[ad_1]

Bitcoin miners are coping with a lot of strain following the latest problem adjustment enhance on Nov. 20, 2022, and the main crypto asset dropping additional in worth in opposition to the U.S. greenback following FTX’s collapse. Statistics recorded this previous weekend present that bitcoin’s common price of manufacturing has been rather a lot larger than bitcoin’s USD worth recorded on spot market exchanges.

Statistics Present Bitcoin’s Price of Manufacturing Is a Lot Larger Than the Main Crypto Asset’s USD Worth

On Sunday, Bitcoin.com reported on Bitcoin’s problem rising by 0.51% at block top 764,064, and the rise pushed the issue to an all-time excessive at 36.95 trillion. After that problem transition, information exhibits the general world hashrate dropped from 317 exahash per second (EH/s) to 233 EH/s.

The hashrate is at the moment coasting alongside at 250.59 EH/s, in response to data from coinwarz.com. On the similar time, BTC’s fiat worth dropped an important deal after FTX collapsed and filed for chapter safety.

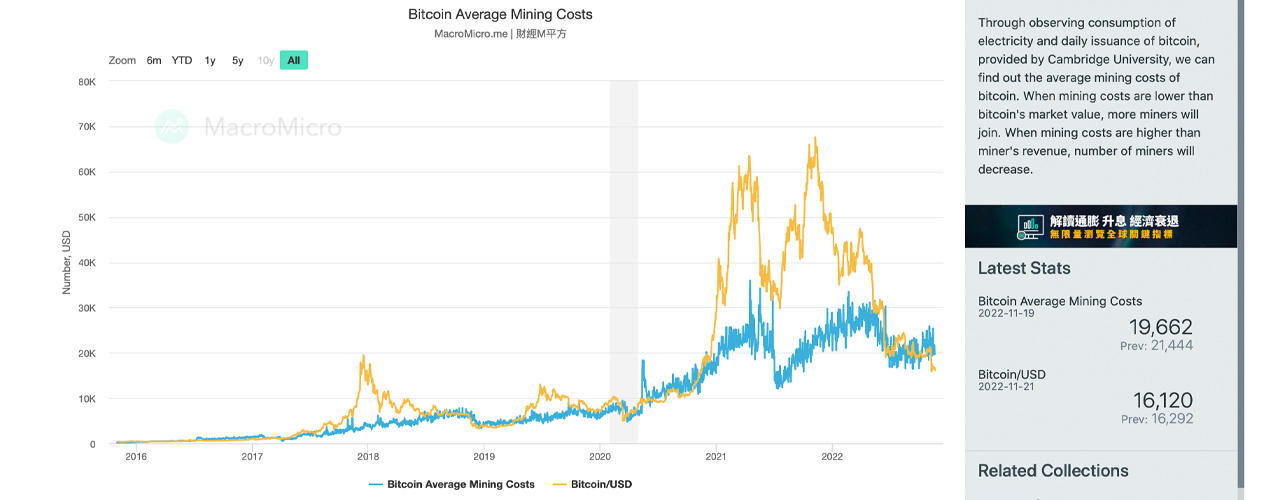

Statistics on Nov. 21, 2022, present that the price of bitcoin manufacturing is far larger than BTC’s present USD spot market worth. The metrics recorded by macromicro.me point out that the common mining price is $19,662 as we speak, whereas the USD worth of BTC is recorded at 16,120 nominal U.S. {dollars} per unit.

The macromicro.me statistics point out that bitcoin’s worth compared to the price of BTC manufacturing has been decrease since Oct. 6, 2022. Macromicro.me says that the net portal makes use of information collected from Cambridge College so as to “discover out the common mining prices of bitcoin.”

“When mining prices are decrease than bitcoin’s market worth, extra miners will be part of,” the macromicro.me web site particulars. “When mining prices are larger than miner’s income, [the] variety of miners will lower.”

