[ad_1]

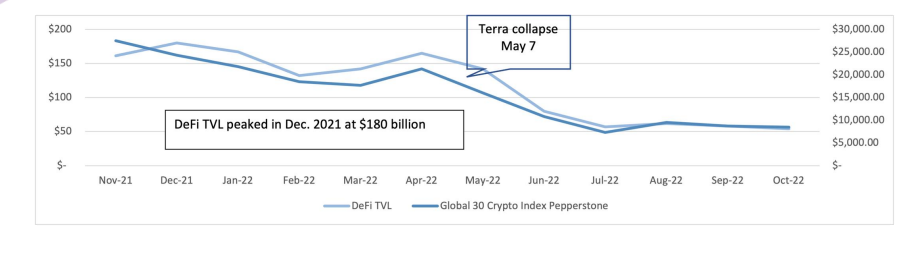

Regardless of the market circumstances that prevailed in a lot of 2022, decentralized finance (defi) nonetheless demonstrated its larger scaling potential than that of the standard monetary trade, a brand new report has stated. Though the entire worth locked dropped from the height of $180 billion in Dec. 2021, to simply over $50 billion by finish of Oct. 2022, sure sectors of the defi market nonetheless “present a really optimistic development.”

Decline in Whole Worth Locked

In keeping with Hashkey Capital’s end-of-year report, decentralized finance (defi) has the “potential to be many occasions extra scalable than the standard monetary trade.” Along with the scaling potential, defi protocols are resilient and are more likely to emerge from black swan occasions such because the Terra luna/UST collapse unscathed, the report recommended.

Nonetheless, within the report titled Defi Ecosystem Panorama Report, Hashkey Capital — an end-to-end digital asset monetary companies group — acknowledged that unfavorable market circumstances that largely prevailed in 2022 had contributed to the decline within the worth of whole property beneath administration.

“The decline of the TVL – Whole Worth Locked (a proxy for whole property beneath administration in Defi) – was additionally motivated by the final market circumstances. Decrease crypto costs (because of typically unfavourable macro) imply that the worth of the collaterals offered in Defi lending can be decrease, decreasing the motivation to get a mortgage in opposition to these collaterals. DEX [decentralized exchange] exercise and crypto buying and selling volumes are additionally decrease,” the report stated.

As proven by the report’s information, the TVL, which peaked at $180 billion in Dec. 2021, dropped from just below the $150 billion seen round Could 2022, to simply over $50 billion in late October. Regardless of this TVL decline, in keeping with the report, sure sectors of the defi market nonetheless “present a really optimistic development.”

Defi Development Slowdown

In regards to the extent of adoption, the report acknowledges that there was a slowdown within the development fee in 2022 (31%) when in comparison with 2021 (545%). Remarking on this consequence, in addition to the rise in variety of wallets to over 5 million, the report stated:

2022 might be seen as a yr of consolidation the place most initiatives are busy constructing and bettering their merchandise somewhat than spending their assets on advertising and marketing actions. 2022 can be the yr when the UI and person expertise of Defi protocols improved considerably, to a degree that we will lastly say that it’s simpler to make use of some Defi protocols than utilizing a house banking app.

In keeping with the report, a big chunk of assist for Defi protocols got here from enterprise capital (VC) corporations which poured “$14 billion into 725 crypto initiatives (lots of these are Defi)” within the first half of 2022.

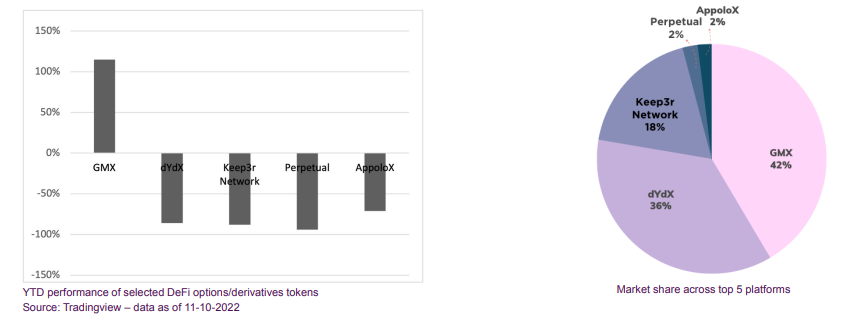

On the seemingly set off of the following defi summer time, the report factors to the derivatives and choices sector the place key platforms like GMX noticed a “substantial development within the variety of customers and TVL.” From the TVL of $108 million at first of 2022, GMX noticed this worth develop to $480 million by the tip of October. One other platform, Dydx, which noticed the worth of its token drop by 90% in a single yr, “earned over $50 million in income and continues to have over 1000 weekly lively customers.”

What are your ideas on this story? Tell us what you suppose within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link