[ad_1]

Bitcoin costs cratered on July 4 earlier than plunging some extra a day later. Nevertheless, by the shut of Friday, the bar ended up with an extended decrease wick, with demand spilling over the weekend. As BTC costs stabilize, there could also be hints that the downtrend is over, however not in response to this analyst.

Bitcoin Stays Underneath Immense Promoting Stress: Right here’s Why

Citing on-chain information, the analyst mentioned the downtrend stays, and sellers have the higher hand. Pointing to the Bitcoin MVRV Momentum indicator, the dealer famous that the studying is in unfavorable territory for the primary time in over 16 months.

The final time this occurred was in March 2023. Though costs recovered a number of months after plateauing all through early Q3 2023 earlier than the lift-off in This fall 2024, whether or not the present formation will comply with this script stays to be seen.

The Bitcoin MVRV Momentum indicator is a technical device. It derives its information from on-chain readings, evaluating the market worth to the realized worth of BTC. These two readings are sometimes used to gauge general market sentiment.

When the indicator tendencies above the 1-year transferring common, Bitcoin costs are inclined to float greater. The chart reveals that when costs have been ripping greater, blasting above $70,000 to as excessive as $73,800, the indicator was agency above the transferring common.

The indicator is beneath the transferring common at press time, suggesting weak spot throughout the board. If this pattern continues, it might imply that the market is swinging bearish after overheating within the first half of the 12 months.

Nonetheless, studying from the chart and particularly contemplating the restoration in March 2023 when the identical situation was printed, buyers are going through a dilemma. The indicator suggests market weak spot, permitting consumers to double down.

On the identical time, the breakout from the 12-month transferring common may imply that bears are getting began, and extra losses may very well be within the offing.

Ought to BTC Merchants Be Affected person?

The state of affairs means merchants must be affected person and verify the market totally. Up to now, when BTC costs plunged final week, they’ve grow to be extra enticing to promote, fanning the downward momentum.

This, in flip, introduced a possibility for consumers to purchase again at a reduction, forcing a brief squeeze and liquidating leverage sellers within the course of.

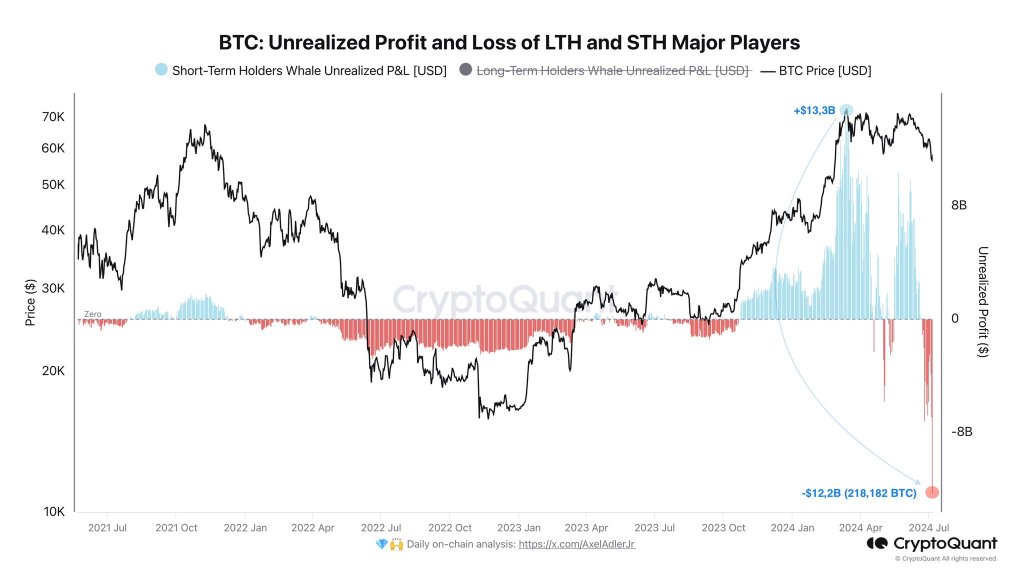

Whether or not leverage merchants will capitulate and exit after beneficial properties within the final 48 hours stays to be identified. Even so, one on-chain analyst notes that unrealized losses held by short-term holders (STHs) stay excessive. If costs drop and STHs panic by promoting, it may set off a speedy value collapse.

Function picture from Canva, chart from TradingView

[ad_2]

Source link