[ad_1]

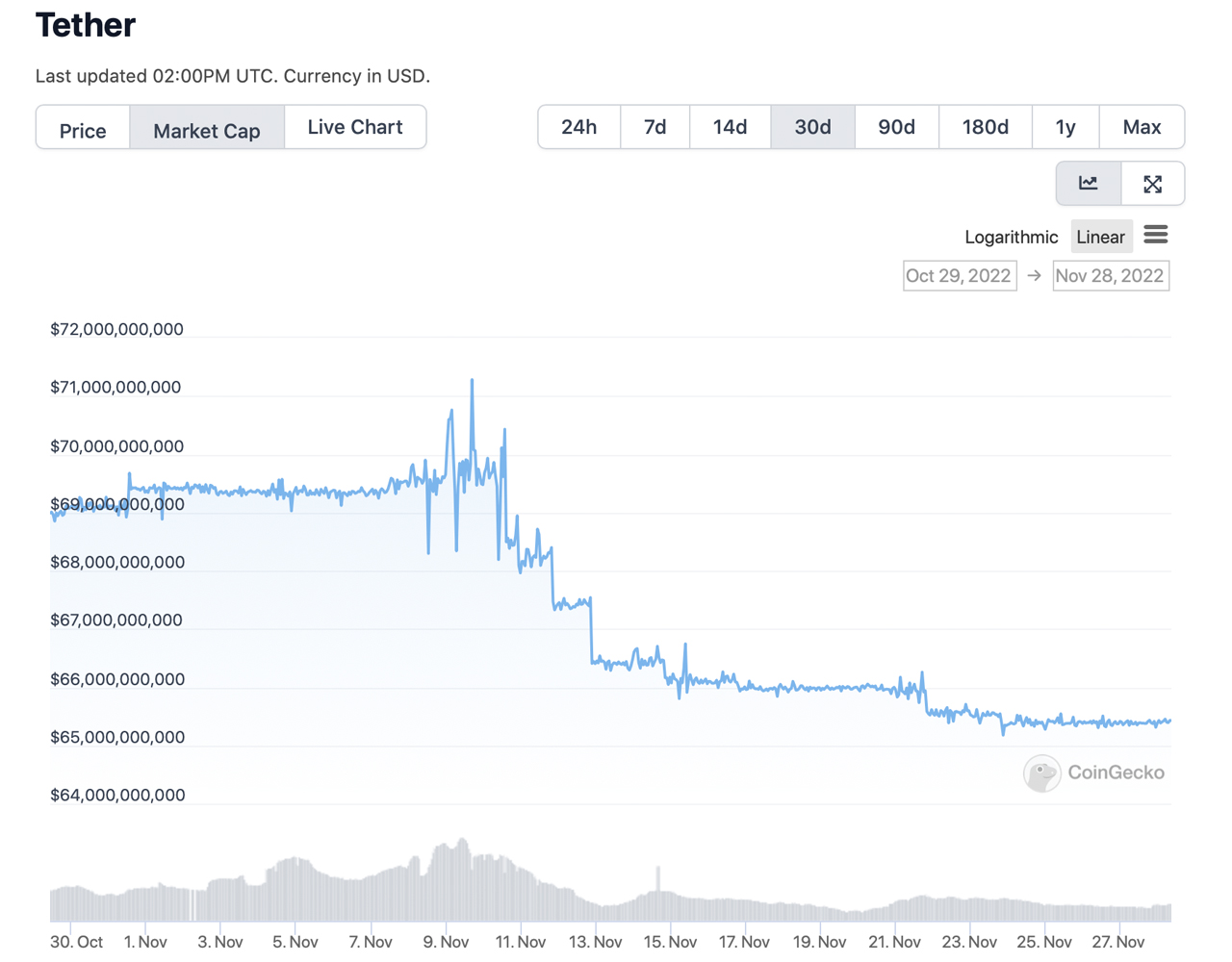

Over the past month, the market capitalization of all of the stablecoins in existence dropped by greater than 2%, shedding roughly $2.98 billion because the finish of October. Statistics present that tether, the most important stablecoin by market valuation, noticed its market cap lose greater than 5% over the past 30 days. Tether’s market cap slipped from final month’s $69.13 billion to right now’s $65.48 billion.

