Bitcoin is perhaps returning to the underside of its present vary; trapped for months, BTC is perhaps unable to push larger. Pushed by macroeconomic forces and uncertainty, the sideways value motion has decreased volatility throughout international monetary property.

On the time of writing, Bitcoin (BTC) trades at $19,400 with sideways motion throughout all timeframes. Earlier at the moment, the cryptocurrency hinted at extra good points, however bulls have been unable to maintain momentum, surrendering BTC’s earnings from final week.

Bitcoin Goes Quiet, Macro Forces Take The Wheel

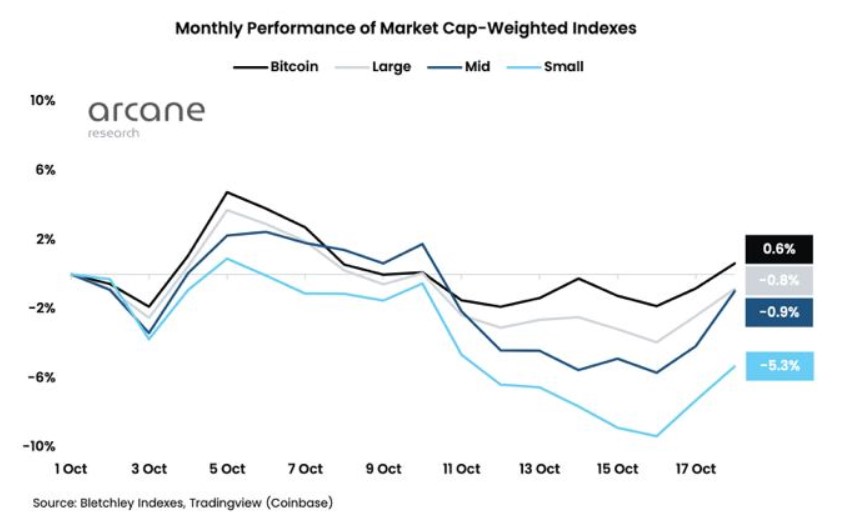

In response to Arcane Analysis, Bitcoin has seen no clear path in October. The cryptocurrency has been the best-performing asset by way of property shifting sideways over this era.

The chart beneath exhibits that the benchmark cryptocurrency recorded a 0.6% revenue over the previous 30 days, whereas different crypto property trended barely to the draw back. Smaller tokens had been the worst performers, with a 5% loss in October.

Smaller cryptocurrencies usually endure probably the most in a uneven and unsure market; buyers normally take shelter in Bitcoin and stablecoins, measured by the BTC Dominance and the USDT Dominance. These metrics have been trending upward after seeing a large decline in mid-October.

The spike in stablecoin and BTC dominance trace at extra sideways value motion because the crypto market enters one other stage of uncertainty till the following macroeconomic occasion triggers an explosion in volatility. Arcane Analysis famous the next on BTC’s present value motion:

Nonetheless no clear development in October, because the crypto market stays flat. Bitcoin and ether are gaining market shares relative to the opposite massive caps this week, whereas small caps are struggling (…). The crypto market remains to be extremely aligned with the inventory market this month. Each Bitcoin and Nasdaq are up 1% in October, with the correlation staying at document highs.

What Occurs When BTC Goes Quiet?

Further knowledge from analysis agency Santiment signifies that Bitcoin whales is perhaps accumulating BTC at its present ranges. The cryptocurrency is shifting close to its 2017 all-time excessive. Traditionally, these ranges have supplied long-term buyers the most effective alternative to extend their holdings.

As BTC’s value developments sideways, Bitcoin addresses holding between 10,000 to 100,000 BTC reached their highest degree since February 2021. At the moment, the cryptocurrency was getting ready to re-enter value discovery mode following a serious bull run that took it from beneath $20,000 into the low $30,000.

The analysis agency famous:

(…) addresses holding 10 to 100 $BTC have reached their highest quantity of respective addresses since Feb, 2021. Because the variety of addresses on a community rise, utility ought to comply with go well with.

Regardless of this knowledge, the present macroeconomic situations is perhaps unfavorable for a Bitcoin rally main the cryptocurrency into lengthy intervals of accumulation and consolidation across the 2017 ATH and its yearly low of $17,600.