[ad_1]

On-chain information exhibits Bitcoin traders have been withdrawing massive quantities from exchanges as mistrust round them has grown not too long ago.

FTX Debacle Leads To Extra Bitcoin Traders Distrusting Exchanges

As identified by an analyst in a CryptoQuant publish, traders who’ve change into afraid to carry on exchanges are sending their BTC to private wallets.

There are a few related indicators right here; the primary is the “Lively Receiving Addresses,” which tells us the overall variety of pockets addresses that have been energetic as receivers throughout a selected time frame.

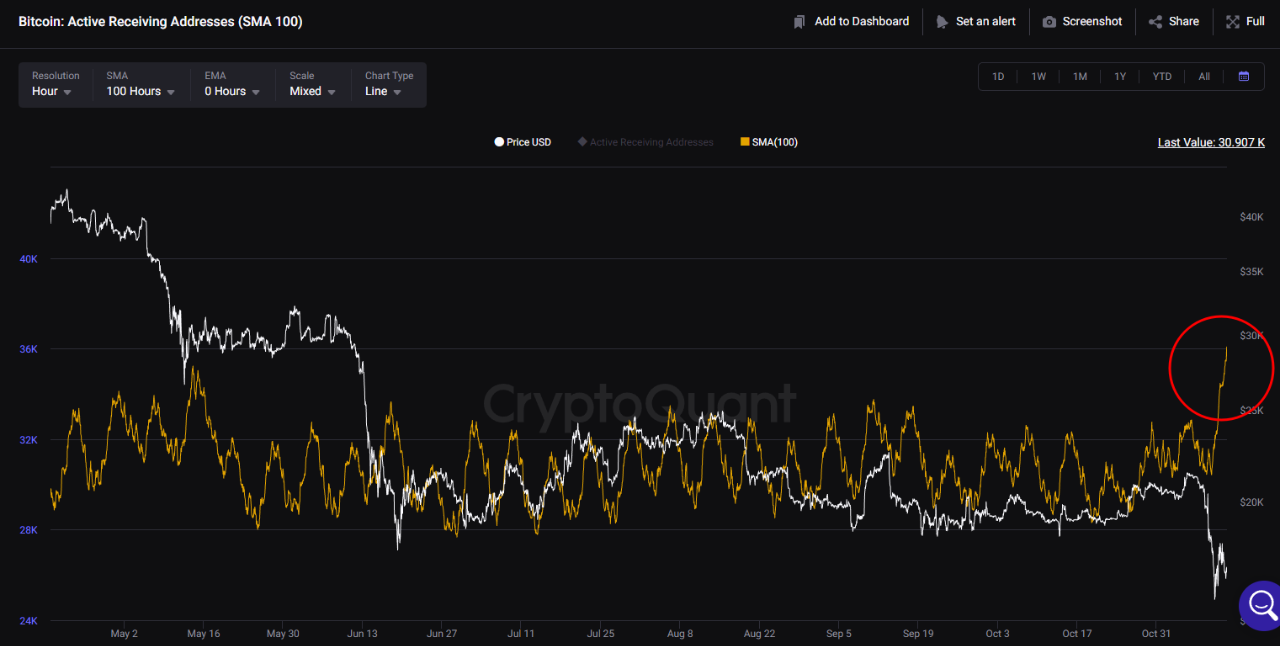

The beneath chart exhibits the pattern within the 100-day easy transferring common worth of this Bitcoin indicator during the last six months:

The 100-day SMA worth of the metric appears to have spiked up in current days | Supply: CryptoQuant

As you possibly can see within the above graph, the worth of the Bitcoin Lively Receiving Addresses has been very excessive in the previous few days.

Which means that traders have been sending cash to numerous particular person wallets for the reason that crash because of the FTX debacle.

The opposite indicator of curiosity is the “all exchanges reserve,” which measures the overall quantity of BTC presently sitting within the wallets of all centralized exchanges.

Here’s a chart that exhibits the pattern on this Bitcoin metric:

Seems to be like the worth of the metric has been happening not too long ago | Supply: CryptoQuant

From the graph, it’s obvious that the Bitcoin trade reserves had been following an total downwards trajectory for greater than a yr now, however the metric has plunged particularly exhausting in current days.

This plummet within the indicator has additionally coincided with the collapse of FTX. Often, the trade reserves spike up throughout main crashes as traders switch their cash to exchanges for dumping.

The current pattern within the metric has clearly, nonetheless, not adopted this sample. The trade reserve happening, mixed with the truth that numerous wallets are energetic proper now, suggests particular person traders are taking the cash out to their private wallets.

This exhibits that the FTX disaster has as soon as once more made Bitcoin holders cautious about holding their cash within the custody of centralized exchanges, as they’re preferring to withdraw them to particular person wallets.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16.5k, down 20% within the final seven days. Over the previous month, the crypto has misplaced 15% in worth.

BTC has been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link