[ad_1]

The most important information within the cryptosphere for Oct. 10 contains Google’s new partnership with Coinbase to begin accepting crypto funds, Bittrex’s $30 million nice for violating federal sanctions, and the SEC’s rejection of WisdomTree’s Spot Bitcoin ETF for not having sufficient surveillance.

CryptoSlate Prime Tales

Google to combine crypto funds with cloud companies from 2023 through Coinbase partnership

Google and Coinbase are collaborating to launch a crypto funds answer. Upon the announcement, COIN shares recorded a spike of 6%.

The duo will permit Google cloud companies customers to pay through cryptocurrencies supported in Coinbase. Google will even retailer its crypto holdings utilizing Coinbase Prime.

Bittrex to pay $30M for sanctions violation

Crypto alternate platform Bittrex was fined $30 million by the U.S. Treasury Division’s Workplace of International Belongings (OFAC) and the Monetary Crimes Enforcement Community (FinCEN) for violating federal sanctions.

Bittrex allowed round 1,800 people from sanctioned areas like Iran, Crimea, and Syria to conduct crypto transactions on its platform between 2014 and early 2017. The alternate agreed to pay the nice and make obligatory changes to adjust to the sanctions.

SEC rejects WisdomTree’s Spot Bitcoin ETF

The U.S. Securities and Trade Fee (SEC) rejected the Knowledge Tree Bitcoin (BTC) Belief ETF for not providing a sound measure that would defend buyers in opposition to market manipulation.

The SEC stated that given the extremely unregulated nature of the crypto market, the surveillance was essential earlier than approving any spot Bitcoin-ETF.

Temple DAO hacked for over $2.3M

Temple DAO was hacked on Oct. 11 and misplaced 1,831 Ethereum (ETH), equating to over $2.3 million. The mission crew provided a bounty on the hacker’s head and shut down the dApp to forestall unintentional utilization.

#PeckShieldAlert Looks as if @templedao acquired exploited. The exploiter funded from SimpleSwap and already transferred 1,831 $ETH (~$2.34M) to a brand new deal with 0x2B63d…B5A0 @peckshield https://t.co/bOyOARyyxY pic.twitter.com/SVEm8o95U6

— PeckShieldAlert (@PeckShieldAlert) October 11, 2022

Coffeezilla calls out Celsius founder Alex Mashinsky for dumping CEL tokens

Crypto sleuth Coffeezilla blamed Celsius (CEL) founder Alex Mashinsky for allegedly dumping over 10,000 CEL tokens through the early hours of Oct. 11.

Coffeezilla printed his accusations on his Twitter account as a thread. Mashinsky’s pockets deal with was later recognized by Nansen, which revealed that round 10,000 CEL tokens had been certainly swapped for about $9300 USD Cash(USDC).

BNY Mellon receives New York approval for crypto custodial companies

Financial institution of New York Mellon (BNY Mellon) was permitted to supply digital belongings custody companies on Oct. 11. With that, BNY Mellon clients will be capable to retailer keys to their belongings with the financial institution.

CNN’s NFT market shutdown sparks rug pull accusations

CNN’s NFT Market “Vault by CNN” introduced that it shut down. The platform was launched in the summertime of 2021 through the NFT increase, and its surprising shutdown sparked talks of a potential rug pull.

A spokesperson from CNN responded to the group’s considerations by saying that Vault by CNN holders can count on to be compensated with roughly 20% of the distributions primarily based on the NFTs of their wallets.

Analysis Spotlight

Liquidations anticipated as Bitcoin open curiosity, leverage ratio spike greater

Given the state of the fiat market and Bitcoin’s comparatively flat value actions, which remained between $18,400 and $22,800 over the previous months, Bitcoin could be giving alerts of decoupling from legacy markets.

CrytpoSlate analysts examined three completely different indicators; Bitcoin Futures Estimated Leverage Ratio (ELR), Futures Open Curiosity, and Futures Perpetual Funding Charges (FPFR) to find that the crypto market is considerably sizzling and overleveraged to the upside.

That is an indicator for the upcoming widespread liquidations interval, which could decline the asset costs led by Bitcoin.

