In response to statistics from mid-Might 2023, 18 completely different application-specific built-in circuit (ASIC) bitcoin mining units are worthwhile utilizing in the present day’s bitcoin alternate charges. Moreover, the highest bitcoin mining machines in the present day are made by three outstanding ASIC producers, as fabrication competitors lately is proscribed.

18 ASICs Revenue With Electrical energy Prices at $0.12 per kWh and Right this moment’s Bitcoin Change Charges

The common hashrate of the Bitcoin blockchain during the last 2,016 blocks stands at roughly 353.9 exahash per second (EH/s) at current. In a powerful feat this month, on Might 2, 2023, at block top 787,895, the community reached an unprecedented peak of 491.15 EH/s. In the meantime, the value of bitcoin (BTC) has been steadily hovering barely under the $27K mark. Actual-time mining rig knowledge gathered from asicminervalue.com reveals that there are 18 worthwhile SHA-256 ASIC miners in operation utilizing present BTC alternate charges.

Given the current worth of BTC and the fast surge in hashrate, one may count on a large number of ASIC producers to be actively crafting superior mining rigs in 2023. Surprisingly, nevertheless, the panorama is dominated by simply three outstanding ASIC fabricators completely centered on designing mining rigs for bitcoin extraction: Bitmain, Microbt, and Canaan. All 18 of the main ASIC bitcoin miners, appropriate with SHA-256 and presently producing income, originate from these three producers.

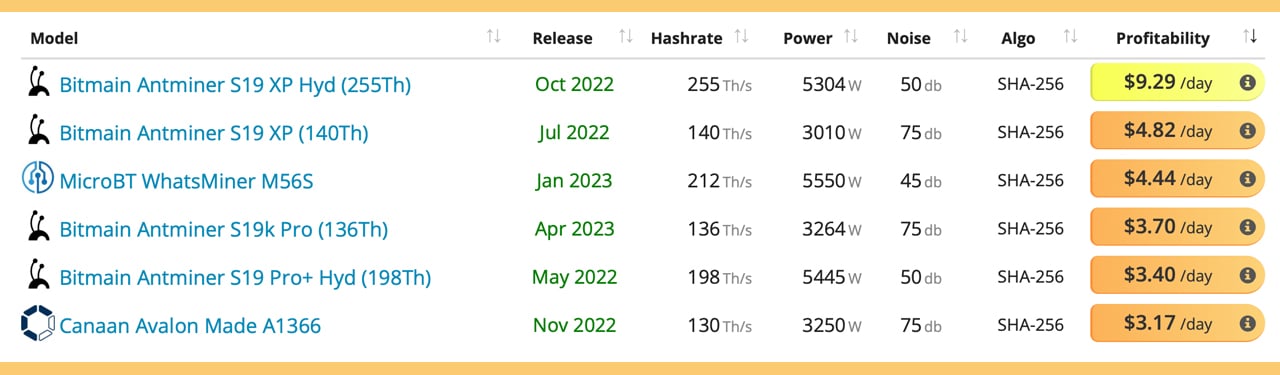

The Prime 6 Most Worthwhile ASIC Bitcoin Miners on the Market in 2023

The highest bitcoin mining rig is the Bitmain Antminer S19 XP Hydro, boasting a hashrate of 255 terahash per second (TH/s). With its institution relationship again to 2013, Bitmain has cemented its presence within the trade through the years, manufacturing 10 out of in the present day’s high 18 ASIC miners. Considering present BTC alternate charges, knowledge reveals that the S19 XP Hydro yields an estimated each day revenue of roughly $9.29, factoring in an electrical energy value of $0.12 per kilowatt hour (kWh).

In shut pursuit, the Antminer S19 XP, producing 140 TH/s, firmly secures its place because the second most profitable ASIC rig. The S19 XP rakes in an estimated each day revenue of $4.82 whereas upholding the identical electrical energy prices. Trailing intently behind is Microbt’s Whatsminer M56S, commanding 212 TH/s and claiming the spot because the third most worthwhile bitcoin miner within the present market. Projections recommend that the M56S yields a each day revenue of $4.44.

Following go well with, the Antminer S19k Professional produces a hashrate of 136 TH/s, whereas the Antminer S19 Professional+ Hydro clocks in at 198 TH/s. These two miners are estimated to generate a each day revenue starting from $3.40 to $3.70. The fifth most worthwhile ASIC mining rig is Canaan’s Avalon A1366 which produces 130 TH/s. At $0.12 per kWh, the Avalon A1366 will get an estimated $3.17 per day in revenue.

With electrical energy prices set at $0.12 per kilowatt hour (kWh) and contemplating the prevailing BTC costs, a complete of 18 mining units show to be worthwhile. Nevertheless, if the electrical energy charge drops under $0.12 per kWh, a broader vary of machines with decrease terahash outputs turn out to be financially viable.

Whereas the worldwide common electrical energy charge hovers round $0.14 per kWh, there’s an honest quantity of nations, together with Iran, Cambodia, Afghanistan, Belarus, Cape Verde, Brazil, Central African Republic, Bhutan, and Azerbaijan, amongst others, the place electrical energy charges vary from $0.01 to $0.05 per kWh.

What are your ideas on the present panorama of Bitcoin mining and the dominance of some main producers? Share your insights and opinions within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.