[ad_1]

Bitcoin worth continues to witness robust resistance across the $19,400 mark. During the last 24 hours, the coin depreciated by 2.9%. In the beginning of this month, Bitcoin worth had staged a short restoration nevertheless it was met with promoting stress.

After the coin began hovering close to the $18,000 worth mark, this stage attracted consumers on the chart. Quickly after that, BTC moved up on its chart two weeks in the past. The technical outlook of the coin indicated that the bears hadn’t given up but.

The bulls may return to the chart if the coin broke previous its rapid resistance mark. Shopping for power was decrease on the chart, and solely a rise in shopping for power may transfer BTC upwards.

If the bulls handle to stay round over the following buying and selling periods, then BTC can transfer above the $20,000 worth mark. The prospect to rally close to the $22,000 worth stage can also’t be referred to as inconceivable as soon as the bulls clear the $20,000 stage.

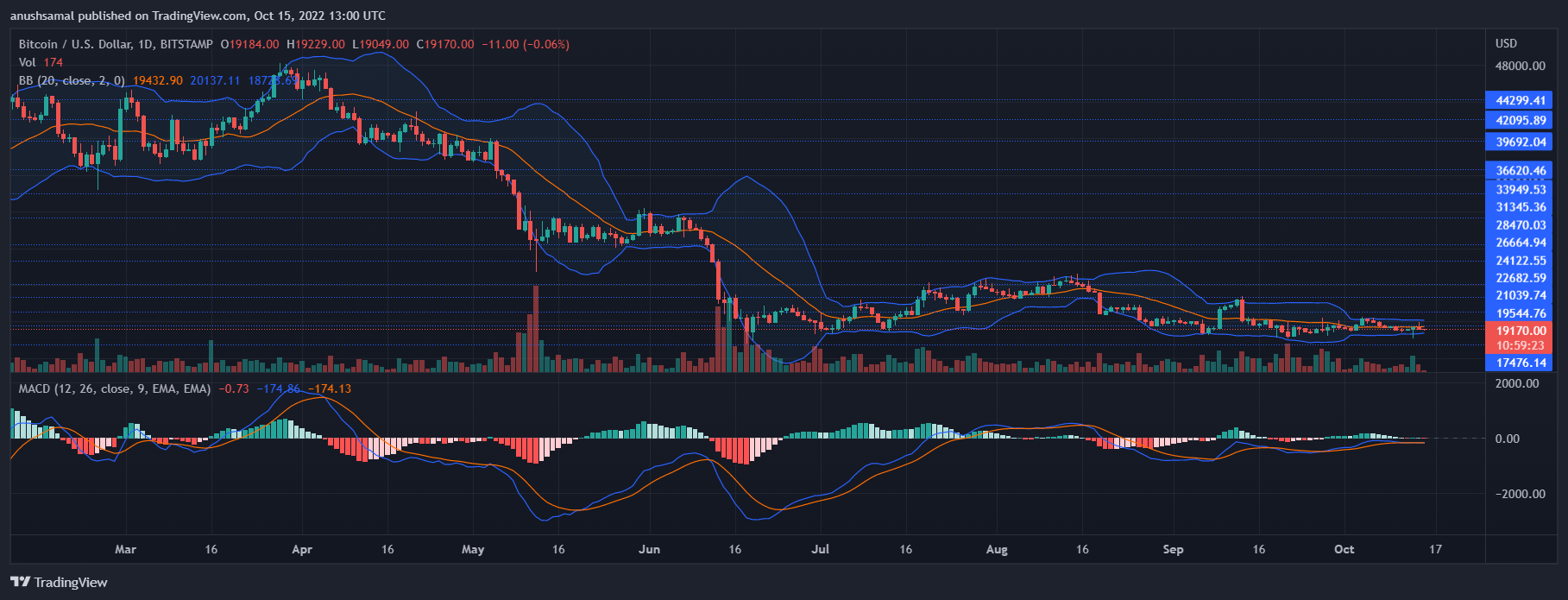

Bitcoin Worth Evaluation: One-Day Chart

BTC was buying and selling at $19,190 on the time of writing. The coin had witnessed important resistance on the $19,400 worth mark. Shifting previous that stage will assist the coin achieve momentum to maneuver close to the $21,000 resistance mark.

As soon as Bitcoin worth touches the $20,000 stage, the bulls may assist BTC rally additional. Then again, assist for BTC was at $18,000 and a fall from that will push the coin to $17,400. If consumers don’t resurface over the following buying and selling periods, a fall to the $18,000 worth zone seems to be doubtless.

Over the previous buying and selling periods, the quantity of Bitcoin traded dropped, indicating a slowdown in shopping for stress.

Technical Evaluation

The coin depicted that because it struggled to maneuver above the rapid resistance, consumers began to lose confidence and sellers took over. The Relative Power Index was parked beneath the half-line, which meant that purchasing power remained low on the chart.

If consumers decide up the tempo, then Bitcoin can problem its subsequent worth resistance stage. In accordance with the identical studying, the worth of the asset was beneath the 20-SMA line and that was a sign that sellers have been driving the worth momentum available in the market on the time of writing.

On the time of writing, BTC was being dominated by the sellers The coin began to show a promote sign, indicating that it may very well be doable for the worth to drop additional.

Shifting Common Convergence Divergence exhibits the worth’s momentum and path, MACD underwent a bearish crossover and began to indicate tiny crimson histograms, which have been promote sign.

Bollinger Bands depict the volatility of the asset. The bands had fully narrowed, which is a sign of explosive incoming worth motion.

[ad_2]

Source link