[ad_1]

Residents of the US, South Korea and the Russian Federation have been essentially the most frequent customers of centralized exchanges this 12 months, based on a brand new examine. The discovering comes after the spectacular crash of FTX, one of many largest such platforms, amid tightening laws and fewer new customers.

U.S. Leads by Variety of CEX Customers, Turkey and Japan Are Additionally within the High in Phrases of Visitors

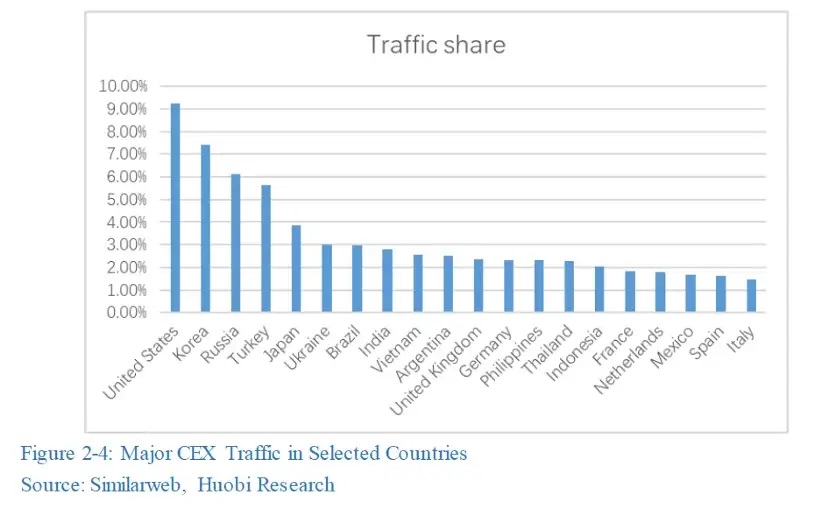

The U.S., South Korea and Russia collectively account for 22% of all visits to centralized exchanges (CEX) for cryptocurrencies, based on the 2022-2023 “International Crypto Business Overview and Traits” annual report produced by Huobi Analysis. The estimate is predicated on information from the highest 100 CEXs on lively customers, buying and selling depth, buying and selling quantity, and reliability.

With a share exceeding 9%, the US is the pronounced chief when it comes to absolute variety of crypto customers producing CEX site visitors. South Korea, Russia, Turkey, and Japan are subsequent with 7.4%, 6.1%, 5.6% and three.8%, respectively.

The drivers are totally different in every case – from excessive unemployment and housing costs turning younger individuals in South Korea and Japan in the direction of crypto investments, to Western sanctions for Russians and hyperinflation for Turks.

The authors insist that “centralized exchanges are important within the cryptocurrency market. These exchanges are normally consumer pleasant and lots of crypto novices begin with them.” Additionally they level out that many of the customers and liquidity within the crypto market are aggregated in centralized exchanges.

Nevertheless, the findings come within the aftermath of the crash of FTX, one of many largest CEXs which filed for chapter safety on Nov. 11 amid liquidity points. The researchers name it “the incident of the 12 months since getting into the present bear market” and word it’s a part of a sequence, additionally together with the collapse of Terra and the chapter of 3AC.

The examine additional reveals that the general market measurement of CEXs declined extra considerably in 2022 compared with the earlier 12 months. The variety of distinctive guests decreased by 24%. “The continual gloomy market situation and the depreciating belongings are each miserable present customers,” the report elaborates. On the similar time, new consumer development declined to 25 million from 194 million in 2021.

Rules for Centralized Exchanges Tighten in Key Jurisdictions Across the World

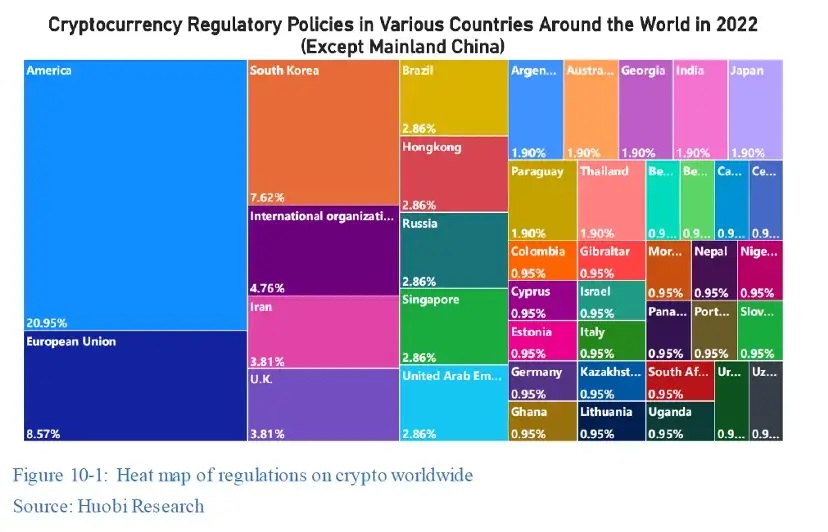

Huobi Analysis additionally notes that laws on centralized cryptocurrency exchanges are tightening globally after the FTX chapter, together with for on-chain actions, and that regulators could oblige CEXs to publicize proof of funds or require that they preserve an quantity of funds in reserve.

This 12 months, U.S. president Biden signed an Government Order on Making certain Accountable Growth of Digital Property, the EU authorised its Markets in Crypto Property (MiCA) laws, Russia has been working to develop its authorized framework for crypto, and South Korea handed eight associated laws.

In opposition to this backdrop, decentralized finance (defi) has develop into one of many crypto markets with skyrocketing development, the creator’s spotlight. Regardless of a sequence of unfavorable incidents in that sector as effectively, the extra skilled defi customers stay assured concerning the restoration and the long-term worth of defi.

With virtually 32% of the site visitors, the U.S. additionally has the most important share on this section. Brasil is second, with a bit over 5%, adopted by a number of developed international locations, not like the CEX market, specifically the U.Ok., France, Canada, and Germany, that are seeing important defi site visitors.

Do you suppose centralized exchanges will proceed to play a key position as entry factors to the crypto area for novice customers? Share your ideas on the topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Creativan / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link