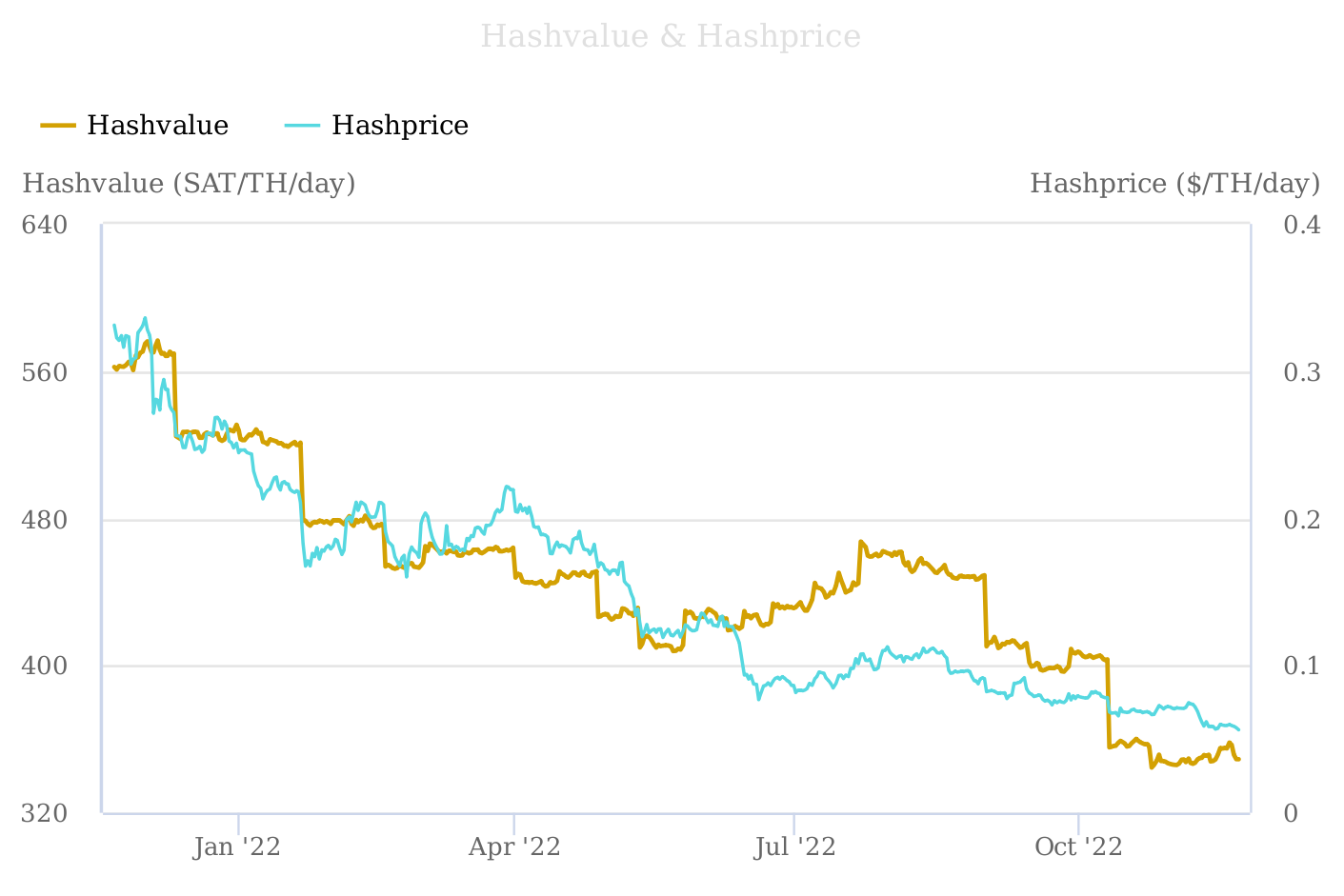

Along with the metrics showcased on macromicro.me, Glassnode’s hash worth chart signifies that the hash worth is at an all-time low. The chart highlights a “metric for estimating day by day miner incomes, relative to their estimated contribution to community hash-power,” Glassnode’s description notes.

Analytics from braiins.com additionally point out that the present hash worth is decrease than the present hash worth. Much like macromicro.me’s stats, braiins.com metrics present the change occurred round Oct. 6, 2022. If bitcoin costs don’t enhance or in the event that they drop decrease, plenty of BTC Mining operations will face a squeeze out of the trade if they aren’t going through this case already.

What do you concentrate on bitcoin’s spot market worth dropping under the crypto asset’s price of manufacturing? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link