[ad_1]

Bitcoin’s worth towards the U.S. greenback misplaced 7.3% over the past 24 hours after greater than $600 million in worth was faraway from the $1.07 trillion crypto economic system. Statistics present that quite a few bitcoin miners capitulated over the past two weeks, promoting 5,925 bitcoin value thousands and thousands, in response to cryptoquant.com knowledge.

Extra Than 6,100 Bitcoin Offered Because the First of the Month, Following a Temporary Miner Capitulation Pause

Bitcoin’s U.S. greenback worth slid from $23,593 per unit to $21,268 per coin at 8:30 a.m. (EST) on Friday morning. Greater than $600 million has been erased from the crypto economic system over the past day as BTC misplaced 7.3% and ETH shed 7.4%. Quite a lot of different cash misplaced worth towards the U.S. greenback in addition to BNB dipped by 5%, XRP slipped by 9%, and ADA misplaced 10.3% throughout the previous 24 hours.

In keeping with knowledge stemming from cryptoquant.com shared by Ali Martinez bitcoin miners capitulated over the past 14 days. “Bitcoin miners seem to have taken benefit of the latest upswing to ebook income,” Martinez stated. “Information exhibits that miners bought 5,925 BTC within the final two weeks, value roughly $142 million.”

Following Martinez’s tweet, cryptoquant.com knowledge exhibits greater than 6,100 BTC have been bought for the reason that first of August. The online portal’s Miners’ Place Index says bitcoin miners are “reasonably promoting” bitcoin. Utilizing immediately’s crypto market values, 6,100 BTC equates to $130.80 million, a a lot decrease worth than Martinez’s quote worth.

Miners took a break from promoting BTC after a flurry of mined bitcoin was bought throughout the two months previous to August 1, 2022. A Blockware Intelligence Publication revealed on July 29 defined that the top of miner capitulation was close to. “In keeping with the hash ribbon metric, Bitcoin is 52 days right into a miner capitulation,” the Blockware publication stated. Blockware’s report added:

The top of a miner capitulation traditionally marks a bear market backside.

In the course of the first two weeks of August, it appeared as if miner capitulation was over and BTC managed to faucet $25,212 per unit on August 14. BTC has misplaced 14.58% for the reason that August 14 excessive and it’s presently down 69% from the $69,044 per unit worth recorded on November 10, 2021. This previous week Bitcoin’s mining problem rose by 0.63% making it harder for miners to find BTC blocks and with costs decrease, mining bitcoin is much less worthwhile immediately than it was 5 days in the past.

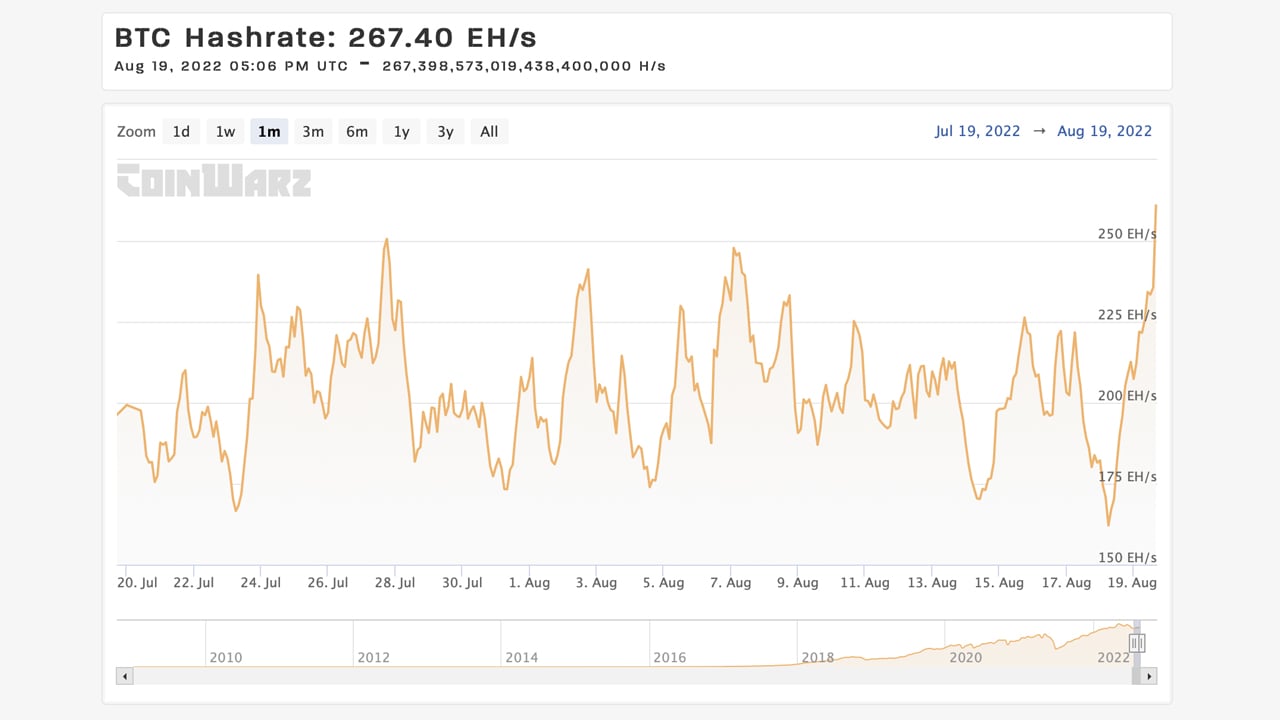

Bitcoin Hashrate Skyrockets by 46% In the course of the Previous 24 Hours Following the Current Problem Improve

Regardless of the issue rise, after coasting alongside underneath the 200 exahash per second (EH/s) zone at 182.40 EH/s the day prior on August 18, 2022, BTC’s hashrate has skyrocketed to 267.40 EH/s. That’s a 24-hour improve of round 46.60% increased than the 182 EH/s recorded on Thursday afternoon (EST).

Utilizing the present problem parameter, BTC’s present market worth and a price of round $0.12 per kilowatt hour (kWh), a Bitmain Antminer S19 XP with 140 terahash per second (TH/s) can get an estimated $4.85 per day in revenue. The Microbt Whatsminer M50S launched in July with 126 TH/s can get an estimated $2.74 per day in revenue, in response to present market statistics.

What do you concentrate on miners promoting 5,925 bitcoin over the past two weeks? Do you assume miner capitulation is over or will proceed? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link