Stablecoin Economic system Drops Decrease, Tether Market Cap Sheds 5%

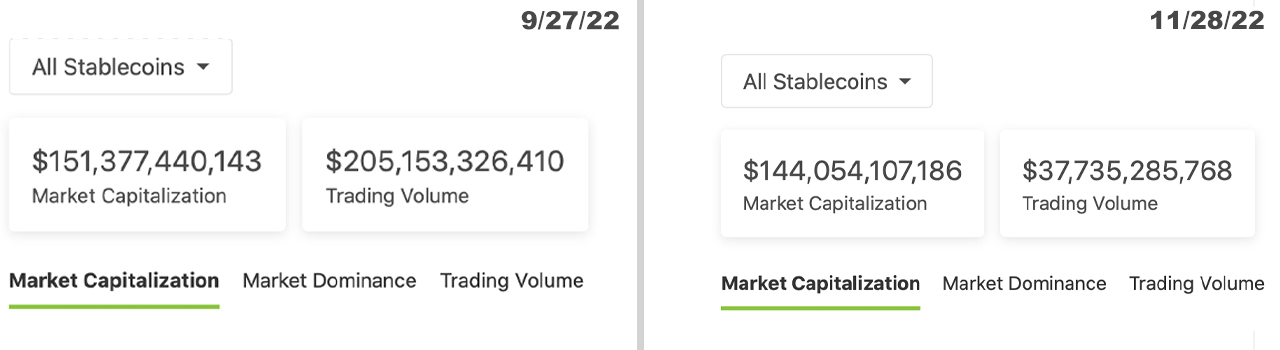

Statistics present that the stablecoin economic system’s market valuation has diminished over the past 30 days by roughly 2.02%. On Oct. 31, 2022, the stablecoin economic system was valued at $147.03 billion and right now, it’s all the way down to $144.05 billion.

Moreover, the market capitalization of all of the stablecoins in existence is way decrease than it was two months in the past, because the market cap dropped by 4.83% from $151.37 billion to right now’s $144 billion whole. Information signifies that this previous month, tether (USDT) has seen its market capitalization drop greater than 5% decrease from $69.13 billion to the present $65.48 billion.

Nevertheless, the second-largest stablecoin by market cap, usd coin (USDC) has seen its market valuation enhance through the previous 30 days, leaping roughly 1.5% larger. The stablecoin BUSD’s valuation continues to develop month after month, and during the last 30 days, it’s up 4.8%. Out of the highest 5 stablecoins right now, BUSD’s market cap grew essentially the most during the last month.

Makerdao’s DAI stablecoin has shed 9.7% this previous month and the stablecoin’s market capitalization was the most important loser out of the highest ten dollar-pegged crypto tokens. On Oct. 31, DAI’s market cap was round $5.77 billion and right now, it’s coasting alongside at $5.20 billion. With tether and DAI main the losses during the last month out of the highest ten stablecoins, frax (FRAX) adopted behind the 2 tokens shedding round 3.1% final month.

Stablecoin commerce quantity has dropped an incredible deal during the last two months however the tokens nonetheless characterize a majority of right now’s trades. As an illustration, on Sept. 27, 2022, stablecoins captured $205 billion out of the $225 billion in international trades. On Oct. 31, stablecoins recorded $55.91 billion in trades out of the overall worldwide crypto commerce quantity ($71 billion).

In the course of the previous 24 hours stablecoins have captured $37.73 billion and the mixture commerce quantity amongst all of the crypto cash in existence right now is roughly $46.56 billion. This implies out of the $46 billion in trades amongst all of the crypto belongings, stablecoins equate to 81.04% of these trades.

What do you concentrate on the state of the stablecoin market right now? What do you concentrate on the stablecoin economic system’s valuation slipping by shut to five% through the previous two months? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link