Curiosity in Bitcoin (BTC) spiked on social platforms over the weekend, resulting in its social dominance surging, based on Santiment.

The crypto perception supplier defined:

“A spike in Bitcoin curiosity on social platforms got here this weekend. Amongst crypto’s prime 100 belongings, BTC is the subject in 26%+ of discussions for the primary time since mid-July. Our again testing reveals 20%+ devoted to Bitcoin is a optimistic for the sector.”

Supply: Santiment

Subsequently, the renewed Bitcoin curiosity is going on amid the highest cryptocurrency buying and selling under the psychological worth of $20,000. BTC was hovering round $19,038 throughout intraday buying and selling, based on CoinMarketCap.

Moreover, Bitcoin has been buying and selling a lot under its all-time excessive (ATH) of $69,000 set in November final yr. The bearish momentum unfold over the yr in 2022, one of many elements triggered by like rate of interest hikes from the Federal Reserve (Fed).

Rate of interest surges normally have bearish impacts on high-risk belongings like Bitcoin. For example, Bitcoin (BTC) sank to $18.5K on September 19 based mostly on international financial tightening considerations, Blockchain.Information reported.

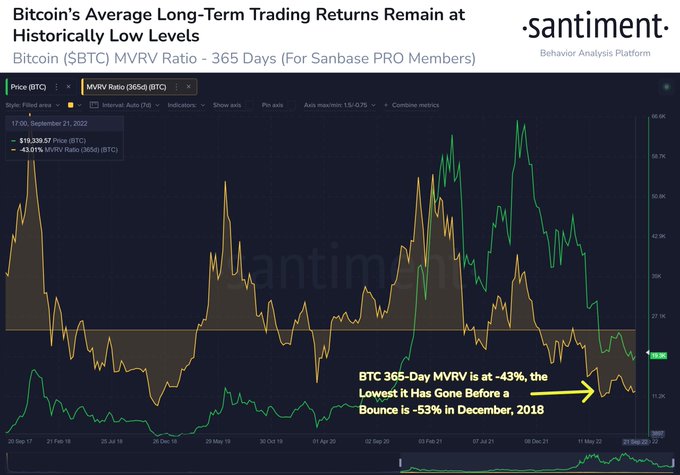

Alternatively, BTC’s common long-term buying and selling returns proceed trending at historic low ranges. Santiment identified:

“Bitcoin stays -72% from its November, 2021 all-time-high. With such a market cap drop, energetic merchants which have transacted over the previous yr are down a median of -43%. Traditionally, MVRV hasn’t dropped a lot additional than this earlier than a rebound.”

Supply: Santiment

Moreover, key Bitcoin whale addresses have depleted their holdings to ranges final seen in April 2020.

Santiment acknowledged:

“The quantity of Bitcoin held by whales has been dropping for 11 months now. As fears of inflation and a world recession proceed, addresses holding 100 to 10k BTC have lowered their proportion of provide held of crypto’s prime asset to 29-month lows.”

With the variety of non-zero BTC addresses reaching a month-to-month excessive, it stays to be seen how the main cryptocurrency performs out within the quick time period as extra contributors proceed getting into the market.

Picture supply: Shutterstock