[ad_1]

On Sunday, the non-custodial market protocol Aave introduced that the Aave DAO has permitted a brand new stablecoin for the ecosystem referred to as “GHO.” Aave Firms proposed the stablecoin through the first week of July and the collateral-backed stablecoin will likely be pegged to the U.S. greenback’s worth.

A New collateral-Backed Stablecoin Crafted by Aave Firms Is As a result of Launch After the Aave DAO Votes on Genesis Parameters

Aave defined on Sunday that the Aave decentralized autonomous group (DAO) permitted a proposal to create a stablecoin token referred to as “GHO.” “The group has given the inexperienced gentle for GHO,” the official Aave Twitter account detailed. “The following step is voting on the genesis parameters of GHO, look out for a proposal subsequent week on the governance discussion board.”

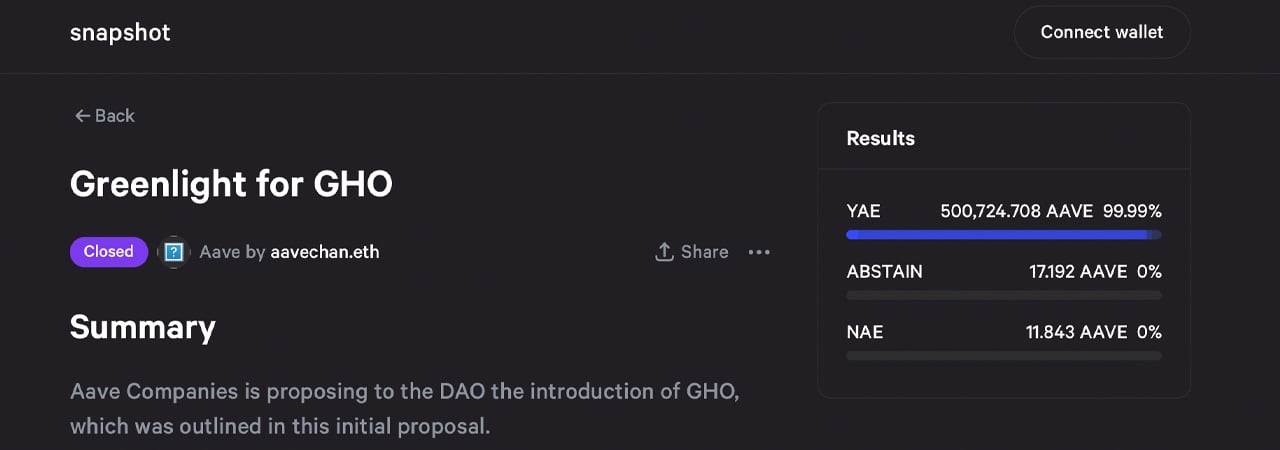

The GHO introductory weblog publish, printed on July 7, 2022, says the stablecoin will likely be “backed by a diversified set of crypto-assets chosen on the customers’ discretion, whereas debtors proceed incomes curiosity on their underlying collateral.” The governance proposal was permitted by an amazing majority of Aave DAO voters, as greater than 99% of voting contributors voted in favor of launching GHO.

The governance proposal’s approval snapshot says GHO will “present advantages for the group by way of the Aave DAO by sending 100% of curiosity funds on GHO borrows to the DAO” and GHO will likely be “administered by Aave governance.” Aave’s stablecoin will be a part of the stablecoin financial system, which is presently valued at $153 billion. Tether (USDT) leads the stablecoin pack and usd coin (USDC) follows behind USDT, when it comes to general market capitalization.

GHO will even be a part of stablecoin crypto belongings that leverage collateral belongings and a few that leverage the strategy of over-collateralization. Makerdao’s DAI stablecoin is over-collateralized and Tron’s USDD can be over-collateralized, which implies there’s extra collateral than essential to cowl the stablecoin’s backing throughout instances of utmost market volatility.

“As a decentralized stablecoin on the Ethereum mainnet, GHO will likely be created by customers (or debtors),” Aave Firms’ weblog publish concerning the topic explains. The weblog publish additional provides:

Correspondingly, when a person repays a borrow place (or is liquidated), the GHO protocol burns that person’s GHO. All of the curiosity funds accrued by minters of GHO could be instantly transferred to the Aave DAO treasury; fairly than the usual reserve issue collected when customers borrow different belongings.

Aave Firms Says Group Was Very Engaged With GHO Governance Proposal

Aave additionally has a local token which is ranked 45 out of greater than 13,000 crypto belongings as we speak. The digital asset has a market valuation of round $1.46 billion and aave (AAVE) has elevated 84.7% over the last month. The open supply decentralized lending protocol is the third largest decentralized finance (defi) protocol when it comes to whole worth locked. Information from defillama.com signifies that Aave has $6.59 billion locked on July 31. In mid-Might, Aave launched a Web3, smart-contracts-based social media platform referred to as the Lens Protocol. The Lens platform has greater than 50 purposes constructed on prime of the Polygon (MATIC) community.

So far as the GHO stablecoin is worried, Aave Firms mentioned that the group was “very engaged with the GHO proposal, offering extremely useful and informative suggestions.” Aave detailed among the issues talked about by the group the staff will give attention to which incorporates DAO-set rate of interest vulnerabilities, provide caps, a peg stability module, and the “necessity for correctly vetting potential facilitators.” For now, the group must take part in voting on the stablecoin’s genesis parameters earlier than the crypto token is issued.

What do you concentrate on the upcoming Aave stablecoin undertaking referred to as GHO? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link