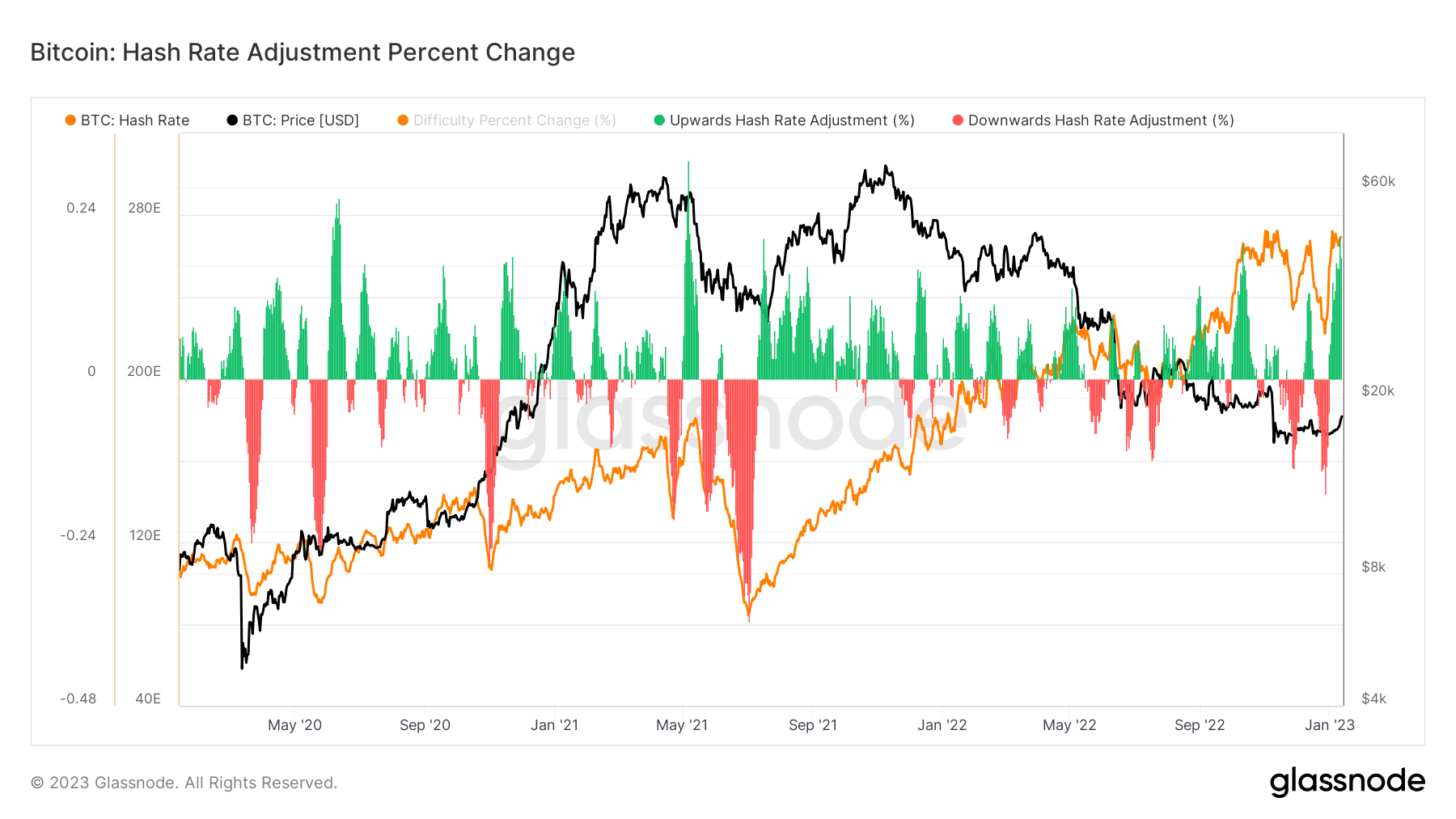

Bitcoin (BTC) hashrate rose 20% to a brand new all-time excessive on Jan. 12 — the second time the hashrate elevated to a brand new ATH within the final seven days.

It has since retraced to 251.79 EH/s as of press time.

Crypto investor Asher Hopp identified that Bitcoin’s hashrate rose to an all-time excessive regardless of bankrupt miner Core Scientific turning off 9,000 ASICs in December. In response to Hopp:

“Hash is transferring from weak arms to sturdy arms.”

BTC’s elevated hashrate is predicted to result in a 9% rise in mining issue, based on bitrawr.

Crypto lenders moonlighting as miners

With a number of Bitcoin miners utilizing their mining rigs as collateral for over $4 billion in debt, crypto lenders are repossessing machines for their very own profit, Bloomberg Information reported on Jan. 12.

Whereas some lenders are storing the rigs, others, like New York Digital Funding Group (NYDIG), have seized the chance to enterprise into crypto mining.

For context, a debt restructuring settlement between NYDIG and Greenidge Era turned the lender right into a Bitcoin miner. In response to the settlement, NYDIG would purchase mining tools of two.8 EH/s that Greenidge would host.

Bloomberg reported that different lenders with mining expertise are favoring this route.

The pinnacle of analysis at TheMinerMag, Wolfie Zhao, reportedly stated:

“Lenders are flooded with mining rigs. A technique for the lenders to forestall additional losses from the defaulted loans is to maintain the collateralized machines operating and generate some earnings.”

In the meantime, studies confirmed that Bitcoin’s mining profitability declined as a result of declining worth of the asset and the rising mining issue and hashrate metrics.

Learn Our Newest Market Report

[ad_2]

Source link