[ad_1]

Although pumping at spot charges, Tron wasn’t spared the wrath of bears after peaking in February. Like different altcoins like Solana and Ethereum, whose costs soared to 2024 highs in March, Tron stays in pink within the final month of buying and selling and has but to beat current peaks.

As TRX and ETH try and unwind current losses, one thing else is occurring: In Tron and Ethereum, the demand for USDT, the world’s most dear stablecoin, is quickly falling.

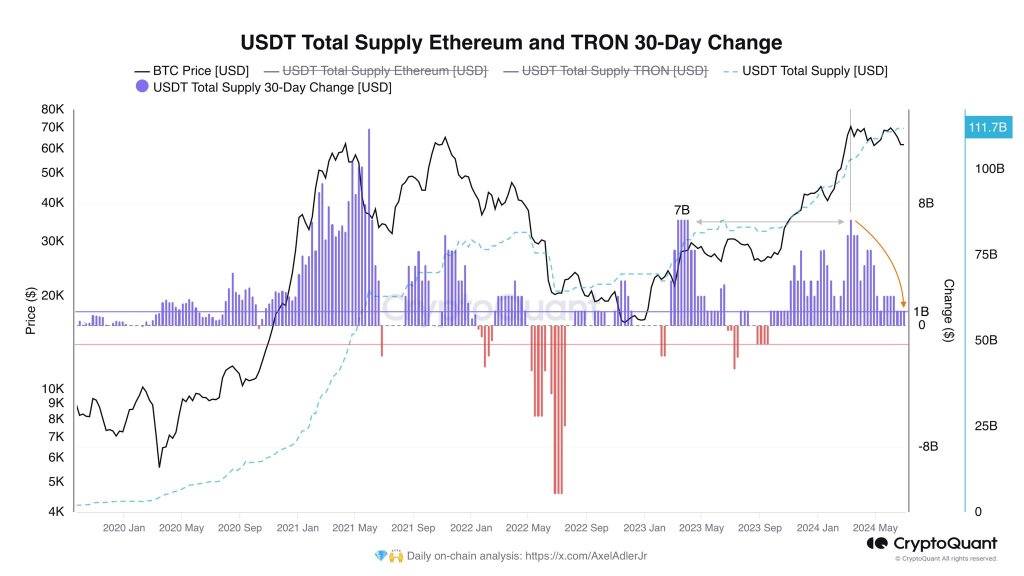

USDT Minting Exercise On Ethereum And Tron Falls From $7 To $1 Billion

One analyst on X famous that the decline in minting exercise, and thus, basic blockchain utilization in each networks, has seen USDT issuance fall from 7 billion to simply 1 billion as of early July.

This decline, which mirrors the worth contraction in June, factors to decreased buying and selling exercise and free-falling demand for cryptocurrencies throughout that interval.

Regardless of Ethereum being dominant, Tron is a most well-liked community for customers searching for to mint USDT. In contrast to the world’s first sensible contracts platform, Tron is scalable and low-cost to transact.

Progress has been made to scale Ethereum. The rise of greater than a dozen Ethereum layer-2 platforms like Base and Arbitrum helps to cement its place as the biggest ecosystem.

Associated Studying: Sony Enters Into Crypto With Acquisition Of Amber Japan

Though gasoline charges have been declining over the months, builders have been making good progress in making layer-2 transactions means cheaper through upgrades like Dencun.

Via this replace, customers who would in any other case mint tokens like meme cash or stablecoins on Tron can choose to take action on Ethereum layer-2 options like Arbitrum.

The drop in USDT minting throughout Ethereum and Tron means that demand for crypto is dropping. Normally, each time there may be bulk minting of USDT, Bitcoin and crypto costs are likely to rise.

Due to this fact, till USDT minting exercise resumes in these high sensible contracts platforms, the costs of Bitcoin and high altcoins will seemingly stay suppressed.

Tether Companions With Uquid, Stops Minting On EOS and Algorand

On July 1, Tether joined palms with Uquid to reinforce funds within the Philippines utilizing the TON blockchain. The purpose is to modernize cost processes for Southeast Asia’s government-run Social Safety System. Past this, the target is to make funds safer, quicker, and environment friendly.

At the same time as Tether, the issuer of USDT, strikes extra partnerships, it additionally introduced the termination of USDT minting on Algorand and EOS networks. USDT redemptions will, nonetheless, proceed for the following yr.

Although EOS and Algorand are out, USDT could be minted on over ten platforms. CoinMarketCap says over $110 billion of the token has been cumulatively minted.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link