[ad_1]

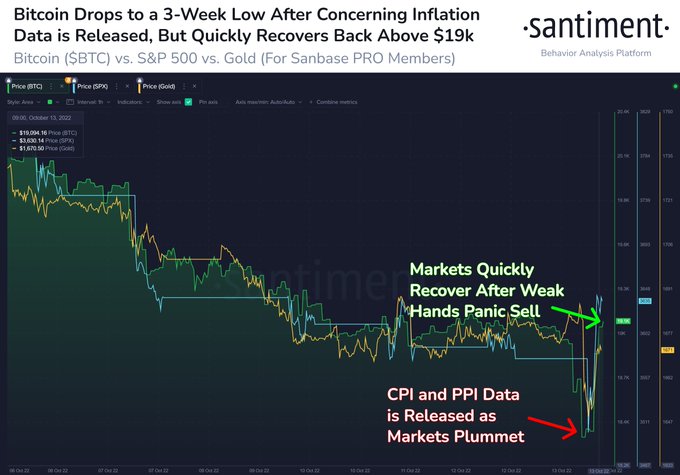

Bitcoin (BTC) has gained momentum to surge previous $19K after dropping to lows of $18.3K after the U.S. inflation information was launched on October 13.

Market analyst Ali Martinez believes the main cryptocurrency ought to keep above $19,200 to scale back promoting strain as a result of it is a vital degree. He identified:

“Roughly 2.5 million addresses purchased practically 1.5 million BTC at $19,200. The longer Bitcoin continues buying and selling beneath $19,000, the upper the strain these traders will really feel to exit their lengthy BTC positions to chop losses brief. Consequently accelerating the downward strain.”

America Bureau of Labor Statistics (BLS) printed the newest inflation figures with the Shopper Worth Index (CPI) for all city shoppers rising by 0.4% in September, Blockchain.Information reported.

Because of this, a broad market response emerged, sending shivers down the crypto market, with Bitcoin dropping to lows of $18,319.

Crypto perception supplier Santiment acknowledged:

“Thursday has been an expectedly unstable day after inflation information was launched. Bitcoin dropped to $18.3k, its lowest value degree since September twenty first. Nevertheless, as merchants had been within the midst of stopping the bleeding, BTC & the SP500 quickly recovered.”

Supply: Santiment

Though Bitcoin’s social dominance has dropped primarily based on the back-and-forth skilled available in the market, the main cryptocurrency was up by 3.38% within the final 24 hours to hit $19,623 throughout intraday buying and selling, in keeping with CoinMarketCap.

Since some merchants have been eyeing short-term pumps, this has additionally brought about BTC’s social dominance to lower. Santiment defined:

“Merchants are chasing short-term pumps proper now to salvage losses. Weak palms dropped out of crypto in 2022, & long-term merchants are ready for Bitcoin to start receiving the highlight once more. When BTC social dominance is excessive, costs usually rise.”

Supply: Santiment

The U.S. Federal System has resorted to rate of interest hikes to tame runaway inflation, which has been detrimental to the crypto market. With the newest CPI information being increased than anticipated, it stays to be seen what transfer the Fed will take subsequent month.

Picture supply: Shutterstock

[ad_2]

Source link