[ad_1]

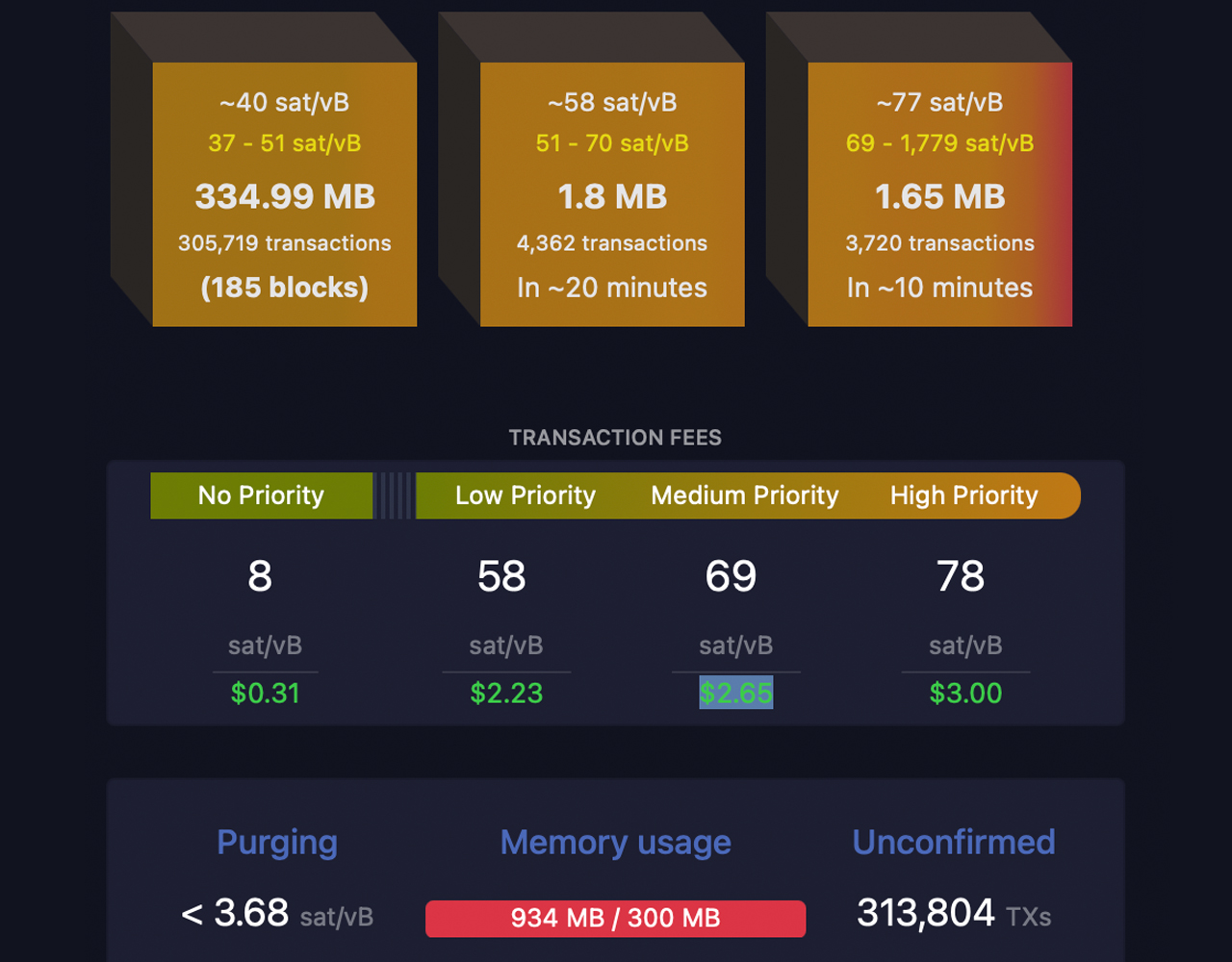

On Might 7, 2023, the Bitcoin community was plagued with an awesome 500,000 unconfirmed transactions, inflicting a serious bottleneck within the system. Nevertheless, the excellent news is that the congestion has been clearing, leading to a major discount in onchain charges, which have now dropped under $5. As of now, there are solely barely over 300,000 unconfirmed transactions awaiting affirmation, and 185 blocks have to be mined to clear the backlog.

Bitcoin Backlog Begins to Regularly Subside

Bitcoin has been the discuss of the city currently, because it grapples with the problem of assembly the demand for block house. Simply 4 days in the past, the mempool, which is the queue of unconfirmed bitcoin transactions, hit an all-time excessive, with over 500,000 unconfirmed transfers ready to be processed.

This surge in demand will be attributed to the current craze for Ordinal inscription, in addition to the emergence of the BRC20 token financial system. As of seven:00 a.m. Jap Time on Might 11, 2023, there are simply over 300,000 unconfirmed transactions ready for affirmation. To clear the present transaction queue, roughly 185 blocks have to be mined.

The excellent news is that the backlog is progressively clearing, leading to a major drop in onchain charges. Only a few days in the past, on Might 8, the common transaction charge skyrocketed to $31 per switch. Nevertheless, as of at this time, a high-priority transaction at 7:00 a.m. (ET) was a mere $3.00.

The drop from $31 to $3 per transaction represents a discount of over 90%. As well as, current statistics reveal {that a} low-priority transaction prices simply $2.23, whereas a medium-priority switch is priced at $2.65 per transaction. As of now, the block instances have been averaging under the ten-minute mark, with a mean of eight minutes and 28 seconds and 9 minutes and 57 seconds.

The worldwide hashrate is holding regular at 342 exahash per second (EH/s), and present estimates recommend that the issue could enhance on Might 18, in seven days. The projected problem rise is anticipated to be round 0.1% to 1.94%.

What are your ideas on the current developments within the Bitcoin community? Share your insights and opinions within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link