[ad_1]

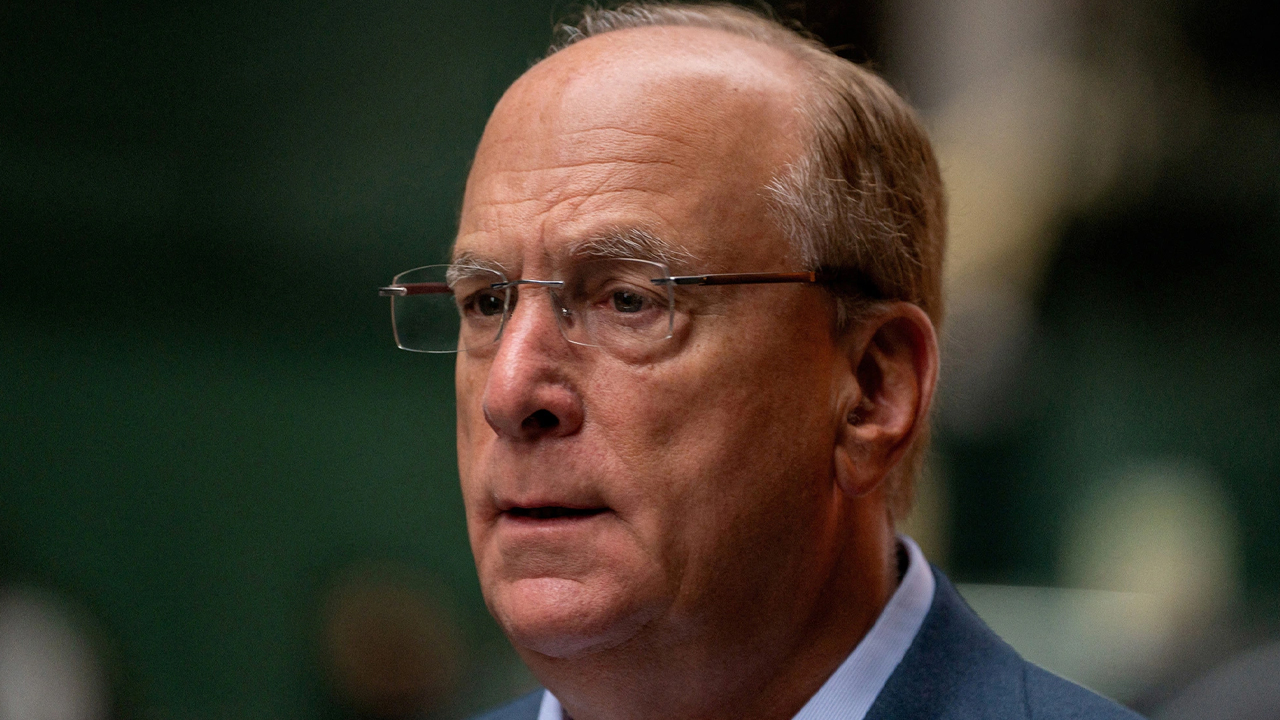

Blackrock’s CEO, Larry Fink, said in an interview on Friday that he doesn’t anticipate a “massive recession” in the US. Nonetheless, he believes that “inflation goes to be stickier for longer.” In distinction to the U.S. central financial institution’s 2% objective, Fink predicts that “we’re going to have a 4ish ground in inflation.”

Blackrock Purchasers Scale back Danger in Portfolios as Inflation Issues Persist

Larry Fink, chairman and CEO of Blackrock (NYSE: BLK), the asset supervisor with greater than $9 trillion in property underneath administration (AUM), predicts that inflation within the U.S. will persist for a substantial period of time. Fink was interviewed on Friday by the hosts of CNBC’s “Squawk on the Avenue” and said that he doesn’t anticipate a significant financial downturn within the nation.

“I’m not anticipating an enormous recession within the [United States],” Fink advised the published hosts. He additionally emphasised that the numerous fiscal stimulus injected into the nation must be “offset.”

Whereas acknowledging that some sectors of the financial system are “weakening,” Fink said that “different sectors, due to these great fiscal stimuli, are going to offset a few of that.” The Blackrock government additionally mentioned inflation, emphasizing that he believes it “goes to be stickier for longer. In different phrases, I feel we’re going to have a 4ish ground in inflation.”

Relating to a potential recession in 2023, he said that he’s “unsure we’re going to have a recession” and prompt it’d happen in 2024. Fink additionally expressed bewilderment on the response to the autumn of Silvergate Financial institution, Silicon Valley Financial institution, and Signature Financial institution.

Fink mentioned:

This isn’t a systemic drawback, this isn’t an issue that’s going to have impression. As we noticed at present we had our massive banks having nice quarters … performing very well. So I feel that is simply an instance of, you already know, when the ocean or the tide goes out, some persons are going to be left there.

In mid-March, Fink shared his views on the banking trade following the collapse of three banks and asserted that “we’re prone to see stricter capital requirements for banks.” Fink’s newest analysis, shared with CNBC hosts on Friday, coincides with latest remarks made by Blackrock’s chief funding officer of worldwide mounted revenue, Rick Rieder.

Rieder anticipates that the U.S. Federal Reserve will enhance the benchmark fee to six% this 12 months and preserve it at that degree for an prolonged interval to alleviate inflationary pressures. Throughout his interview, Fink additionally knowledgeable CNBC that Blackrock’s shoppers are decreasing threat of their portfolios.

“We’re seeing an increasing number of shoppers who need to lower threat whereas sustaining a extra holistic and resilient portfolio by establishing a stronger basis of bonds and equities,” Fink defined.

Additional, the Blackrock CEO touted the corporate’s success over the previous 5 years, boasting of “rising by $1.8 trillion in web inflows.” Regardless of “all this pessimism,” he emphasised that Blackrock grew “extra on this first quarter than the primary quarter of ’22.”

What do you suppose Larry Fink’s predictions imply for the way forward for the U.S. financial system? Do you agree or disagree with the Blackrock CEO’s evaluation of the inflationary atmosphere and the chance of no recession in 2023? Share your ideas within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link