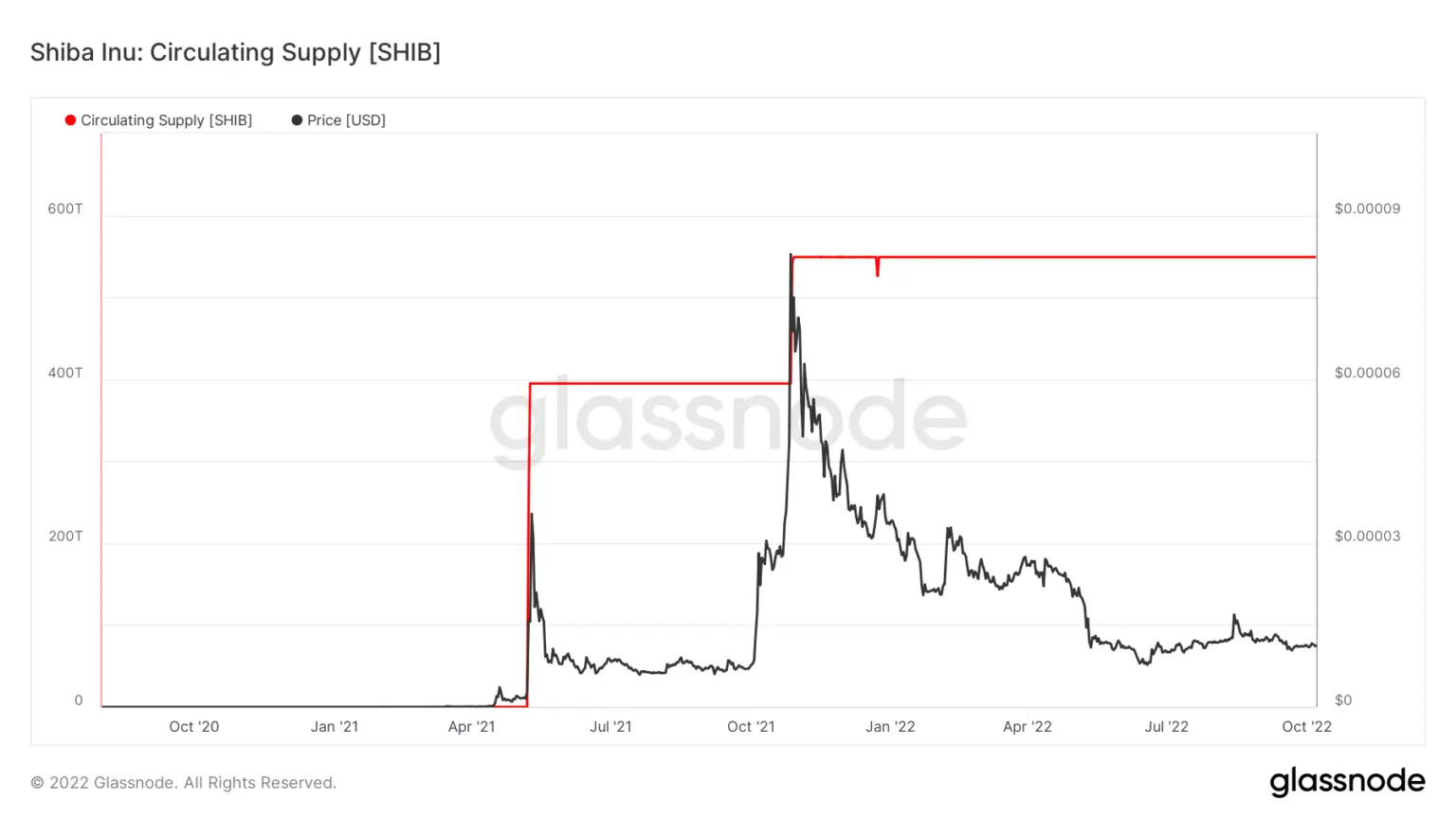

Analysis: What precisely occurred in 2021 for Shiba Inu?

Shiba Inu (SHIB) soared by way of 2021, solely to maintain falling in 2022. CryptoSlate analysts recognized a distinction within the quantity of SHIB held by exchanges in each main SHIB unlocks.

SHIB was launched for the primary time in April/Could, which soared the value and the quantity of SHIB tokens held on exchanges. The second main unlock befell in October/November and recorded a brand new value ATH. Nonetheless, SHIB tokens held by exchanges decreased drastically.

SHIB value solely continued to fall from that time on. Based on CryptoSlate information, SHIB fell by 58.32% within the final three hundred and sixty five days, and the present value lingers round $0.000011, which is 88% decrease than its ATH.

Information from across the Cryptoverse

YugaLabs faces SEC probe for unregistered choices

Bored Ape creators, Yuga Labs is going through an investigation from the SEC, based on Bloomberg. The fee is analyzing the legality of Yuga Labs’ high-value NFT gross sales.

Crypto Market

Bitcoin (BTC) decreased by 1.19% within the final 24 hours to be traded at $19,003, whereas Ethereum (ETH) additionally fell by 2.02% to commerce at $1,282.

Greatest Gainers (24h)

Greatest Losers (24h)

[ad_2]

Source link