[ad_1]

For the primary time since 2020, MakeDAO has crashed in its quarterly web earnings. The DAO is the autonomous group that governs the Maker Protocol. The mission is predicated on the Ethereum blockchain and helps the lending and borrowing of crypto property with out a third get together.

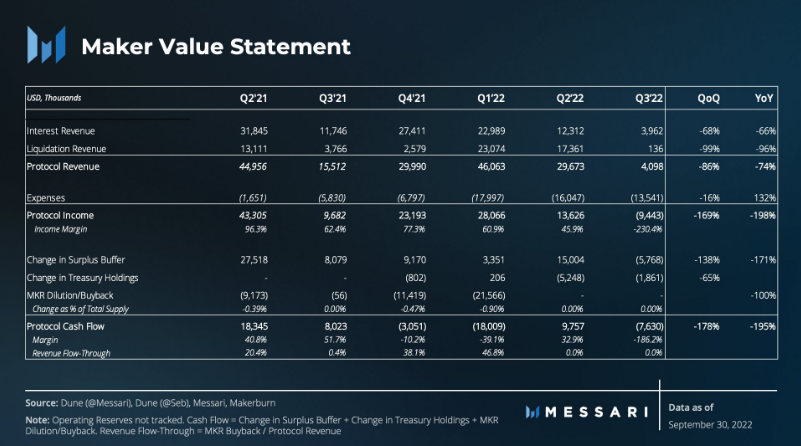

MakerDAO has simply witnessed a drastic drop in its 2022 third quarterly income. The decline in its earnings is linked to a plunge in mortgage demand and a few liquidations. Nevertheless, regardless of the pathetic scenario, the group has excessive bills inside the quarter beneath overview.

A Messari analyst and co-author of ‘The State of Maker Q3 2022’, Johnny_TVL, gave perception relating to the scenario. In his tweet, the analyst reported that the DAO skilled a income decline of over $4 million in Q3.

Additional, he famous that the worth dropped by 86% from the second quarter. Such a income loss for MakerDAO has been recorded in the neighborhood’s report within the first quarter of 2020.

Doable Causes For Income Decline

In keeping with the analyst, a couple of liquidations within the system spiked the income drop. Additionally, he talked about that weak mortgage demand is a contributory issue.

The analysis analyst highlighted Ether and Wrapped BTC as the largest earners of the protocol. Nevertheless, he famous that they carried out poorly within the third quarter. Whereas BTC-based property dropped by 66%, Ether-based ones plummeted by 74%.

Normally, debtors present different crypto property as collateral for DAI loans. Nevertheless, the analyst famous a fall within the collateral ratio of MakerDAO from 1.9 to 1.1 inside the similar interval final yr.

Additionally, there’s a consideration of the bills inside the quarter, which aren’t versatile. The report indicated greater prices in Q3, which reached $13.5 million, with only a dip of 16% from the final quarter.

Steps For MakerDAO Elevated Development And Growth

MakerDAO is placing in a couple of steps for the expansion and continued sustainability of the Maker Protocol. First, the DAO has centered on Actual World Asset (RWA) backed loans. Following its targets, it launched its largest RWA-backed mortgage to Huntingdon Valley Financial institution (HVB) in Q3 2022.

The collaboration with HVB is a win-win integration on each side. The financial institution leverages the mortgage to extend its authorized lending restrict to create extra enlargement alternatives. The MakerDAO believes that extra banks will observe after the graceful crusing of its partnership with HVB.

At the moment, RWA-backed loans characterize as much as 12% of the whole income for the Maker Protocol. The mortgage entails the creation of a vault with 100 million DAI tokens and includes a brand new collateral kind within the protocol. Additionally, it may yield extra income by vault stability charges from vault upkeep and DAI minting.

Moreover, the DAO has initiated steps to enhance its return on property held as collateral. For instance, it drew an funding proposal of about $500 million in treasuries and bonds. The purpose is to make sure the protocol will get extra yield related to low danger.

Featured picture from Pixabay and chart from TradingView.com

[ad_2]

Source link