[ad_1]

A lot of Bored Apes Yacht Membership NFTs are approaching liquidation on the lending platform BendDAO, can this cascade right into a crash of the complete non-fungible token market?

Bored Apes NFTs At Danger Of Liquidation As Flooring Costs Drop Extra Than 50% Since All-Time Excessive

BendDAO is a platform that lends out Ethereum loans to customers towards NFT collaterals. Usually, customers can avail as much as 30-40% of the ground worth of the non-fungible token they’re placing up on the platform.

Nevertheless, if the ground worth of the digital collectible in query drops to a sure degree, the platform forcibly places the token up for public sale.

This liquidation degree is decided by the “well being issue” of the NFT-backed mortgage. When the worth of this metric drops under 1, the token robotically enters right into a 48-hour liquidation safety state the place the proprietor can select to repay the debt and reclaim the token.

If the consumer fails to clear the mortgage, the non-fungible token is auctioned away, and the best bidder will get to say it.

Now, what’s happening with Bored Apes is that many BAYC holders have borrowed ETH utilizing the BendDAO lending service, and a major variety of these customers are at a danger of liquidation presently as the ground costs of the gathering has been happening in latest weeks.

Because the BendDAO well being issue alert record exhibits, a considerable amount of BAYC-backed money owed are very close to to going under the 1 threshold:

Seems like many of those tokens are close to to being locked into the 48-hour interval | Supply: BendDAO

An analyst on Twitter has advised {that a} potential consequence of those BAYC liquidations is usually a crash of the complete NFT market.

When these Bored Apes loans with well being issue values near 1 begin going below, the ensuing liquidations will drive the ground costs even decrease. This may imply extra BAYC-backed money owed can be pulled down into liquidation.

On this means, the liquidations can cascade collectively and harm the complete Bored Apes Yacht Membership ecosystem.

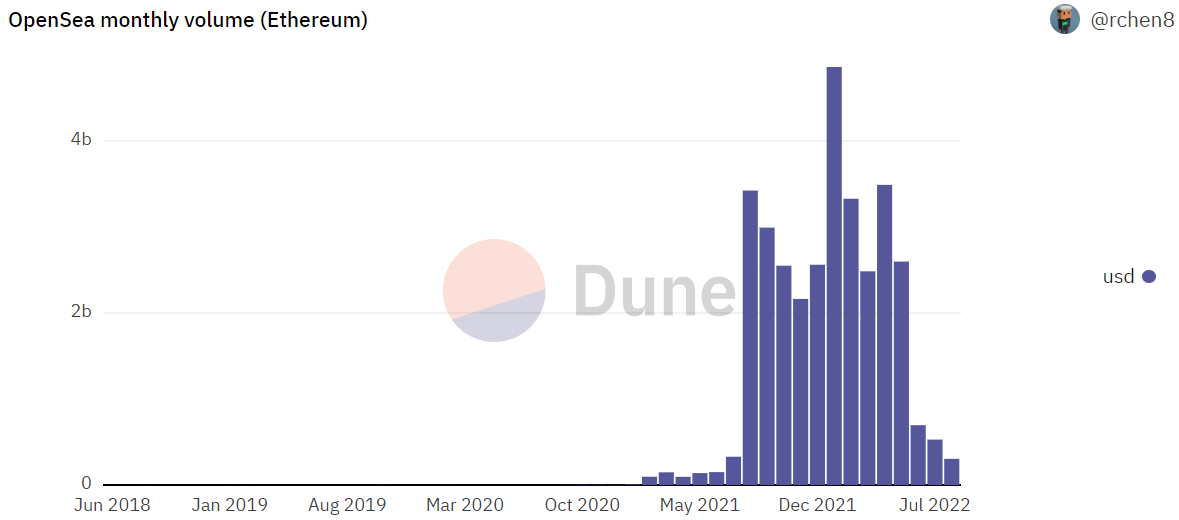

Because the analyst factors out, the month-to-month quantity on OpenSea, the preferred market for non-fungible tokens, has been at a 12 month low lately:

The amount in Ethereum has been fairly low on the OpenSea platform in latest days | Supply: Dune

This quantity is low sufficient that the complete NFT market might really feel a cascading impact by these giant liquidations of the Bored Apes loans on BenderDAO.

BTC Value

On the time of writing, Bitcoin’s worth floats round $21.4k, down 12% previously week.

The worth of BTC has plunged down | Supply: BTCUSD on TradingView

Featured picture from Markus Spiske on Unsplash.com, charts from TradingView.com, Dune.com

[ad_2]

Source link